Discount Stores Remodel to Capture Walmart Grocery Share

Major remodels by the country’s top two dollar store chains signals expectations for prolonged higher food prices. As reported by FT earlier this week (Apr. 19), both Dollar Tree and Dollar General each plan to increase the number of existing store renovations by double-digit percentages compared to the previous year. Both chains are making these overhaul investments, including increased refrigerator and freezer capacity, to accommodate consumer demand across income brackets for cheaper groceries than those found at traditional grocers.

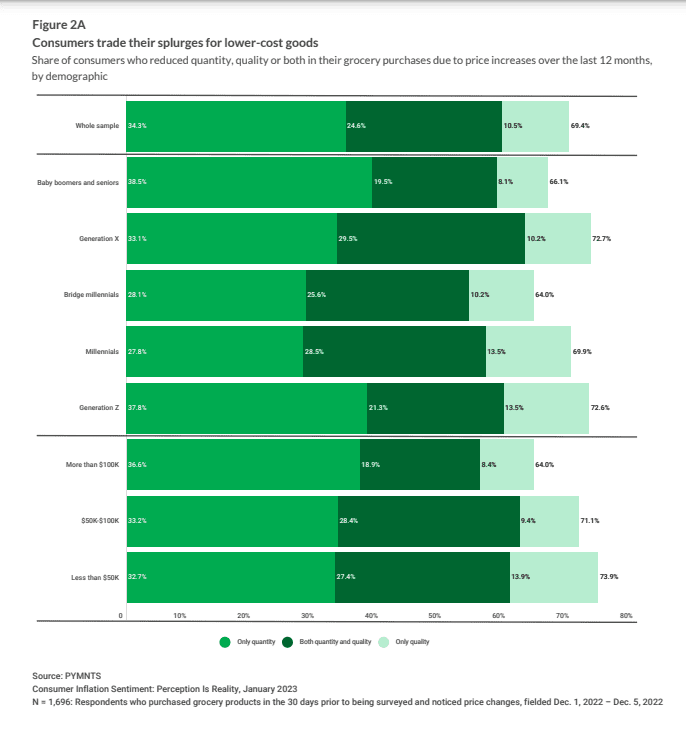

Consumers’ increased leaning toward value retail is noted in PYMNTS’ January “Consumer Inflation Sentiment” report, which found that 69% of consumers fought rising food costs over the last 12 months by reducing quality or quantity — or some combination — of grocery purchases.

This trade-down has benefitted discount grocers such as the dollar chains and big box retailers who are trying to woo higher-income shoppers into discretionary spend with competitive grocery prices.

In the current rocky economic landscape, consumers compare prices in choosing where to shop, and previous PYMNTS’ research notes consumer behavioral shifts to a mix of brick-and-mortar and eGrocery channels to accommodate their deal-seeking. Additional PYMNTS research finds that the most ardent cost-cutting grocery shoppers look for bargains in-store and that the highest share of these in-store bargain seekers are the often less-digitally connected generation of baby boomers and seniors.

Aligning with the brick-and-mortar bargain sentiment in a PYMNTS interview, Barbara Connors, vice president of commercial insights at 84.51°, a marketing subsidiary of grocery giant Kroger, noted that consumers who are worried about grocery prices tend to shop in-person. “We know that very price-sensitive customers are those that have lower engagement with eCommerce and are lower on the adoption curve, and those are the customers that are most likely to go into a store. And one of the reasons is because they are looking for sales, deals and coupons, and it is easier for them to do that in-store than online.”

Even while inflation slows, consumers don’t predict an end until fall 2024. Shoppers are partly combatting stubbornly high food costs by making value a central part of their grocery strategy. So long as families are cutting into their food budgets to make ends meet, there will be a demand for the discount groceries dollar stores may provide. And, if these chains’ confidence in the long-term value of upcoming remodeling is any indicator, that demand may be long-lasting.