1 in 6 Shoppers Choose Merchants Based on Payment Choice

As consumers demand more flexible options at checkout, many shoppers make decisions about where to buy based on whether they can use their preferred payment method.

By the Numbers

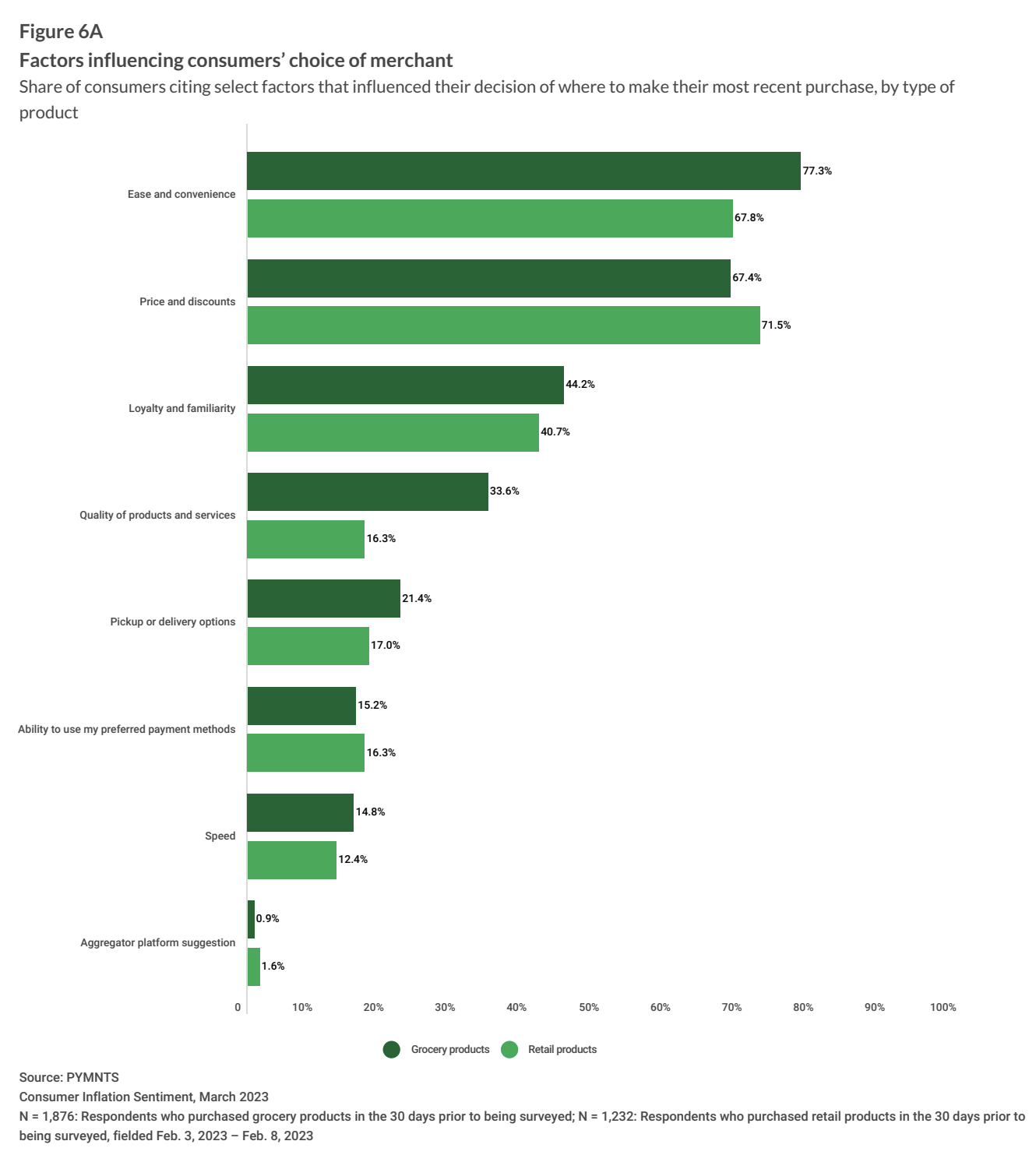

PYMNTS Intelligence’s report last year, “Consumer Inflation Sentiment: The False Appeal of Deal-Chasing Consumers,” surveyed more than 2,100 United States consumers about the factors affecting their shopping habits and their relationships with retailers.

The results revealed that, when buying non-grocery retail products, 16% of consumers cited the ability to use their preferred payment methods as being among the factors that influenced their decision of where to make their most recent purchase.

The Data in Context

Indeed, major firms are seeing this demand drive consumers’ shopping decisions.

“Whatever calculus the user performs to determine the payment methods that they want to use, they want more options across more merchants,” Drew Olson, senior director at Google Pay, told PYMNTS CEO Karen Webster in December.

It is not only when shopping online that consumers want more convenient payment methods. In a 2023 interview with PYMNTS, George Hanson, then senior vice president and chief digital officer at Panera Bread, said the fast-casual eatery’s addition of biometric payments was key to meeting customers’ demand for more frictionless transactions.

“We’re leveraging what the guests have told us and what they continue to show us, which is that they’ve increased their digital adoption,” Hanson said. “They expect their phone to be a part of every interaction at every access point. We’re looking at all the areas that traditionally have been offline and adding value to the experience, leveraging our digital capabilities, and the guest is responding very favorably.”

With the growing preference for flexible payment options, retailers who fail to cater to this evolving consumer behavior risk losing a significant portion of their customer base.

For all PYMNTS retail coverage, subscribe to the daily Retail Newsletter.