Senate Democrats would be willing to see some changes made to Dodd-Frank in order to give small banks and credit unions some relief from the banking regulation’s tougher rules.

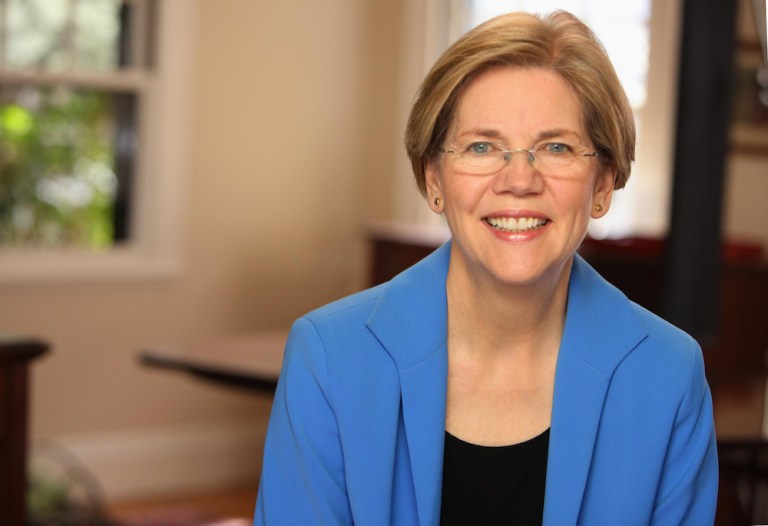

Senator Elizabeth Warren — a strong backer of D0dd-Frank and the architect of the CFPB that came from it — told reporters that Democrats would be willing to pursue targeted changes to the law for small financial services institutions, but that she and her colleagues would fight long and hard against changing laws to roll back consumer protections or to help big banks.

Ms. Warren’s remarks came a day after the Trump administration unveiled a road map for easing regulatory requirements for all types of financial institutions.

“There are places where we should do targeted changes in laws and regulations to make sure community banks don’t have to endure regulations…for problems like disrupting the entire U.S. economy when they really don’t pose that kind of threat,” Ms. Warren said.

Warren further noted that many of the “too big to fail” banks have actually gotten bigger, and that means regulatory editing is needed.

House Republicans would like to see that editing done liberally and have rolled out various plans to roll back the financial regulations that followed the Great Recession. But many of those regulations require legislative action in the Senate — which means Democrat involvement, since Republicans do not have a 60 vote super-majority.

“We can work together when you are not changing the law,” she said.

The Trump administration’s report released Monday made recommendations like easing capital and liquidity requirements and reducing regulatory exams such as “stress tests.” The report also recommend strongly scaling back the power of the CFP — which was called “unaccountable” in a recent Treasury report. Ms. Warren noted such a move is essentially against the will of the people since polls have shown some 80 percent of the general public and 55 percent of the supporters of President Donald Trump wanted the agency left in the current state, if not made more powerful.

Ms. Warren was also a vocal critic of House Republicans’ moves to roll back rules for large financial institutions to the point where they are weaker than regulations that existed before 2008.

“I’ve got to say to a crowd like this everyone should be saying: No. No. No. No. No,” she said. “This ought to be one of the things that should unite all of us in saying we are not in favor of deregulation that puts the American taxpayer, and more importantly, the American economy, at greater risk.”