eCommerce Platforms Open Up New Digital Channels for Auto Parts

Buying auto parts, historically speaking, has been about as brick and mortar a process as one might find anywhere.

Buying the parts themselves tends to be an urgent consideration: Something’s wrong with the car or the truck, a repair’s necessary to keep things moving, literally.

Head to the store, weigh the choices available, pay up at the register, and (assuming you’ve got the transportation handy) and haul the tire, the battery, the mirrors — pretty much anything you can name — home.

Given the fact that PYMNTS Intelligence data found earlier this year that 64% of consumers said they’d be unlikely to buy a new vehicle this year, as so many of us are living paycheck to paycheck, maintaining the vehicles we do have on hand becomes a juggling act between finding the right parts, at palatable price points.

There’s been a bumper crop (pun intended) of firms offering new digital channels and platforms to bring the act of browsing and buying auto parts more firmly into eCommerce.

In just one of the latest announcements, AutoNation launched AutoNationParts.com, which allows customers to purchase parts and have them delivered to their doorstep. AutoNation said that the site offers manufacturer parts from over 25 brands, as customers can search for parts by vehicle identification number (VIN) or by year, make, model, trim and engine details.

Amazon and Walmart Have Revved Their Engines

Earlier this year, Amazon debuted its OEM Automotive Parts Shop, which lets consumers order parts and opt to have them delivered to their home or to a local service provider to facilitate installation.

And Walmart, of course, has its online efforts in the space, having announced back in 2018 that it was teaming with Advance Auto Parts in an omnichannel approach to selling auto necessities. More recently, as reported late last month, automotive parts eCommerce platform RevolutionParts is working with Walmart GoLocal to expand same-day delivery.

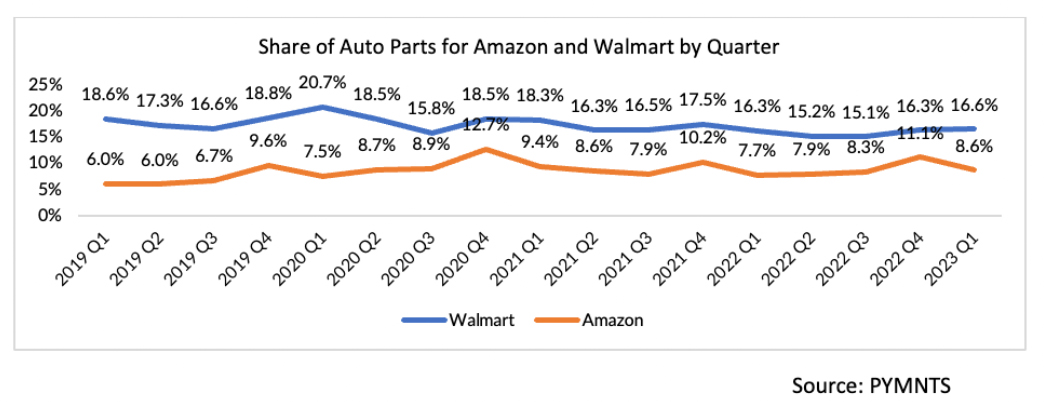

Amazon and Walmart, as is the case in so many categories, joust for a share of customers in auto parts. The chart below shows that as of earlier this year, Walmart has roughly double the share logged by Amazon.

But the auto parts pie is large enough to accommodate several players. The latest retail sales data from the government show that motor vehicle and parts sales were $133.6 billion in September, up 1% from the previous month and more than 6% higher than a year ago.

The platforms, in general, have the data flows and analytics to help match supply and demand and maximize inventory efficiencies — and perhaps even prod vehicle owners to be proactive in their maintenance efforts while embedding a range of payment options into the eCommerce experience.

In an interview with PYMNTS this past summer, David Meniane, CEO of CarParts.com, illustrated the appeal of buy now, pay later, where the costs of parts are spread out over time.