Kohl’s to Launch 100 Small Format Stores in Untapped Markets

In a bid to get closer to customers and enter new neighborhoods, Kohl’s said Wednesday (May 25) that it was launching a sweeping store investment program that will see the addition of 100 new small-format locations over the next four years.

The announcement coincides with the retailer’s Investor Day meetings and marks the latest effort by the embattled operator of 1,100 stores to reinvigorate sales and move beyond a bruising two-year effort to oust the current board and shake up company operations.

“The average Kohl’s store of around 80,000 square feet is too large for many small markets,” the company’s presentation said, noting that the roll out of the new 35,000 square foot locations follows the successful pilot of 20 small format locations.

By shrinking its footprint, the Wisconsin-based department store chain said it gains flexibility needed to enter new neighborhoods but also be able to provide a “hyper-localized experience” that reflects each community’s particular needs, such as an over-allotment of outdoor gear in markets like Tacoma, Washington.

“Our strong and productive off-mall store base can continuously evolve with our customer’s expectations and demand,” Kohl’s Chief Property Officer Mark Griepentrog told analysts. “We see substantial opportunities to leverage our real estate in producing long-term growth,” he added.

The Sephora Connection

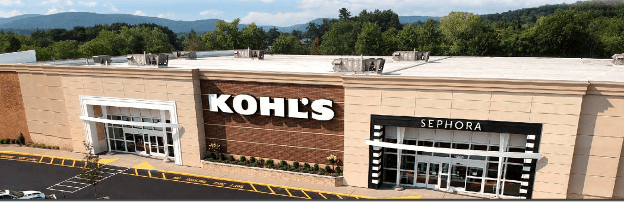

As the company begins to ramp-up its half-sized locations, its existing and expanding partnership with French makeup giant Sephora will continue to be at the center of both its traditional stores and new small format locations.

“The transformation underway in our stores, with our partnership with Sephora as a cornerstone, is driving impressive results,” CEO Michelle Gass said on the company’s earnings call last week.

“It is again important to note that while the build out of the Sephora shop-in-shops is at the core of the store remodels, these 200 stores — soon to be 600 by the end of summer — are a representation of the future of Kohl’s,” Gass told analysts.

The Shrinking Store Trend

To be sure, Kohl’s is not the first mass retailer to pursue new customers and markets via the addition of small format stores. For example, “mini Macy’s” have been popping up as part of a similar neighbor store expansion plan for more than a year, while the addition of so-called “tiny Targets” have been the predominant driver of new locations by the Minnesota-based retail chain.

At the same time, Kohl’s store makeover plans are also aimed at improving other logistical aspects that will improve convenience, including redesigned in-store pick up, drive-up, self-pick up, and Amazon returns, the company said.

“Kohl’s has a healthy and productive store base that can evolve with customer expectations and demand,” the retailer’s Investor Day presentation stated, pointing to other upcoming initiatives such as the debut of self-service BOPUS in all stores in 2022, as well as a planned pilot of self-serve returns and self-serve checkout in over 100 stores.

After benefitting from reported buyout bids and other reorganizational prodding from activist investors, Kohl’s investors approved the re-election of the full slate of existing board members in what was seen as a rebuke to outside intervention.

While Gass has said the company is still awaiting firm and final offers and will evaluate their merit, she has repeatedly stressed that the retailer’s existing strategy offered the best long-term value to shareholders, even though Kohl’s stock has fallen over 30% in the past two months.