Walmart+ Marks 1st Anniversary with Slow Subscriber Growth, Unfazed Executives

Walmart+, seen by most as Walmart’s answer to Amazon Prime, is celebrating its first birthday this month, but the subscription service doesn’t have a lot of growth to show as it struggles to differentiate itself from other offerings.

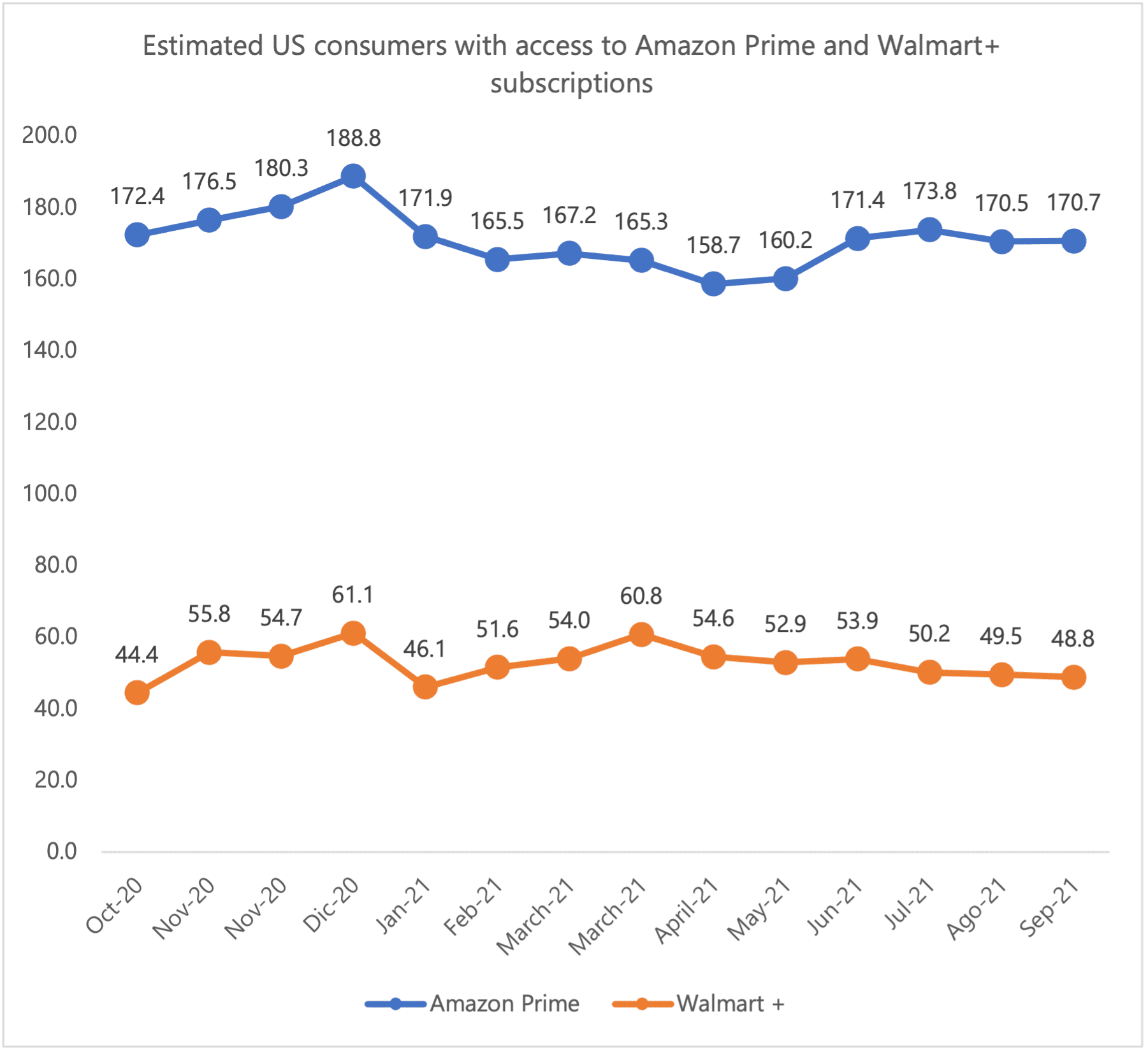

As of this month, just under 49 million, or about 19%, of U.S. consumers have access to Walmart+, versus nearly 171 million, or 66%, of consumers who have access to Amazon Prime. That amounts to about 4 million new subscribers overall for Walmart+ and about 1 million fewer Amazon Prime members.

PYMNTS’ proprietary data are based on balanced samples of 2,200 U.S. consumers between October 2020 and September 2021.

Walmart+ launched in September 2020, reaching 44 million subscribers in its first month and climbing to nearly 56 million by November — though nearly one-quarter of those subscribers were utilizing a free trial.

Related: Nearly One Quarter Of Walmart+ Users Are On A Free Trial

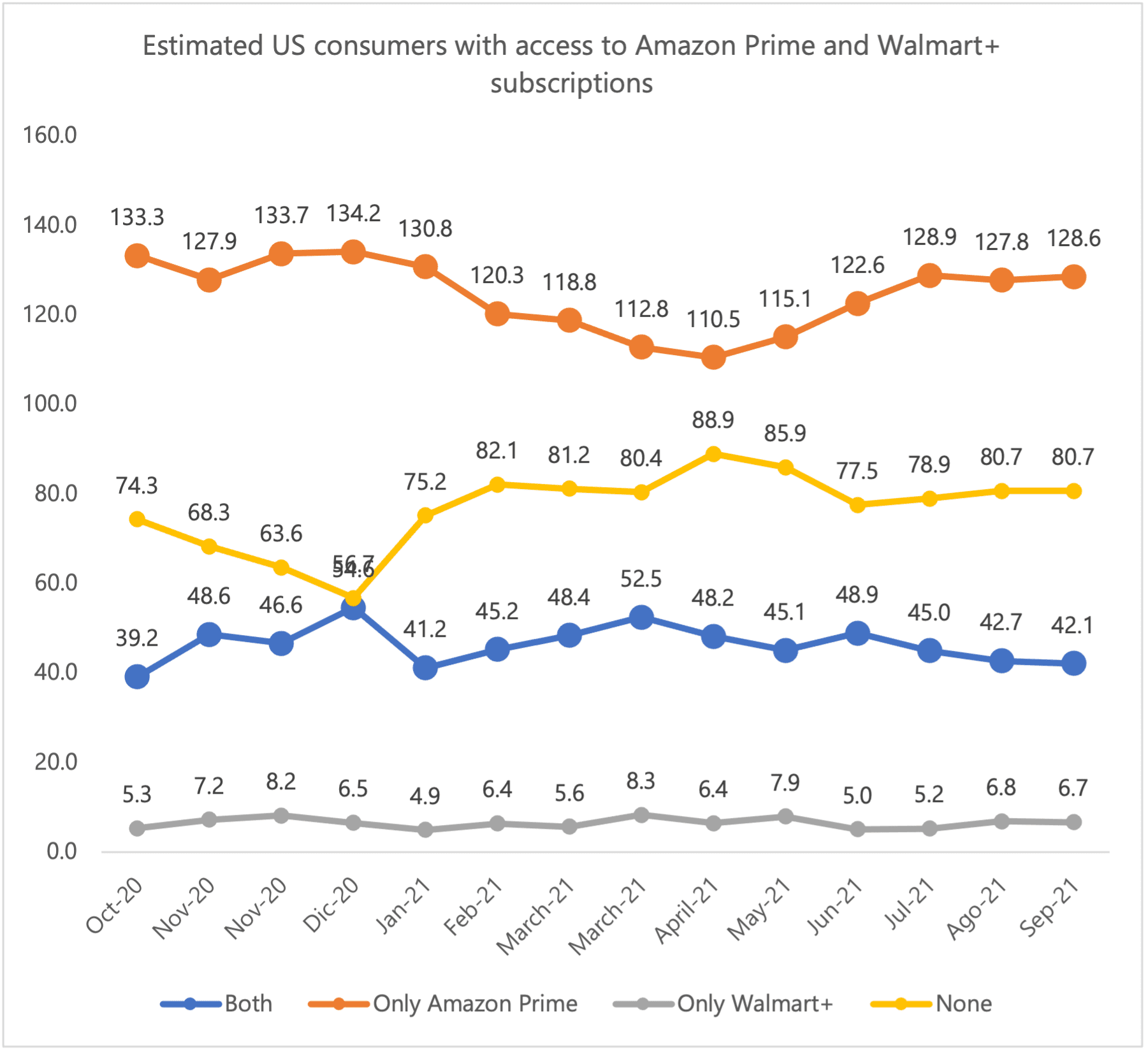

Data show, though, that consumers may not see Walmart+ as an alternative to Amazon Prime as much as a supplement. The majority of Walmart+ subscribers also have access to Amazon Prime, with 16% of respondents saying they have access to both, totaling 42 million consumers. Less than 3% telling PYMNTS that they only subscribe to Walmart+, which amounts to 6.7 million consumers who only have Walmart’s offering versus the nearly 129 million consumers who only use Amazon Prime.

Enticing the Unsubscribed

Still, over 31% of consumers, or nearly 81 million people, say they don’t have access to either, leaving substantial room for Walmart and Amazon to add to their respective subscriber counts. But even now, the share of Walmart+ subscribers who are using a free trial is over double that of Amazon Prime, suggesting that consumers may be having a difficult time justifying the expense.

Walmart+ offers consumers free next-day and two-day shipping, in addition to discounts on prescription drugs and fuel prices — but many of these benefits are also provided by Amazon Prime, which has myriad other features such as access to Prime Video, Amazon Music Prime, apparel try-on service Prime Wardrobe, and unlimited photo storage.

According to PYMNTS research, conducted in collaboration with sticky.io, the average consumer has about 3.7 subscriptions, with the share of retail subscriptions growing almost threefold since the beginning of 2020 to 24% in Q3. Still, about 45% of Gen X subscribers and 40% of bridge millennials are looking to cut back costs and eliminate at least one subscription.

Read more: 61M US Consumers Have at Least One Retail Subscription

Downplaying Slow Growth

Walmart CEO Doug McMillon said earlier this month that he’s more focused on the quality of a consumer’s experience with Walmart+ than the subscriber count. The top priority, he said, is expanding Walmart’s capacity to fulfill more online grocery orders; grocery accounts for about 56% of Walmart’s total sales and is the key driver of many Walmart+ signups.

“We don’t have all the capacity that we need,” McMillon said at Goldman Sachs’ Annual Retailing Conference. “So the worst thing we could do is to really aggressively market this, get a bunch of members that are disappointed because they can’t get a slot or they don’t get the right in-stock level or some other problem happens.”

McMillon also noted that “in the big scheme of things happening at Walmart, it’s just one factor,” and he doesn’t expect Walmart+ to “punch above its weight.”

Walmart has given few details about how it’s internally quantifying the success of Walmart+ and provided only a few hints at what role the platform will play going forward. One potential avenue that McMillon mentioned in a conference call with analysts and investors last month is bringing food and health data together for consumers.

“I think the future of Walmart+ just is kind of this continuous burn for us where we add things to it and it becomes even more unique to Walmart,” he said. “Of course, delivery is a big part of it, but there’ll be other components, too.”

Related: Walmart Tells Shoppers ‘We’re Here For You’ As Omnichannel Retailer Neutralizes Delta Variant

Despite the many headwinds it still faces, as well as its distant-second-place status behind Amazon Prime, Walmart is showing no signs of backing down from this fight. Over the summer, in fact, the company hired 19-year American Express veteran Chris Cracchiolo to lead Walmart+, a move seen by many as a signal that its long-term plans are still intact.