New Data Shows Amazon Prime Continues To Outpace Walmart+

Since it was first launched in September 2020, the exact intent and purpose behind Walmart+ has been a bit of a moving target. At launch it was hyped as an Amazon Prime competitor, but the lack of a streaming entertainment element rendered that comparison to be irrelevant, especially as Amazon steamrolled Q4 with Amazon Prime customers leading the way. Then, as Walmart rolled out its brand strategy that went along with its subscription service with major network TV buys, it looked like Walmart+ was as much a branding play as it was a serious attempt at competing with Amazon.

As Walmart heads into the new year however, new data from PYMNTS shows Walmart+ has made some headway versus Amazon Prime, though it’s certainly not the dramatic bounce that the company was hoping for. And recent comments from Walmart CEO Doug McMillon show that the company is looking for more data and a better customer experience from the service.

“Over time, more and more of our customers will want Walmart+ because it makes life better,” McMillon told analysts on the company’s most recent earnings call. “That relationship will drive repeat business and provide data that enables us to serve them even better and be more personalized. It’s an important piece of our strategy. For now, we’re focused on continuing a high quality experience for Walmart+ members as we add capacity. Over time, we’ll add more benefits to the membership to broaden its appeal.”

So Walmart+ is still very much a work in progress. And McMillon’s comments show more than a hint of some dissatisfaction with the rollout as he prioritized an increase in net promoter scores over an increase in net new members. He also said serving customers through the service needed work.

“We don’t want to get ahead of ourselves and go sell too many Walmart+ memberships and have a customer experience that is less than our expectation or their expectation,” McMillon said. “So net promoter score is a key metric, for example, that we keep our eye on. The number of memberships will work out, but let’s focus on quality as we start to scale it. Walmart+ then unlocks data that we can use to serve up items for customers more effectively, which helps us with margin mix. So that’s important and something that over time will matter to the company. We’re not great at that today.”

It was a surprisingly honest assessment from McMillon, and his comments are validated by PYMNTS data. Overall, Walmart picked up some members compared to PYMNTS November data that compares Walmart+ to Amazon Prime.

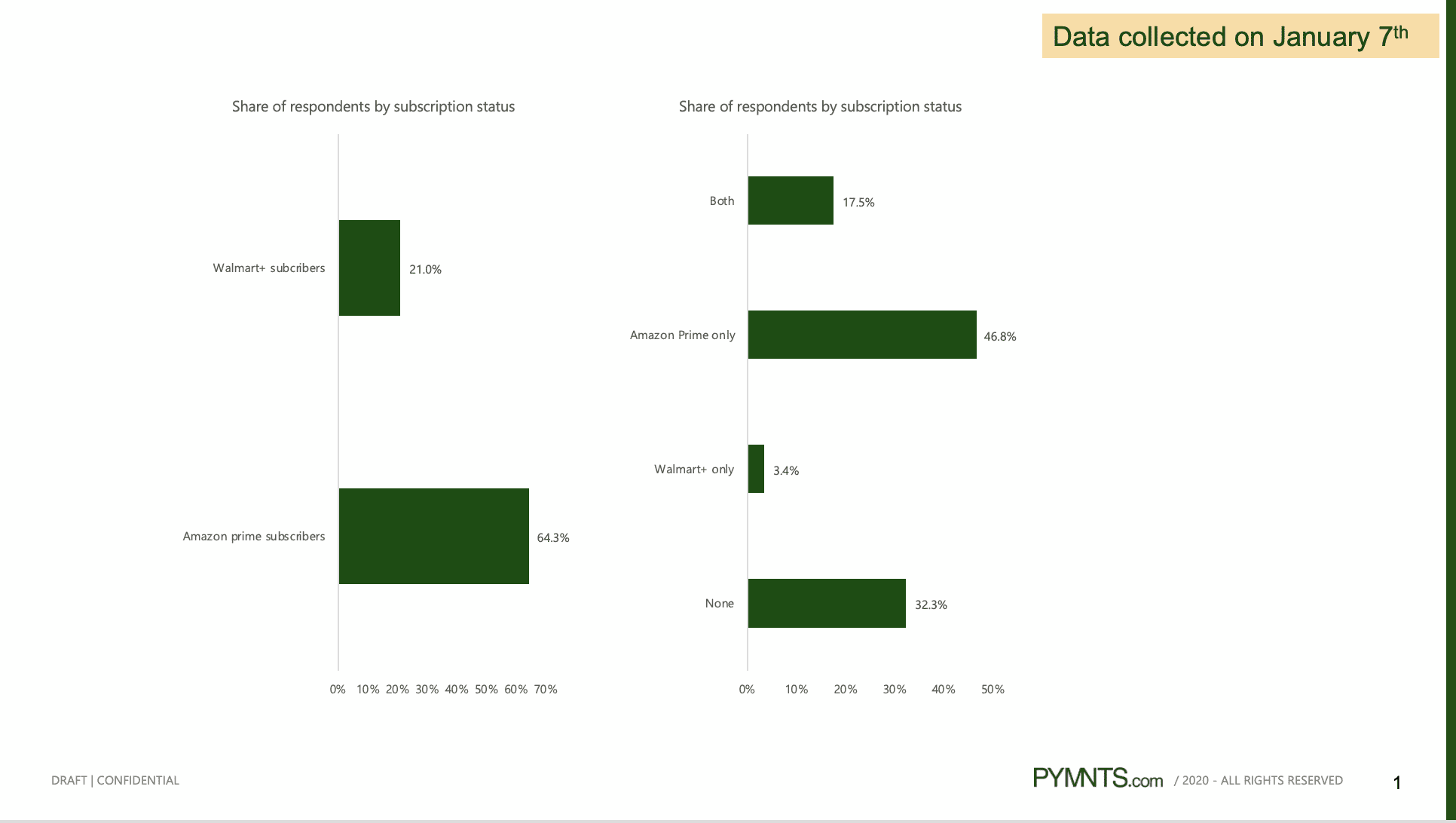

In November our data showed that 68 percent of all U.S. consumers had a Prime subscription versus 17 percent for Walmart. That number has come up slightly for Walmart to 21 percent. Prime on the other hand dropped to 64.3 percent.

The number of consumers who subscribed to both services held the same at 17.5 percent, with Amazon exclusives staying steady at 46.8 percent. Walmart+-only subscribers went from 2 percent in November to 3.4 percent in our most recent data pull from early January.

Both companies stayed within an impressively low number of free trials at 3 percent (Prime) and 2.9 percent (Walmart+) among the share of our survey respondents.

However, when applied to the share of total users for each service the PYMNTS analysis showed that Amazon had only 4.7 percent of its customers on a free trial. Walmart’s numbers tripled that at 13.7 percent.

The key customer segment for both companies continues to be bridge millennials. They showed the highest percentage of using both services at 35 percent. Baby boomers and seniors took the lowest spot at only 5 percent. Amazon continues to win handily among this group however, 40 percent to 5 percent.

Amazon also continues to win the battle for affluent consumers. Among consumers who earn more than $100K, 28 percent subscribed to both services. Drilling down to exclusives however, Amazon took 52 percent of this group; Walmart+ just 3 percent.

Bottom line, expect Walmart+ to fine tune its offerings and improve its customer experience as the year unfolds. Amazon, on the other hand, is trying to add fuel to the Prime engine.

“We’re going to have a race between lapping things that may have been one-time in nature in 2020 versus accelerating Prime membership and Prime members purchases, purchase frequency, and adoption of digital benefits,” Amazon CFO Brian Olsavsky said on the firm’s early February conference call. “So we’ll see what that looks like in 2021.”