Amazon’s Grocery Footprint Grows with Amazon Fresh Expansion

Amazon Fresh appears to be continuing its slow, furtive expansion, giving little hint as to the long-term vision for the brand. Last week, news broke of two possible new locations, each of which would be in a market previously untapped by the grocery brand.

On Thursday (Sept. 30), USA Today’s Quincy, Massachusetts news outlet The Patriot Ledger reported that the planning board for the town of Braintree, Massachusetts has approved a 37,500-square-foot Amazon Fresh store, with the company applying under the pseudonym “Seritage KMT Finance LLC,” per a letter to the town, “for confidentiality purposes.” Amazon declined to confirm that this is in fact an upcoming Amazon Fresh location, as the news outlet claims.

Meanwhile, last Tuesday (Sept. 28), Eden Prairie Local News, a nonprofit local news outlet from Eden Prairie, Minnesota, reported that the city’s planning commission had approved plans for a 40,000-square-foot grocery store from an unnamed owner, one that is a national grocer, and the plans were accompanied by a rendering very similar to the one in Braintree. Additionally, the architect, NORR, has connections to previous Amazon Fresh projects.

As Amazon appears to be making plans for upcoming physical locations, it is also creating new ways to embed its offerings in consumers’ daily lives with contextual commerce integrations. On Tuesday (Oct. 5), Insider reported that Amazon is developing a smart fridge that would prompt reorders from Whole Foods or Amazon Fresh when consumers are running low on a given item.

Amazon’s grocery efforts have been somewhat erratic throughout 2021, with some moments that suggest impressive growth and others that show significant uncertainty about the future of the company’s grocery business. Amazon began the year by shutting down its Prime Pantry services in early January, folding the shelf-stable goods program into Amazon’s main website. In March, the company opened a U.K. location of its Amazon Go cashierless convenience stores, the first of its kind outside North America. In May, the company folded its Amazon Go Grocery business, the grocery offshoot of the convenience chain, into its Amazon Fresh grocery brand. Shortly after, the company announced its first full-sized “Just Walk Out”-enabled Amazon Fresh store.

The company’s Whole Foods Market grocery brand has also been undergoing some significant changes this year. On the one hand (quite literally), Amazon is trying out leading-edge payment methods such as Amazon One palm scans and Just Walk Out checkout at select Whole Foods locations. On the other hand, Amazon recently announced a roughly $10 fee for Prime members ordering from Whole Foods for delivery in select cities, a move that threatens to alienate a significant portion of the grocer’s customer base. Plus, Whole Foods’ Co-founder and CEO John Mackey, who has been central to the brand, recently announced his retirement, suggesting major changes to come.

For the most part, the company’s corporate communications throughout 2021 have borne little mention of Amazon’s intentions for its grocery chains going forward.

There has not been much comment since March, when the company’s CFO Brian Olsavsky told analysts, “Grocery has been a great revelation during the post-pandemic period here. I think people really value the ability to get home delivery, and we’ve seen that as numbers go up considerably pre- and post-pandemic … on the Fresh stores, it’s a little too early … we’re confident that the Just Walk Out technology will be a boon, a benefit to customers, and we’re very excited about what’s in the works, but that’s still really early in day one.”

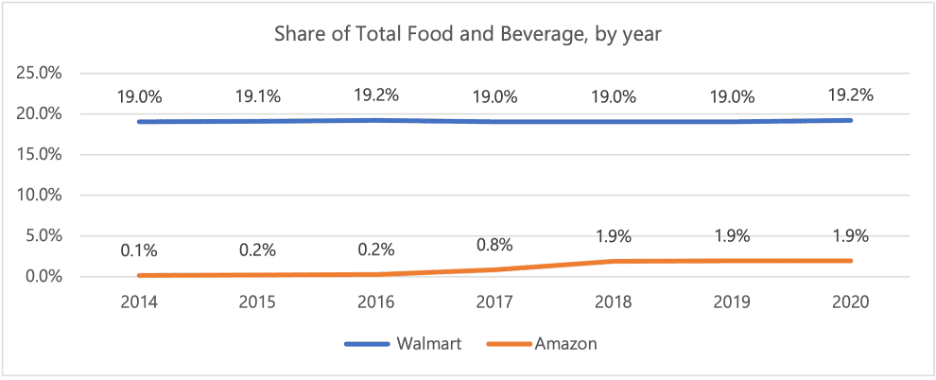

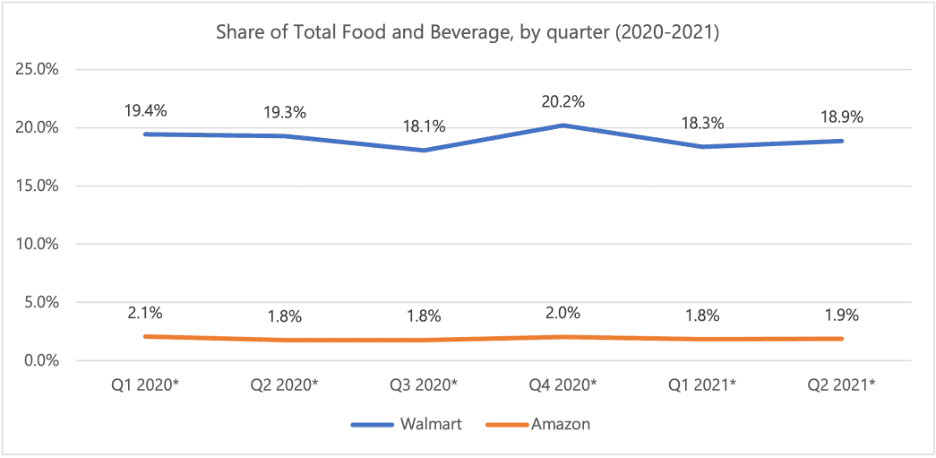

When it comes to grocery sales, Amazon lags behind competitor Walmart, the world’s largest grocer, by an order of magnitude. Recent PYMNTS research indicates that Walmart holds an 18.9% share of total food and beverage sales, while Amazon lags way behind at 1.9%. Even at Walmart’s lowest point in the past couple of years, capturing only 18.1% of the total market, Amazon’s share was still smaller by a factor of 10.

Read more: Amazon’s Food Fight Fails to Minimize Walmart’s 10-to-1 Lead

Read more: Amazon’s Food Fight Fails to Minimize Walmart’s 10-to-1 Lead

For a moment in 2018, it appeared as if Amazon would take over, with its share of the category more than doubling for two years in a row. However, after this period of rapid growth, the company’s share of the category stagnated at 1.9%.