89% of UAE Retail Shoppers Leverage Digital Tools in Physical Stores

Worldwide, when it comes to shopping, consumers no longer think in terms of channels such as in-store or online. For an increasingly larger share, physical stores have become an extension of the digital shopping experience, and shopping is just shopping.

This is one prominent trend PYMNTS Intelligence identified in its extensive 2024 Global Digital Shopping Index series, which was commissioned by Visa Acceptance Solutions.

One essential component in this trend around the world is the rise of the Click-and-Mortar™ shopper: those consumers who leverage both digital tools and physical locations to maximize their shopping experience. It’s a pattern we identified in Mexico, Europe, the U.S. and elsewhere, but, as we reveal in the United Arab Emirates (UAE) Edition of our Global Shopping Index, Click-and-Mortar™ shoppers are especially prevalent in the UAE.

Eighty-nine percent of UAE retail shoppers leverage digital tools while browsing in physical stores. Meanwhile, 45% of UAE grocery shoppers do the same. And, when surveyed about the quality of their digital shopping features, respondents shared what turned out to be the second highest level of customer satisfaction among the six countries we studied. This likely explains why 71% of UAE consumers used digital features to enhance their most recent shopping experience.

But there is still room to grow. We surveyed 1,392 consumers and 212 merchants in the UAE for our study and determined that merchants there should not rest on their laurels; rather, they would be wise to continue building on the existing enthusiasm for Click-and-Mortar™ shopping.

In a retail landscape increasingly driven by digital innovation, ongoing development can help ensure the UAE stays ahead of other regions. After all, it doesn’t take long for once-novel digital features to become stale in the eyes of consumers — and that can result in stagnation.

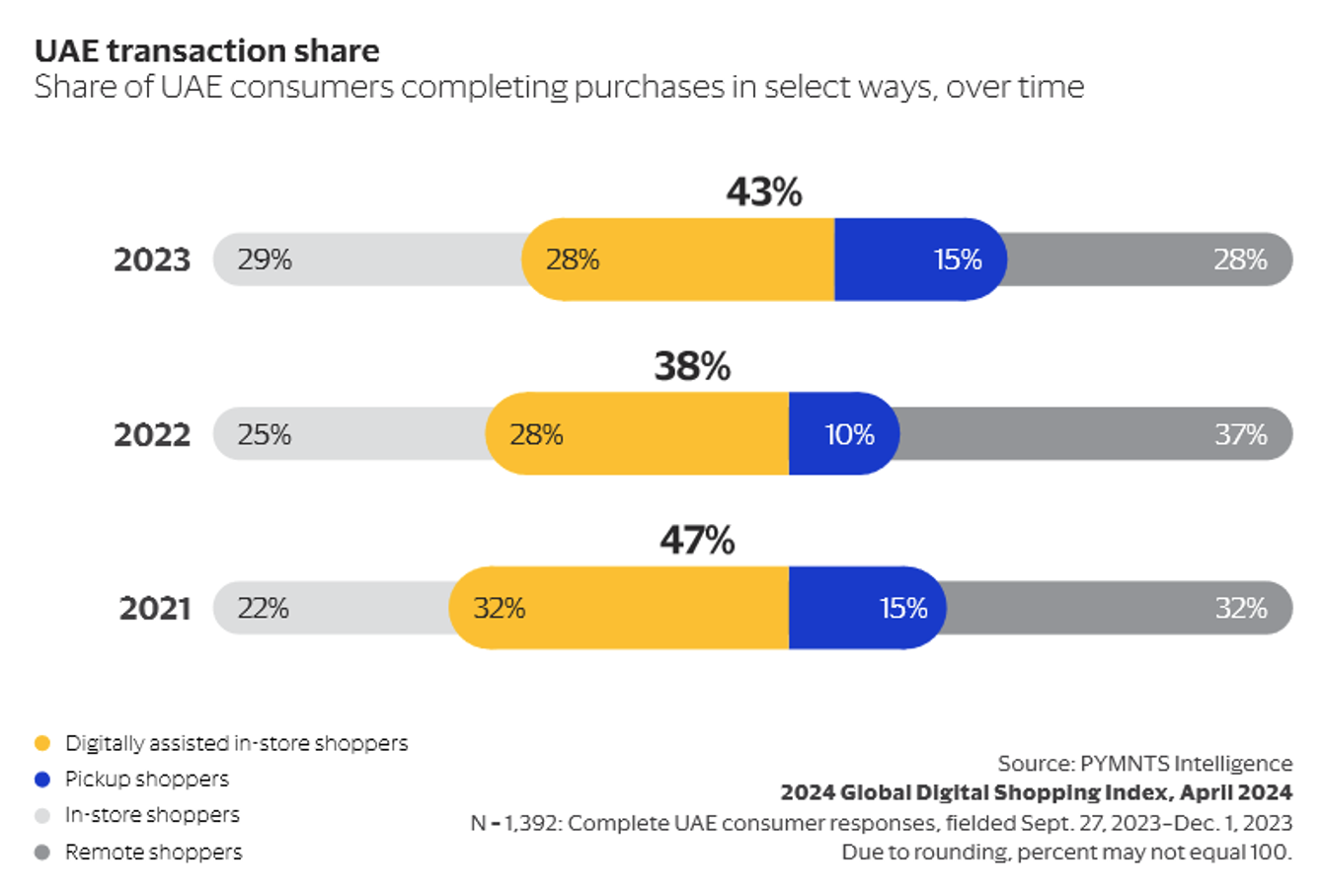

Our research suggests digital shopping stagnation is a genuine risk in the UAE. PYMNTS Intelligence data spans several years, and, the figure below illustrates, the high rate of Click-and-Mortar™ shoppers has actually declined since 2021. Merchants may have contributed to this, however, as those in the UAE offered one less feature on average than they did the year before.

Despite this, the Click-and-Mortar™ base recovered somewhat from 2022 to 2023, further suggesting that enthusiasm isn’t the problem. An opportunity remains for proactive UAE merchants to continue expanding their shopper base.

In particular, data shows that the gap between consumer demand and market supply of digital features has strong growth potential for merchants, especially grocers. By expanding and diversifying their digital offerings, rather than staying content and pruning down their offerings, merchants can reinvigorate the Click-and-Mortar™ experience for consumers in a bid to reap the benefits.

With consumers already utilizing an average of 14 different digital features and nearly 9 in 10 retail shoppers depending on these digital aids, the appetite for an enhanced Click-and-Mortar™ experience in the UAE is strong. For local merchants to maintain their competitive edge, they must meet current needs and set new benchmarks for digital retail innovation.