Tight Holiday Sales Outlook Heightens Demand to Reduce Retail Returns

At a time when retailers are competing aggressively on price to drive sagging sales, the need to limit returns via virtual try-on tools and tougher sales policies is expected to rise.

Even before the inflation-driven clampdown on spending, free shipping and returns were becoming too costly, prompting many retailers to seek new ways to mitigate losses for the peak season.

“We’ve seen the return rate continue to increase as times have gotten worse and things a bit more challenging,” thredUP Chief Financial Officer Sean Sobers said Monday (Nov. 14) on the resale marketplace and apparel subscription company’s earnings call. “The consumer’s maybe a little more focused on cash back or buyer’s remorse, whatever it is, but we’ve seen the return rate kind of spike up, and we’re working on quite a few different things internally to help resolve that.”

Those comments reflect an existing but exacerbated problem for the retail industry, which is using virtual try-on tech and restricting free returns policies as they also tighten up against returns chargeback abuse.

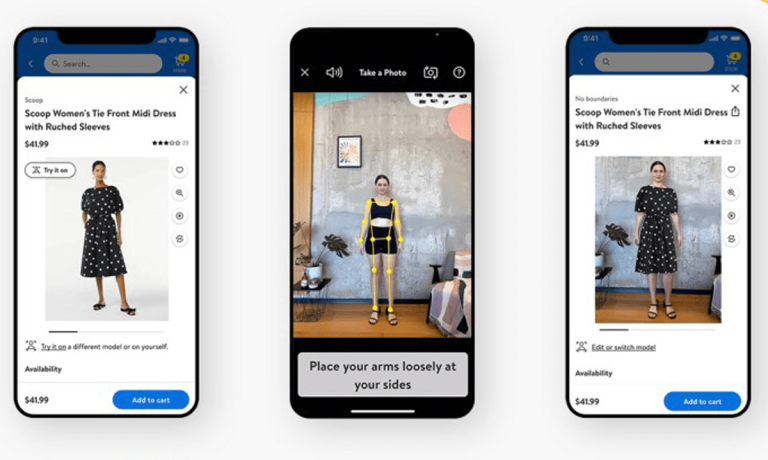

To cut off returns and chargebacks using consumer satisfaction as a more effective tool in this fight, innovation is pouring into virtual try-on tech, assuring a good fit on apparel and accessories, infamous for high returns.

In the first quarter, Walmart introduced its Zeekit virtual fitting room technology and Choose My Model technology, then updated it in September with Be Your Own Model, allowing shoppers to upload full-body selfies to get a more customized and personalized fit.

See also: The Many Faces of Fraud Haunt a Beset Holiday Selling Season

Early in November, Amazon Fashion and Snap teamed on virtual try-on experiences for social shoppers starting with eyewear.

“For this partnership, Amazon’s 3D Asset technology, a service that can be extended to industry partners, works with Snap’s Lenses to allow 3D assets and product information to be shared, as well as dynamically updated, providing shoppers up-to-date selection, product details and availability,” a press release stated.

Faced with rising returns, some retailers are also adjusting policies to be stricter.

CNBC reported earlier this month that “Stores such as Gap, Old Navy, Banana Republic and J. Crew (which was once well known for a generous return policy that spanned the lifetime of a garment) have shortened their regular return windows to within a month.”

“At Anthropologie, REI and LL Bean (which also once promised lifetime returns), there’s now a fee — all around $6 — for mailed returns,” the report added.

Like free shipping, few limits on returns are in some ways a souvenir of the pandemic migration to online shopping, as eCommerce players attracted millions of shoppers with free returns guarantees that are now out of sync with the altered retail reality of 2022.

Returns are problematic in several ways. There’s the costly reverse logistics of paying the return shipping, the fact that returned merchandise is often never restocked for future sale, and the thorny issue of disputes and chargebacks that retailers must also contend with.

Combating Fraud Parading as Legit Returns

The National Retail Federation (NRF) said early this year that returns added up to more than $761 billion in lost sales for United States retailers in 2021, adding that for every $1 billion in sales, retailers typically eat $166 million in returned merchandise.

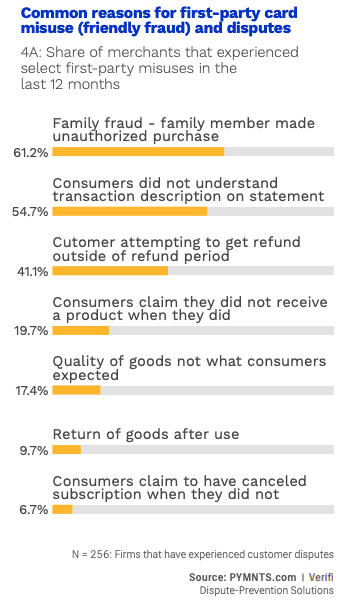

With a very different economic picture this year, some fear things could get worse in 2022, with returns abuse going by the misnomer “friendly fraud” a growing problem for retailers.

The study “Dispute-Prevention Solutions: Third-Party Tools Limit Dispute-Related Losses,” a PYMNTS and Verifi collaboration, noted that 61% of merchants “have experienced unintentional fraud by a member of the cardholder’s family making an unauthorized purchase, making this the most common type of first-party misuse,” and that “63% of digital subscription providers, 56% of travel and leisure companies and 46% of retailers have also faced this sort of disputed transaction.”

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.