Retailers Lean on Employees to Do More Amid Labor Shortage

Amid a national hiring crunch that’s hitting nearly every industry, retailers have been pulling out all the stops to attract workers, but some are also coming to terms with the fact that it’s time to make do with what they’ve got.

Earlier this week, Target said it’s cutting down on the number of seasonal workers it hires this year, instead giving more hours to existing employees. The Minnesota-based company said current store associates will work an additional 5 million hours, with the ability to add or swap shifts that align with their schedules through a new mobile scheduling app.

Target is still planning to hire about 100,000 seasonal employees, but that’s fewer than the 130,000 it has hired in years past. The retailer has about 300,000 store staff in total at its 1,900 stores.

“Our strategy is only possible because of Target’s incredible team,” Melissa Kremer, Target’s chief human resources officer, said in a statement. “We’ve worked to provide our team members with more consistent schedules which means more consistent paychecks and a more consistent way to manage their life.”

Earlier this month, Mastercard projected a 7.4% increase spending compared to last year during the holiday shopping season and an 11.1% increase versus 2019. Though online sales are expected to jump 7.6% year-over-year, in-store sales are also expected to see a rebound, growing 6.6% compared to 2020.

Read more: Mastercard Predicts 7.4% Retail Growth During Holiday Shopping Season

According to the U.S. Bureau of Labor Statistics, retail trade employment is down by 285,000 since February 2020, with employment in the sector declining by 29,000 last month because of losses in grocery and home improvement stores. As of July, the retail sector had 1.1 million job openings.

And the longer these hiring woes persist, the more it seems to hurt, with the National Federation of Independent Businesses (NFIB) saying last month that its Small Business Optimism Index dropped 2.8 points in July, erasing gains made in the previous month.

“Small business owners are losing confidence in the strength of the economy and expect a slowdown in job creation,” said NFIB Chief Economist Bill Dunkelberg.

Further Complications

Retailers are also facing rapidly changing consumer preferences, such as increased preference for buy online, pickup in-store (BOPIS) and curbside delivery, which are creating new workloads for store associates. PYMNTS research shows that 44% of consumers would be more inclined to purchase from brick-and-mortar stores if they could purchase online and pickup items in-store, while 42% would be more likely if they had access to curbside pickup.

These changes mean that instead of a cashier being able to process 50 in-store orders in an hour, a store employee may only be able to fulfill four orders per hour, according to Suresh Menon, senior vice president and general manager at Zebra Technologies.

“The opportunity now is to optimize the costs of inventory and labor going forward,” Menon told PYMNTS in a recent interview. “And I think the ones who do it right are the ones who are really going to grow over the next two to three years.”

Related: In-Store Fulfillment Creates ‘New and Unusual Workloads’ for Retailers

Other Initiatives

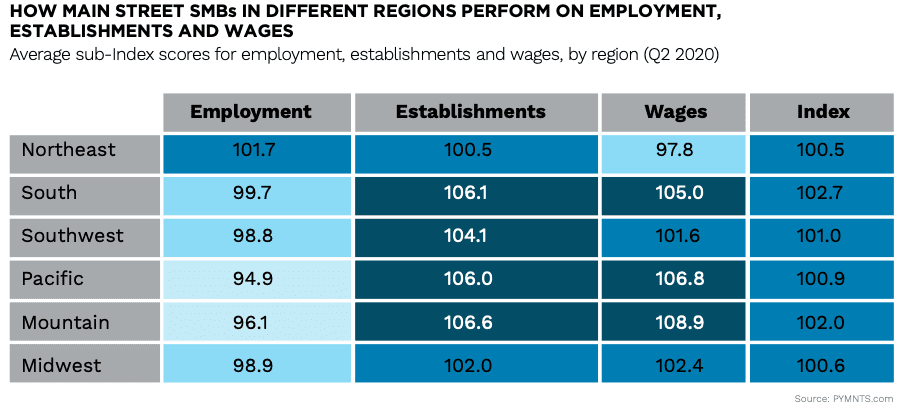

For some, the part of the answer to the labor shortage is increased pay, with many companies now offering employees at least $15 per hour. PYMNTS research has found that Main Street small and medium-sized businesses (SMBs) employ 1.4% fewer workers now than they did before March 2020, but they’re paying their workers 3.1% more.

See also: New PYMNTS Data Shows SMBs Adapting To Wage Hikes, Economic Change

But higher wages may not be enough incentive, especially with nearly every company touting increased wages. Target, Walmart and other retailers have also been looking at creative ways to attract and retain talent, with education assistance programs among the most common benefits offered.

Chipotle and Target are also among those testing the use of TikTok to recruit new, young workers from Gen Z. The pilot program, called TikTok Resumes, allows job candidates to put their resumes on the popular video streaming site.

Read: Companies Use Higher Wages, Tuition And TikTok To Hire Workers

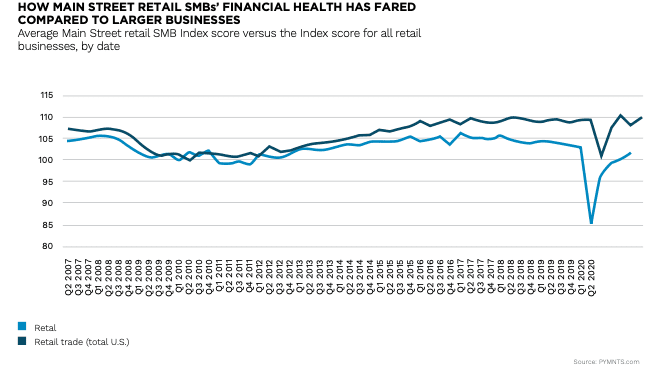

Some of these solutions, however, may not be available to small and medium-sized businesses (SMBs) as they likely don’t have the resources to compete with the benefits offered by Amazon, Walmart, Target and other large retailers. PYMNTS data show that Main Street retail SMBs have consistently underperformed larger chain retailers for the last decade, with the past 18 months seeing them fall even farther behind.