Holiday Shopping Outlook Suggests ‘Amazon Christmas’ May Be Underway

Ahead of Amazon’s third-quarter earnings report, new data show that nearly everyone will be shopping online this holiday season, a likely boon to the Seattle-based eCommerce giant.

PYMNTS research, conducted in collaboration with Kount, found that 87% of consumers plan to shop online this holiday season, a 10 percentage point jump from last year despite many consumers returning to reopened stores. Additionally, younger consumers are more likely to increase their spending, with 31% of Generation Z saying they will be spending more on gifts this year along with 28% of millennials and 25% of bridge millennials.

See: NEW DATA: Nearly 90% of US Consumers Plan Online Holiday Purchases in 2021 — 13% More Than in 2020

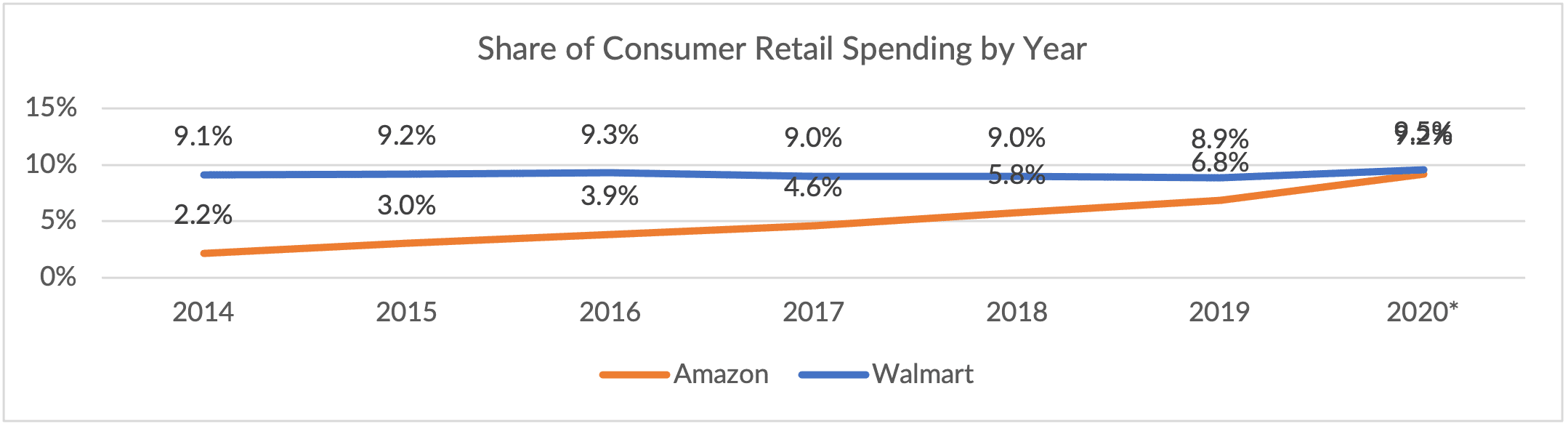

Amazon, according to PYMNTS’ proprietary data, has nearly 50% of the eCommerce market and over 9% of consumers’ overall retail spend, locking the company in a dead heat with rival Walmart.

Source: PYMNTS data

And with a surprisingly robust fashion marketplace, including a year-old luxury fashion platform, Amazon may be poised to fully capitalize on consumers’ desires to do Christmas shopping digitally. Amazon had a nearly 16% share of the overall clothing and apparel market in 2020, up from 9.5% in 2019 and just over 7% in 2018. Looking just at eCommerce, Amazon has a 45% share of clothing and apparel sales, up from about 41% in 2019.

Related: Amazon’s Extreme Makeover Paying Off With Entire Ecosystem Embracing Fashion

Mastercard SpendingPulse has projected that apparel sales could jump 46% year-over-year this holiday shopping season, and luxury purchases could see a nearly 93% increase. Compared to 2019, apparel is likely to be up almost 18% and luxury could be up 56%.

Read more: Mastercard Predicts 7.4% Retail Growth During Holiday Shopping Season

Supply Chain Headwinds

Two interconnected factors that could hold Amazon back, though, are the tight labor market and supply chain shortages, which have made it harder to meet demand in recent months and caused many to extol the virtues of getting holiday shopping done early.

PYMNTS data show that 71% of online holiday shoppers say product availability will impact their purchasing decisions, including 94% of convenience-driven shoppers who are all but guaranteed to want their products delivered, potentially by an Amazon carrier.

And Amazon has spent time over the last couple weeks, as have other retailers, reassuring consumers that they can meet this holiday’s demand. The company says it has been planning and preparing since Jan. 1, increasing ports of entry across its network by 50%, doubling container processing capacity, and utilizing multiple forms of transportation, including planes, trucks, ships and vans.

Read: Amazon Unveils Strategy to Ensure Timely Holiday Delivery

“Up and down the supply chain, costs are increasing, and Amazon isn’t immune,” Andrew Lipsman, principal analyst at market research firm Insider Intelligence, told The Wall Street Journal. “But they are reaping some of the benefits now in the investments they made in logistics a couple of years ago.”

The Quarterly Report

Still, it remains to be seen if these investments are enough to soothe customers, as well as investors and analysts who are expecting Amazon’s earnings to suffer because of slowing eCommerce growth and increased labor costs. In July, Chief Financial Officer Brian Olsavsky said moderated spending from Prime members and consumers’ increased mobility were key contributors to slowing sales numbers, which caused Amazon to post a rare earnings miss in the second quarter.

“I think the impact of people getting vaccinated and getting out in the world — not only shopping offline but also living life and getting out — it takes away from shopping time,” Olsavsky told analysts.

Additionally, the third-quarter report, set for Thursday (Oct. 28), will be missing its usual Prime Day bump for the second year in a row. Amazon held the sales event at the end of June this year and in the middle of October in 2020.