Contextual Commerce Expands Beyond Social Media

The contextual commerce wave has been building for quite some time. In 2018 — a full two years before the words “global pandemic” became a part of everyone’s day-to-day vocabulary — Karen Webster noted in a commentary that in an economy increasingly running on consumer time, the rise of contextual commerce was a certainty. At that time, PYMNTS found that 58 percent of consumers said they had already made a purchase via a contextual commerce path, and 84 percent of that group reported being so satisfied that they’d do it again.

While still in its nascent stages, Webster noted, commerce in context was already on its way to becoming a new channel for brands, merchants and payments players, opening up an entirely new frontier in consumers’ online journeys, beyond merely making the purchase itself.

“Commerce enabling new paths to purchase is the next evolution of commerce — one that satisfies another requirement of today’s on-demand consumers: finding something they want to buy fast and free of friction while they’re doing something else,” Webster wrote.

The evolution kicked into overdrive in 2020, as consumers reconfigured their lives around digital channels when it came to working, shopping, entertainment and education. Brands and social media networks spent much of the year rushing to meet consumers where they happened to be hanging out online, generally on social media, and allow them to complete transactions there.

In February, Shopify announced plans to expand its payments tool, Shop Pay, to merchants on Facebook and Instagram. “People are embracing social platforms not only for connection, but for commerce,” Carl Rivera, general manager of Shop, said in a blog post. “Making Shop Pay available outside of Shopify for the first time means even more shoppers can use the fastest and best checkout on the internet. And there’s more to come: We’ll continue to work with Facebook to bring a number of Shopify services and products to these platforms to make social selling so much better.”

With the Shop Pay addition, businesses selling on Facebook and Instagram can immediately make the payments tool available to buyers for a secure checkout experience. Previously, the only payment options available on social media were PayPal or manually entering credit or debit card information.

Shopify also made headlines last week with the announcement that Shopify’s pact with TikTok, which was struck last October, is expanding to 14 more countries in North America, Europe, the Middle East and Asia. Facebook has also recently expanded its commerce ambitions with its new Facebook Shop functionality, designed to allow retailers “to create a single online selling presence on the platform and to sell from users’ feeds.”

And while we could spend quite some time documenting the myriad ways in which social media platforms have upgraded their commerce capabilities to more effectively ride the contextual commerce wave, what is perhaps more interesting to observe is the ways in which contextual commerce itself is evolving. It appears that retail’s next phase may be moving toward its own next stage. Looking at the data, going forward, contextual commerce isn’t just about inserting commerce opportunities into social contexts like social media platforms — it will also be about creating that context through events, and then wrapping a commerce opportunity around them.

And while we could spend quite some time documenting the myriad ways in which social media platforms have upgraded their commerce capabilities to more effectively ride the contextual commerce wave, what is perhaps more interesting to observe is the ways in which contextual commerce itself is evolving. It appears that retail’s next phase may be moving toward its own next stage. Looking at the data, going forward, contextual commerce isn’t just about inserting commerce opportunities into social contexts like social media platforms — it will also be about creating that context through events, and then wrapping a commerce opportunity around them.

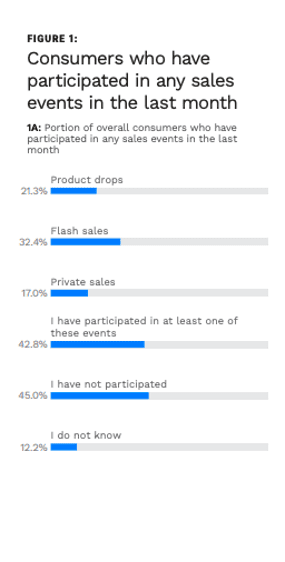

It’s an evolutionary step that’s illustrated by PYMNTS’ latest Product Drops report. Product drops, flash sales and private sales are growing in popularity, with 43 percent participating in them in the last month in general, and 60 percent of bridge millennials and younger consumers participating in the same timeframe.

And what is driving consumers to these events? Price plays a key role, but it’s far from the only driver. Consumers are also looking for access to hard-to-find or rare goods they might not otherwise be able to get their hands on.

These contextual events are also increasingly popular among affluent consumers, with 82 percent and 78 percent of that demographic reporting being “very” or “extremely” satisfied with their participation in flash sale and product drop events, respectively.

And with evolution comes opportunity. Video streaming support platform Maestro reported this week that it has raised $15 million in new financing to expand its project of helping brands and merchants expand their video streaming efforts to better support commerce interactions. The small firm already has a roster of some fairly big clients, including the Golden State Warriors, the Dallas Cowboys, and pop star Billie Eilish, all of whom it worked with to incorporate interactive tools into live events and promotions. With new funds in hand, the firm’s goals for 2021 are to strike while the video-streaming iron is hot — and to expand its services more widely.

“We were targeted to a small number of very premier customers. It was around 50 to 60, and we grew to the hundreds,” Maestro CEO Ari Evans told TechCrunch. “2020 was a blowout year … People needed an interactive streaming platform that they could spin up quickly that they could launch on their website.”

Because, as PYMNTS data has demonstrated for quite some time, in context is how consumers want to shop. But what those contexts will look like beyond social media platforms is an evolution that is still very much in progress.

Read More On Contextual Commerce:

- Tastemade Says Multitasking Presents a Big Contextual Commerce Opportunity

- Streaming Platforms Step Up Push for Shoppable Integrations

- Brown-Forman: Shoppers’ Rising Expectation of Convenience Demands Contextual Commerce

- Grocers’ Contextual Commerce Efforts Reached New Digital Spaces in 2023