Europe’s wine and spirits space is about to get a major new eCommerce player. Moët Hennessy, the wine and spirits division of luxury goods company LVMH, and spirits company Campari Group, the brand behind Campari as well as Aperol, SKYY vodka and Wild Turkey bourbon, among others, announced on Monday (July 12) that they are partnering to create an eCommerce platform in a 50/50 joint venture.

The platform will be led by Marco Magnocavallo, the current CEO of the wine and spirits eCommerce company Tannico, in which Campari holds a minority stake that it is contributing to the joint venture. The goal is to create a platform that will have a presence all across Europe.

“This partnership represents a significant step forward in our global eCommerce development strategy. While eCommerce was already a growing channel for wines and spirits, the global pandemic has triggered a significant acceleration,” Moët Hennessy President and CEO Philippe Schaus said in a statement.

Sure enough, PYMNTS research finds that almost half of all consumers purchased alcohol online more during the pandemic than before its start, and that the majority of these shoppers continue to maintain this behavior going forward. In the United States, the eCommerce wine and spirits sector already had a major sector, with Uber’s $1.1 billion acquisition of Drizly bringing same-day alcohol delivery into the mainstream. Now, this joint venture could play a similar role in Europe, disrupting the continent’s alcohol eCommerce market.

“With the joint backing of Moët Hennessy and Campari, Tannico will have the firepower to consolidate the fragmented European eCommerce sector and offer a qualitative, sizeable and integrated route to market option catering to the needs of all its wines and spirits suppliers,” Magnocavallo, CEO of Tannico, said in a statement.

“With the joint backing of Moët Hennessy and Campari, Tannico will have the firepower to consolidate the fragmented European eCommerce sector and offer a qualitative, sizeable and integrated route to market option catering to the needs of all its wines and spirits suppliers,” Magnocavallo, CEO of Tannico, said in a statement.

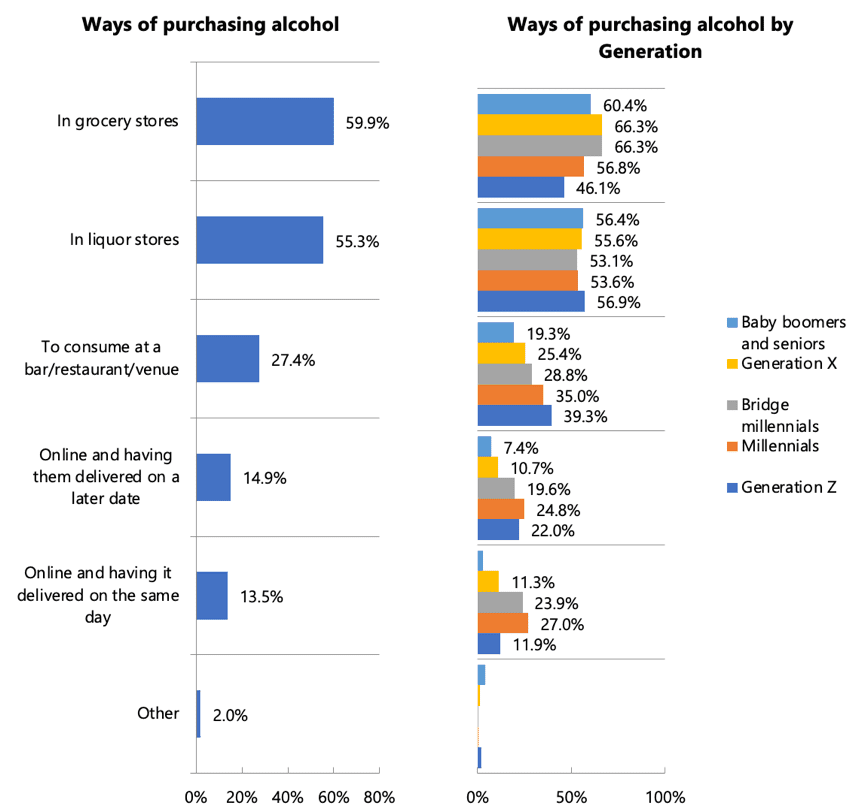

This new eCommerce platform presents an opportunity for both wine and spirits companies to earn the spending of younger consumers who might not otherwise seek out luxury wine and spirits. PYMNTS research finds that the consumers ordering alcohol online most often, whether for delivery in the future or the same day, are millennials. Additionally, a significant portion of those ordering for delivery on a later date are Generation Z-ers, meaning that both wine and spirits companies have the opportunity to win the lifelong loyalty of young consumers who are new to the alcohol market.

Earlier this year, online wine marketplace Vivino raised $155 million, bringing its total funding to $221 million, to support its expansion in markets in the U.S., U.K., Germany, Portugal and Japan. And last November, digital delivery service Gopuff acquired eCommerce alcohol platform BevMo in a $350 million deal. Overall, one analysis found, online alcohol sales grew 33 percent in 2020, with France, one of the top contributors to this growth, seeing its market increase 43 percent by volume.

Earlier this year, online wine marketplace Vivino raised $155 million, bringing its total funding to $221 million, to support its expansion in markets in the U.S., U.K., Germany, Portugal and Japan. And last November, digital delivery service Gopuff acquired eCommerce alcohol platform BevMo in a $350 million deal. Overall, one analysis found, online alcohol sales grew 33 percent in 2020, with France, one of the top contributors to this growth, seeing its market increase 43 percent by volume.

In 2020, LVMH’s organic revenue from its wine and spirits sales fell 14 percent. Meanwhile, in February, Campari CEO Bob Kunze-Concewitz stated that the company’s eCommerce mix grew 90 percent year over year in 2020. “Net in net, we’re adapting very well and very quickly to the new normal, particularly eCommerce, and will bear the benefits of that in the years to come,” he added.