Bridge Millennials Want Payments Innovation as Long as It’s Secure

This second-to-last installment of PYMNTS’ generational mini-series takes a closer look at the digital habits and behavior of bridge millennials.

The cusp generation known as bridge millennials contains both older millennials and the youngest members of Generation X. These consumers are generally considered to have been born between 1980 and 1989.

Defying the notion that younger generations are the most tech-forward, bridge millennials are generally on a par with millennials and Generation Z when it comes to adopting digital innovations. Simultaneously, they are the age cohort most likely to store their identification and other personal information in a mobile wallet.

Here, we focus our bridge millennial findings around five of PYMNTS’ key research themes — healthcare, finances, payment preferences, food and banking security — in order to form top-down view of what drives bridge millennials.

Healthcare: Representative of the age cohort’s affection and trust in digital innovations throughout the themes PYMNTS tracks, 40% of bridge millennials surveyed had used a digital portal to make a payment within the last year, making the option most popular among this age cohort. Bridge millennials paid for doctors’ visits in full 87% of the time, and 62% set up payment plans when it came to their last surprise medical bill. Interestingly, this demographic has the highest share of consumers spending more on healthcare than they can afford, at 48%.

Payment Preferences: Bridge millennials were the most reluctant among the younger generations to try a new payment method in the year previous to being surveyed, with just 66% having done so, compared to millennials and Gen Z, at 70% and 79%, respectively. However, when bridge millennials did try a new payment option, digital wallets were adopted by 63% of them, making the method their far and away favorite. This age cohort has the highest degree of trust in mobile wallets, with 36% of surveyed bridge millennials agreeing that mobile wallets are safer than physical wallets and 27% believing they are as safe. Perhaps because of these trust levels, bridge millennials represent the highest share of consumers to store important information in mobile wallets such as train tickets (18%), auto insurance cards (43%) and identification documents (38%).

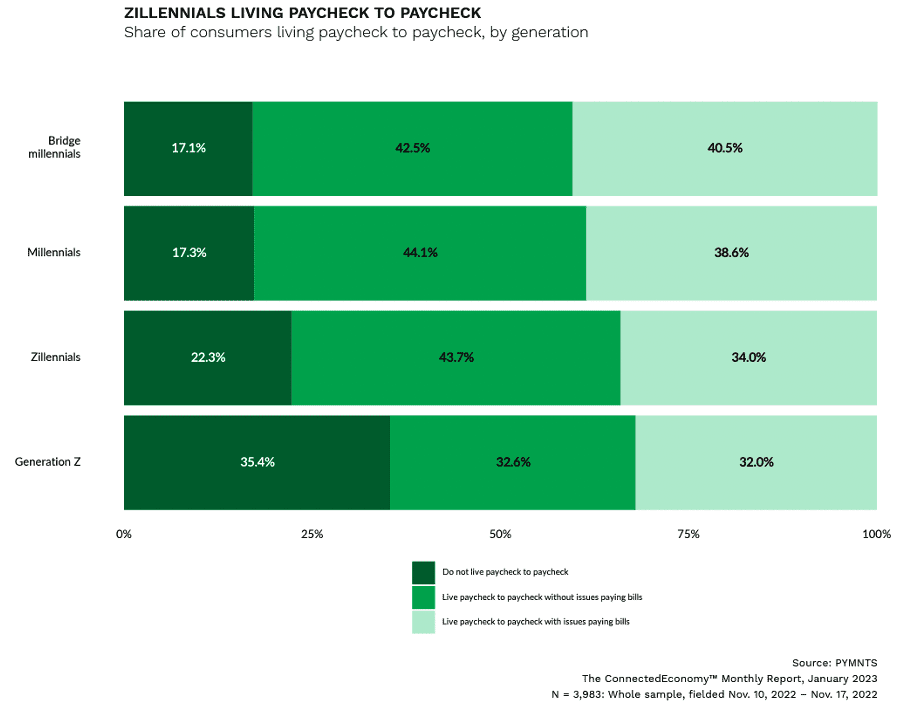

Finances: Perhaps due to their age and life stage, 76% of surveyed bridge millennials live with a partner, the highest among the younger generations. However, as noted in the PYMNTS’ January “Connected Economy™ Monthly Report,” compared to the same younger demographics, they are the age cohort most likely to be living paycheck to paycheck, both with and without issues paying bills. This may also be due to their life stage, as some presumably start a family as well as take on the burden of homeownership.

Food: Surveyed bridge millennials are working to lower costs while eating out, with 16% choosing less expensive menu items and 27% eating out less often altogether. However, as they maintain an “old school” sense of responsibility, inflation has not stopped bridge millennials from leaving tips at 97% of their last table-side restaurant meals and 61% of their last quick-service restaurant meals. However, a stretched budget has led 50% of bridge millennials to reduce the amount they do tip. Just over 25% of this age cohort have sacrificed both quality and quantity to manage higher grocery prices, with 28% sacrificing quantity only.

Banking Security: One-quarter of surveyed bridge millennials bank exclusively digitally. Much like the age cohort’s trust in mobile wallets, they are the demographic trusting their primary bank’s security most, with 42% strongly agreeing that their financial institution offered the highest level of security, and 43% agreeing with the statement. Contrary to the general sentiment across other age cohorts, 32% of bridge millennials said they would prefer increased levels of invisible security from their primary bank, the highest across age demographics.

Read more: Gen Z Most Open to Trying New Ways to Pay

Caring for Kids and Parents Has Gen X Falling Behind Financially