Banks Combine AI and Communication to Combat the Rising Threat of Payment Fraud

With the rise of digital transactions and online services, fraud has become an increasing concern for both consumers and businesses.

In March 2023, for example, 11% of consumers who paid for groceries encountered payment fraud, marking an 88% increase since December 2021. This is one of key findings in a recent PYMNTS Intelligence report entitled “The Next Chapter in Fraud: Using AI to Unveil Payments Intelligence,” which examines concerns around cybercrime and how financial institutions (FIs) are mitigating fraud risks.

Data from the joint PYMNTS Intelligence-AWS study shows that businesses are also grappling with the far-reaching impacts of fraud, with failure to prevent sophisticated fraud schemes leading to customer attrition. In fact, more than 30% of Big Tech and FinTech firms have lost customers due to fraud or financial crimes, the study found.

In response, firms are planning investments in fraud detection and management tools, with many turning to artificial intelligence (AI) and machine learning (ML) for enhanced fraud prevention. These advanced tools offer the potential to analyze vast amounts of data, identify patterns, and detect anomalies that indicate fraudulent activities.

For Big Tech and FinTech firms that still need convincing, the fact that 66% of FIs that use ML or AI experienced a decrease in overall fraud rates could help increase their trust in the effectiveness of AI in combating fraud.

Michael Jabbara, vice president and global head of fraud services at Visa, has also made a case for AI in fraud prevention efforts, telling PYMNTS in a recent interview that the technology can help combat the “democratization” of cybercrime and ransomware.

As he noted to PYMNTS, AI is “the superpower that gives us the ability to detect that proverbial fraudulent needle in the overall haystack of legitimate interactions — and then build the automation necessary to carve out the fraud while letting the authentic transactions go through.”

Strengthening Anti-Fraud Efforts

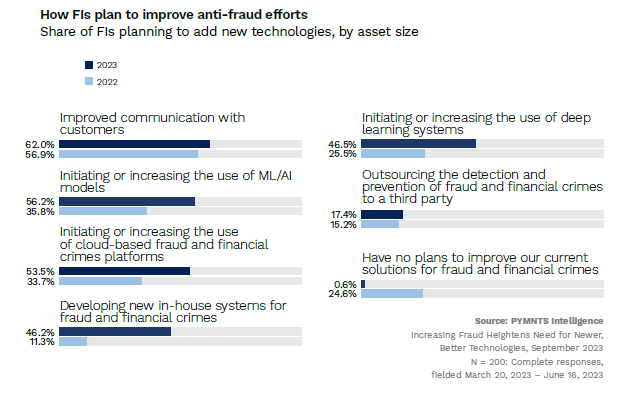

While most banks and firms are focusing primarily on increasing the use of ML/AI models to stem the rising tide of fraudulent activities, FIs also plan to improve anti-fraud efforts in other areas.

PYMNTS Intelligence data shows that in 2023, 62% of FIs plan on improving communication with customers as an anti-fraud measure, up from about 57% in 2022. This includes regularly updating customers on the measures taken to protect their accounts and transfers from fraud, which can go a long way to alleviating customer fears and foster trust.

For example, Irish bank Permanent TSB has launched a new feature of its banking app to notify customers if they receive a text message containing a fraudulent link, the Journal reported on Sunday (Oct. 15).

More than half of FIs surveyed also plan to initiate or increase the use of cloud-based fraud and financial crimes platforms in 2023, a share that is significantly higher than the nearly 34% recorded in 2022.

Additionally, about 46% of FIs said they plan to develop new in-house fraud-prevention systems, an increase from 11% of FIs who had similar plans last year. Similarly, more FIs have plans to initiate or increase the use of deep learning systems than they did in 2022, at 46%.

Overall, the study proves that there is no one-size-fits-all solution to mitigate fraud and financial crimes. While the increasing prevalence and sophistication of fraud incidents underscores the urgency for newer and better technologies, other anti-fraud measures could also contribute to ensuring a secure and trustworthy environment for financial transactions.