Consumers Say Amazon’s Big Spring Sale Was Stronger Than Walmart+ Week

Last month, Amazon introduced its first-ever Annual Big Spring Sale. Whereas Amazon’s Prime Days events are designed to woo Amazon subscribers into filling their shopping carts with merchandise, the Big Spring Sale was the first Amazon event to cater to non-subscribers as well.

As PYMNTS Intelligence found in its Amazon’s First Annual Big Spring Sale Report — which analyzed the big event by surveying more than 7,000 shoppers — overall, the Spring Sale fell short when compared to what Prime Days typically generate in terms of participation and sales.

For starters, there was less consumer engagement. From 2021 through 2023 Prime Days sales drew in a solid 36% to 40% of U.S. shoppers. The Big Spring Sale, however, drew in just 28% of consumers, meaning Spring Sale turnout was 29% less than an average Prime Days draw.

Equally important, shoppers who participated in Amazon’s Big Spring Sale bought, on average, six items during the sale, which is one less than what was purchased during the last Prime week sale. Not only did shoppers buy less, but they bought fewer high-end items (home appliances, electronics and furniture), choosing instead to stock up on daily-use merchandise, such as clothing, accessories and beauty and health products.

Despite these setbacks, the Spring Sale did capture the attention of 28% of U.S. consumers, and — perhaps even more importantly — it also helped convince nearly 1 in 4 non-Prime members who participated to subscribe to Prime.

Additionally, Amazon’s Big Spring Sale overshadowed another big, annual eCommerce extravaganza: last year’s Walmart Plus Week.

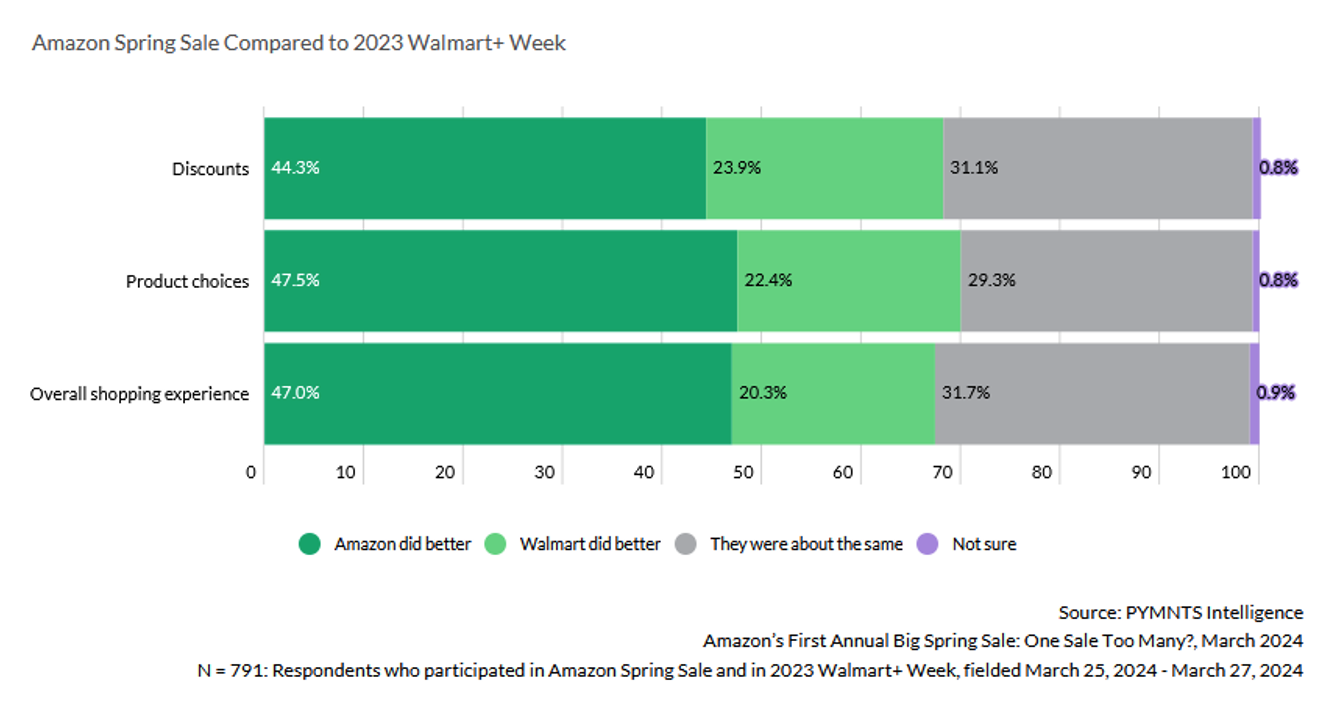

In exclusive data that was not included in our original Amazon’s First Annual Big Spring Sale Report, we compared how consumers perceived the two big shopping events.

Amazon performed significantly better in every comparison we asked about. When it came to offering impressive discounts, 44% of respondents said Amazon outpaced Walmart (24% said Walmart did better). Amazon also impressed far more consumers (48%) than did Walmart (22%) in the area of product selection. When asked to rank the overall shopping experience, 47% preferred Amazon, whereas only 20% sided with Walmart.

However, the exclusive PYMNTS Intelligence data tells another tale that might be easy to overlook: when asked to compare the quality of the discounts and the overall shopping experience, more than 31% said both retailers were “about the same,” suggesting both have ample opportunity to win over online shoppers the next time.