FBI: More Than $12 Billion Lost to Online Fraud in 2023

American consumers and business owners lost a record $12.5 billion last year to online scammers, marking a 22% spike in cybercrime over 2022, according to the FBI.

Despite these losses, the FBI’s newly released annual internet crime report indicates Americans are growing more vigilant. The agency says it also received a record number of complaints about online crimes last year — 880,000 — a bump of nearly 10%.

But, the agency cautions, a few grains of salt might be in order, because most online fraud goes unreported.

What was reported is striking. Losses due to online investment scams top the FBI’s list of 2023 cybercrimes, costing Americans $4.57 billion last year, up 38% over the $3.31 billion lost in 2022. Next on the list — with a price tag of $2.9 billion — are bogus business emails, where bad actors compromise legitimate business accounts and trick unsuspecting consumers into sending money, sensitive data or both. Tech support scams rose 15%, making them the third costliest scam of the year, totaling nearly $1 billion. Losses due to ransomware climbed 74% in 2023, draining Americans of nearly $60 million.

Faced with losses of this magnitude, it’s little wonder that eCommerce merchants tell PYMNTS Intelligence that they are ramping up their defensive measures. Ninety-five percent of the 300 fraud-prevention executives we recently surveyed told us they have either already enhanced their anti-fraud security kits — or they plan to do so soon.

These executives, representing a variety of U.S. companies with international sales, were surveyed for “Fraud Management in Online Transactions,” a new report created in collaboration with Nuvei detailing the fraud trends merchants are seeing and steps they are taking to stem losses and preserve customer relationships.

PYMNTS Intelligence found that 82% of eCommerce merchants endured cyber or data breaches in the last year. Forty-seven percent say the breaches resulted in both lost revenue and lost customers. And because high-profile breaches can undermine reputational damages, 68% of merchants also saw a drop in customer satisfaction, which they attributed to a breach.

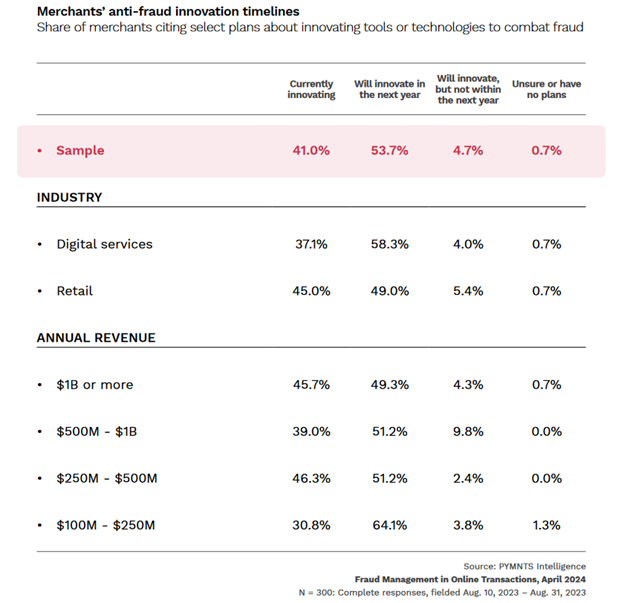

It’s no surprise, then, that 41% of respondents told us they were already modernizing their anti-fraud toolkits, and 54% say they plan to in the months to come. PYMNTS Intelligence also found those merchants that primarily sell physical items were being more proactive — 45% are currently in the process of upgrading their anti-fraud capabilities, while only 37% of digital service providers were taking similar steps. But even they won’t be pausing for long: 48% of digital service providers told us they intend to expand their defensive capabilities within the year, while less than half of retailers have similar plans.

Upgrading battle plans appear to be tied to earnings. “Fraud Management in Online Transactions” found that 46% of merchants generating annual revenues of $1 billion or more are currently improving their anti-fraud efforts. Meanwhile, merchants generating between $100 million and $250 million in annual revenue are lagging, with only 31% actively enhancing their anti-fraud protections.

When asked about plans to improve their online fraud-prevention measures in the months to come, merchants’ responses indicate a sense of urgency might be in play across all annual revenue brackets. Forty-nine percent of companies earning $1 billion or more intend to shore up their security measures, while more than half of companies earning between $250 million and $1 billion are doing the same. Meanwhile, 64% of companies earning between $100 million and $250 million — those now lagging behind — also intend to fortify their defenses soon, suggesting they’ve seen the writing on the wall and suspect 2023’s unprecedented fraud figures foretell greater threats on the horizon.