Rate-Sensitive Retailers Getting Rocked by Rising Borrowing Costs

They have survived COVID, sidestepped the supply chain, and have — so far — been able to manage their way through a multigenerational bout of inflation. Now, as retailers face their fourth major economic test in the past 25 months, many of the same players that have not only thrived but emerged stronger from the prior three tests are suddenly finding themselves at risk of being tripped-up by the latest hurdle: rising interest rates.

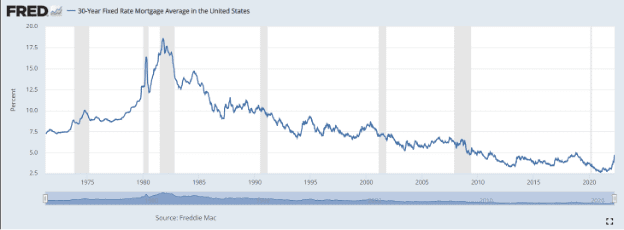

While still only a fraction of the historical 50-year average, the rapid increase in the rate of a typical 30-year mortgage has seen this benchmark nearly double over the past two years, but perhaps more painfully, sprint from roughly 3% to almost 5% in the first quarter of 2022 alone.

While all four of these headwinds are interconnected and the interest rate rise is being intentionally pushed higher by the Federal Reserve, the latter obstacle is already taking a major short-term toll on a number of rate-sensitive retailers that have direct exposure to anything that makes housing even less affordable.

An Economic Cancer

In much the same way that radiation and chemotherapy inflict major harm to the patient in the process of killing the cancer, higher borrowing costs are comparably lethal.

Not only do rising rates slow overall purchasing, but they also constrain construction as well as the furnishing of those properties too. As such, shares of Home Depot have fallen 25% this year at a time while the broader S&P 500 has dropped by not quite 6%.

It doesn’t stop there. Take a look at the reaction being seen by furniture or bedding retailers and the rate-sensitive retreat gets even more ugly, with brands like Wayfair and RH (formerly Restoration Hardware) each down close to 40% in 2022, with mattress retailer Tempur Sealy also experiencing equivalent declines this year.

In addition, appliance-related names such as Whirlpool and paint store Sherwin Williams are each down about 25% year to date.

The list goes on and on, but the effect is always the same: As much as the Fed is (rightly) moving to bring a red-hot housing market under control while also looking to cool inflation that is rising far more quickly than consumer wages, the knock-on effects of these actions run deeply into the economy and throughout the retail industry.

Not Just Housing

To be fair, all of the aforementioned companies are still up from the March 2020 COVID lockdown low by anywhere from 25% to 100% — even after the recent rate-driven retreat.

As much as the retail beneficiaries of the home nesting trend have benefited greatly over the long term, they are not alone in being hammered by this rate-driven rough patch which is inflicting damage on all purveyors of “big-ticket” items.

After housing, of course, that means cars. Although the auto industry has faced, and continues to be hit by, unique supply constraints, the rising interest rate monster has also inflicted pain this year on most of the nation’s vehicle showrooms and dealerships.

In particular, multi-store brands such as AutoNation, Penske Auto Group and CarMax have all underperformed the broader markets this year, and have slumped by 11%, 12% and 21%, respectively.

With this in mind, it is also important to note that most economists expect this trend, and the disastrous effect it has on many retailers, will get worse before it gets better.

In fact, the rising rate riptide may worsen when the latest inflation data is released Tuesday (April 11) morning. Economists project that headline CPI will hit 8.5% in March, up from a 40-year high of 7.9% in February and more than triple the 2.6% pace posted in March 2021. It will be a figure that quantifies what consumers already know and the Federal Reserve already fears, but one that could hold deep repercussions for rate-sensitive retailers, which will deliver their own updated reading for March on Thursday (April 14).