Away Luggage Quiets Talks of Buyout, Shifts Focus to Retail Expansion

In February, Away luggage toyed with the idea of selling. Now, it’s expanding its physical footprint with its latest store opening in San Jose, California, this week.

See also: Luggage Brand Away Reportedly Seeking Potential Buyers

The decision to look for a purchaser follows the ongoing impact of the pandemic. In April 2020, Away put about 50% of its team on furlough and terminated another 10%. At that time, the company reported a 90% decrease in sales of its products since the start of the pandemic.

At the time of the news, a report surfaced in March that the drop in travel due to coronavirus fears would end up costing the airline industry over $113 billion in revenue.

See also: Away Luggage Company Furloughs Approximately Half Its Staff

Away expanded its physical store locations to 13 in the United States, the United Kingdom, and Canada, with the opening of a new store in Seattle in February 2021, 10 months after the previous store opening.

At the time, the New York City-based firm said it also shipped merchandise to 40 nations around the globe.

See also: Away Brings Brick-and-Mortar Store to Seattle

Emphasis on Retail Expansion

The travel brand has planned a few new store openings, signaling a bigger focus on brick-and-mortar expansion in 2023.

Away plans to expand its retail presence beyond the San Jose store by opening a location in the Georgetown neighborhood of Washington, D.C., later this summer, with plans for additional stores to be announced.

This year, retail stores are expected to contribute almost 20% of Away’s revenue, generating at least $3 million in revenue.

How Retail Boosts eCommerce

According to Away President Catherine Dunleavy, retail plays a significant role in their business not only in terms of revenue but also in boosting the entire business. Dunleavy also notes that opening a retail store results in a 150% increase in eCommerce business in that market.

The company recognizes that due to the pandemic, it had to pause its retail expansion plans and that it would have to proceed with caution.

Today, Away operates 13 retail stores, primarily located in major U.S. cities like New York, Los Angeles and Houston, as well as in popular international destinations like London and Toronto.

According to Dunleavy, when selecting new store locations, Away takes into account factors such as travel spending patterns, the presence of style hubs in different cities, and the amount of foot traffic on various streets.

“We need to make sure that we have the right brand experience and need to be in the right markets with the right street. We need to have attractive financials. When all these things come together, we open a store,” Dunleavy said.

Dunleavy has identified retail expansion and product assortment expansion as key priorities for Away this year, with the release of the F.A.R. outdoor gear line and a focus on enhancing omnichannel services like buy online and pickup in-store.

As a company that sells luggage, Away is addressing the challenge of maintaining customer loyalty and ensuring repeated purchases due to the infrequent need for replacement. This is particularly crucial, especially with inflation affecting consumer spending patterns.

Impacts of Consumer Spending

According to the PYMNTS report, although inflation is on the decline, consumers are not confident about its long-term impact, and 74% have cut down on nonessential retail purchases.

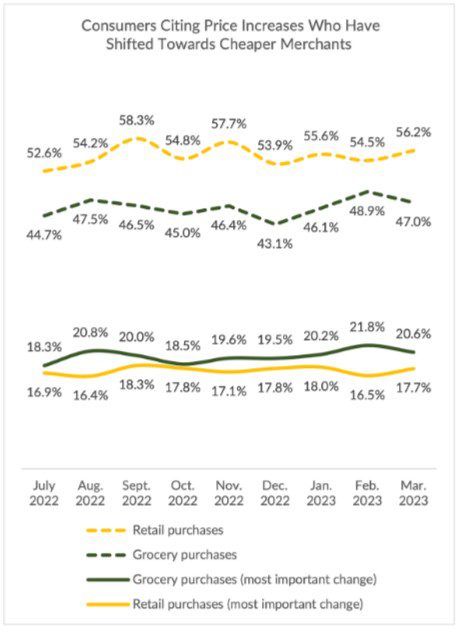

According to proprietary research, 56% of consumers have been switching to lower-priced grocers, while 47% have been doing the same for their retailers.

See also: Inflation Slows but Consumers Still Pivot to Cheaper Merchants

Additionally, this graph shows the percentage of consumers surveyed who consider shifting to less expensive merchants to be the “most important” change in their spending habits.