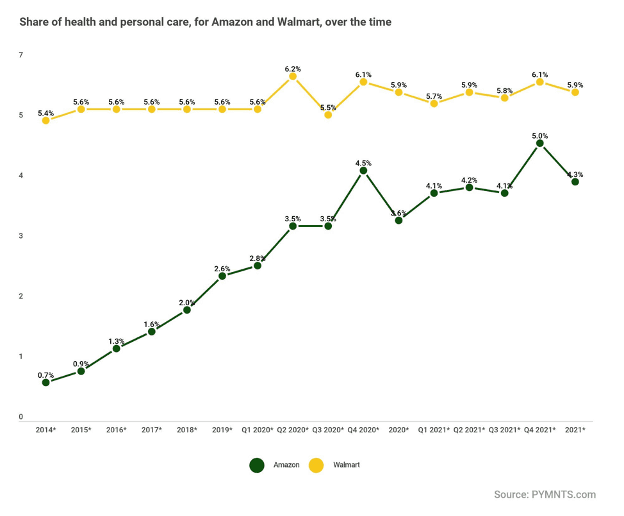

From an 8-to-1 market share advantage in 2014, to the present 1.6 percentage point margin at the end of 2021, Amazon’s efforts to chip away at Walmart’s lead in this key category have been notable and continue to pay off.

As PYMNTS’ new Whole Paycheck data show, the mile-wide exponential gaps of yore are long gone, and have been replaced by something more akin to a 1.5% margin. In what has been a decade-long flat trajectory, Walmart closed the year with a 5.9% share in its second largest category (behind only groceries) compared to Amazon’s 4.3% stake.

In dollar terms, the data show, Walmart’s nearly $50 billion take in the health and personal care category has grown by about 30% over the past five years and is still about one-third, or roughly $13 billion, larger than Amazon’s total sales in this segment.

However, despite Walmart’s revenue growth in health, it has been essentially treading water, or unable to add market share, in a category that has experienced outsized growth for the past 30 years.

By comparison, Amazon has grown its revenue in this segment by nearly 340% over the past five years, and seen its share of the pie go up year after year. Even so, health and personal care is taking on a growing importance for Amazon, where it is now the company’s fourth largest contributing category of seven retail segments tracked by PYMNTS, behind its Top 3 including electronics and appliances (24.5%) sporting goods, hobbies, music and books (16.9%) and clothing and apparel (14.6%).

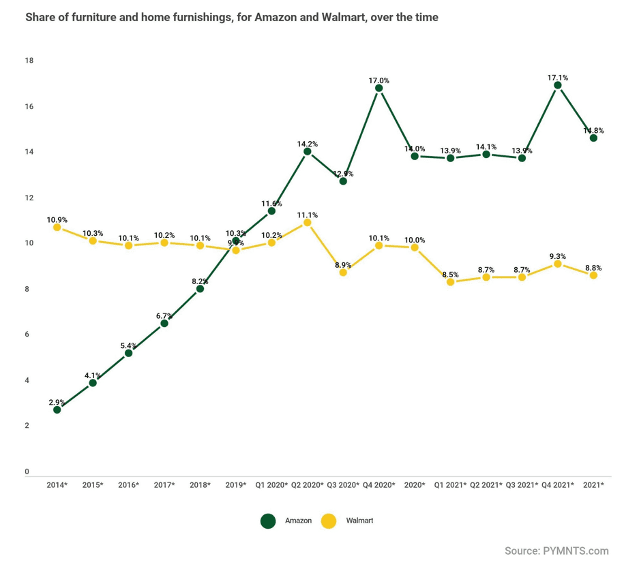

The Furniture Example

Clearly Amazon’s overall sales growth and 57% share dominance within U.S. eCommerce are the result of consumers’ massive mindset and wallet shift to online shopping over the past decade, where the Seattle-based retailer has been taking over categories once led by Walmart and controlling them one by one.

Take a look at the furniture and home furnishing chart below as an example of this “chase and dominate” performance. In 2014, Amazon’s 2.9% share of furniture sales in the U.S. was not only small but it sharply trailed Walmart’s 10.9% stake. Fast forward to 2019, the leadership cross-over year, and Amazon suddenly found itself with a slight lead, as consumers became increasingly comfortable with the idea of buying big bulky furniture items without touching them.

That trend has only accelerated over the past two years of pandemic lockdowns where the nesting trend has seen people investing heavily to make their homes, and home offices, more inviting and Amazon’s lead in the category widened to 14.8% in 2021, amounting to a 6 percentage-point lead.

The point with furniture is two-fold. First, no category lead is safe or too large for Amazon to attack, and second, once it starts to gain traction it historically adds sales and share and momentum until it is the dominant player.

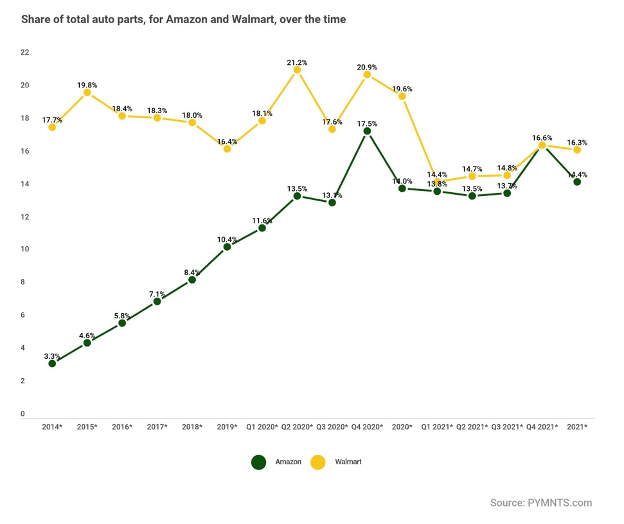

Auto parts is a similar story, albeit on a much smaller scale for both companies given the 7th place ranking the category holds for both retailers.

While admittedly a complicated category dominated by specialty retailers that have historically relied on store-based buying, that too has been changing. Today, Amazon sits at the cross-over stage, having erased Walmart’s dominant market share lead over the past eight years and brought it within striking distance.