Merchants Say Defeating Checkout Friction Defines Retail’s New Reality

Want more loyal customers? Give them a smooth checkout experience and the payment options and shopping features they desire. It’s not rocket science, but it is a science.

It’s also an art, as PYMNTS learned speaking with leading retailers for our recent article series, “Merchant Voices and Commerce Voices,” which view ongoing moves by merchants through the different but related lenses of what great shopping and checkout experiences must be today.

For Marko Ivanovic, director of digital payments at Adidas, he’s got a brand that practically writes its own headlines. His task comes down to ensuring a seamless payment experience that doesn’t deter someone from checking out with that $250 pair of Air Jordans. It ends up being about understanding regional preferences as a global brand.

Adidas is doing this with a strong mobile focus. Ivanovic told PYMNTS, “We clearly see the shift to mobile in general. We’re already offering a range of mobile payment methods, like Apple Pay, Google Pay and WeChat Pay. We also launched PayPal in stores. For us, it’s members first, one-click checkout, especially for the young generations that do everything with their mobile.”

What’s valid for footwear is also true in lingerie, as we discovered speaking with Nicolas Capuono, chief customer officer at intimates brand Adore Me, now part of Victoria’s Secret.

Where Adidas is a buy now, pay later (BNPL) trailblazer, BNPL isn’t a fit for an Adore Me customer’s average $100 basket size. Features these shoppers want are around things like virtual try-on, curated offers, plus the free shipping and returns they’ve come to expect.

Learnings from its subscription box offering have taught Adore Me to save time for the customer “by shipping a box with our own recommendation based on key information

that we get from the customer,” Capuono said. “We curate the box based on this information, the customer is saving time browsing the website, and this is valuable.”

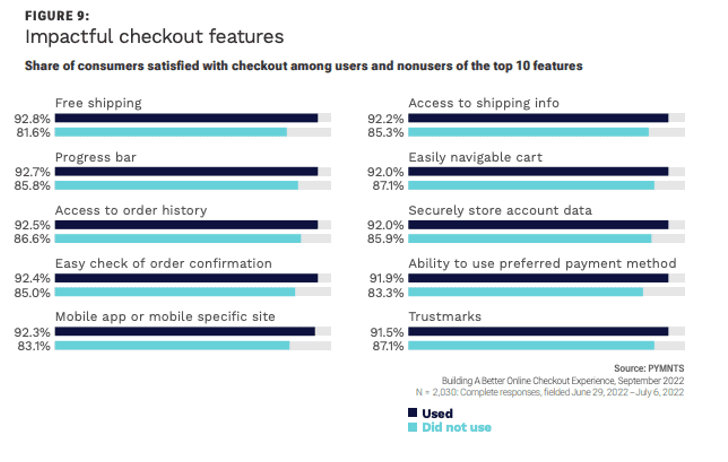

That’s in line with findings from “Building A Better Online Checkout Experience: The Key Features That Matter To Customers,” a PYMNTS and Checkout.com collaboration, which states that “Frustrating checkout processes stand out as the most common pain point, occurring in 15% of consumers’ most recent transactions, followed by excessive requests for personal information, which affect 11%.”

Move it over to workout togs and athleisure wear and you find the same dynamics at work.

Fabletics SVP and Head of Retail Ron Harries talked about the role smartphones now play in the shopping experience — we’ve called them the new “remote control” of retail — saying, “If you see a price in a retail store today, you can check your phone real quick to see if that’s less expensive online or less expensive somewhere else. That’s why it’s so important to come across in a way that is authentic to consumers and gives them the best price that they’re going to get in the marketplace at that moment.”

Features Fix Food Friction

Move this conversation to the grocery environment, and ALDI Retail Payments Leader Teresa Turner spoke with PYMNTS about the chain’s ongoing update of checkout tech to cater to a spectrum of shoppers, many of whom like speed and simplicity when they go to pick up just a few items.

“We do have a smaller basket size than some of the larger competitors, so there is a large portion of our customers that just have three, four items, and they just want to check themselves out,” Turner said. Here again, data confirms the trend and how it’s best handled.

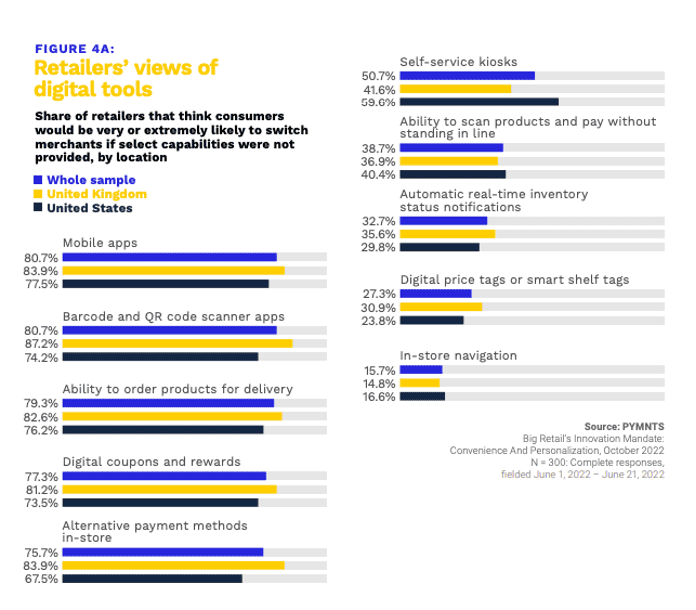

PYMNTS and ACI Worldwide’s study, “Big Retail’s Innovation Mandate: Convenience and Personalization” notes, “Most retailers stated that consumers were likely to shop elsewhere if they could not use the following in-store digital features: mobile apps, cited by 81% of retailers we surveyed; barcode and QR code scanner apps, cited by 81%; digital rewards and coupons, cited by 77%; alternative payment methods, cited by 76%; and self-service kiosks, cited by 51%.”

Similarly, Paul Fletcher, head of payments at Co-op, one of the U.K.’s biggest food retailers and one of the world’s largest consumer co-operatives with around 2,500 food stores, told PYMNTS, “Contactless is now about 80% of our transactions,” adding, “we’ll support all of the digital wallets — Google Pay and Apple Pay among them — that are booming, particularly in eCommerce.”

Putting the ‘Auto’ In Online Car Sales and Eyewear

Drive over to the online car buying experience and the parallels to lingerie and grocery exhibit the human nature driving all transactional behaviors.

In a conversation with CarMax Assistant Vice President of Product Ann Yauger and Assistant Vice President of User Experience Design Eric Martin, we found that digital features are taking the notorious pain and distrust out of buying a ride, and are becoming indispensable.

Using online prequalification and assessment tools, CarMax has been able to remove the friction car shoppers dread. “Now digital can take that pain point away … before you come in or even after, and just make the time you spend in the store itself all about the reason you’re there: to see the car, to get the car, all the positive things,” Yauger said.

You might not think so, but eyewear retailing shares many of the same issues as car buying.

Doron Pryluk, senior vice president of customer experience at GlassesUSA.com told PYMNTS, “We’re trying to add a lot of customer-facing tech tools to transform the process of buying glasses online. We have a prescription scanner app. We have our virtual try-on and a lot more tools. One of the key things that we’re focusing on is simply providing exceptional customer care and handholding our customers every step of the way.”