How The Pandemic Makes 90-Day Customer Histories A Fraud-Fighting Weakness

Consumers who are seeking to avoid exposing themselves or others to COVID-19 are turning to eCommerce where possible and are demanding touch-free ways to pay when they have to visit stores in-person.

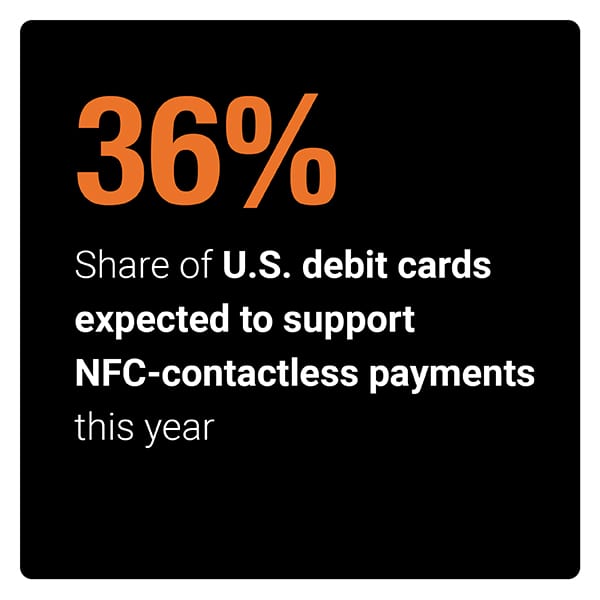

A June report found that 27 percent of U.S. debit payments were contactless before the pandemic — a rate that has since leapt up to 40 percent. Financial institutions (FIs) are therefore expected to offer more contactless cards this year and some are also unveiling services intended to help consumers easily add cards to their digital wallets.

FIs are also finding that consumers are currently showing less interest in using credit cards, which may reflect a desire to avoid taking on debt while struggling with unemployment an d other financial losses. Consumers are instead using debit, and one financial services company expects U.S. consumers to shift as much as $100 billion in annual spending from credit to debit cards.

d other financial losses. Consumers are instead using debit, and one financial services company expects U.S. consumers to shift as much as $100 billion in annual spending from credit to debit cards.

The June Next-Gen Debit Tracker® digs into these and other trends in how consumers are using debit.

Around the Next-Gen Debit World

Not all consumers have been able to use eCommerce or contactless payments to shop. This can force them to visit stores in-person for all their purchasing needs — putting them at greater risk of catching the virus — or requiring them to do without items if the stores are closed due to the crisis. This is a problem faced by many elderly Australian consumers who have bank accounts but do not have payment cards, and it is an especially troubling situation given that older consumers are among those at highest risk of experiencing severe effects from COVID-19. Australian FIs have been seeking to give these consumers more options by issuing and mailing out hundreds of thousands of debit cards to them at no cost.

Banks are also trying to help consumers who apply for new cards to be able to more quickly use them. One new solution allows consumers to immediately add new cards to their digital wallets so that they can begin spending even while waiting for physical cards to arrive in the mail. This can be a significant help for consumers who may be unable to make purchases during the pandemic unless they have cards for checking out online or digital wallets to use with any brick-and-mortar merchants who have stopped accepting cash.

to make purchases during the pandemic unless they have cards for checking out online or digital wallets to use with any brick-and-mortar merchants who have stopped accepting cash.

The pandemic is not the only ongoing crisis weighing on consumers’ minds. Many are also concerned about protecting the environment against further destruction. Children appear especially focused on this problem, which inspired a FinTech to offer biodegradable credit cards designed for use by minors. The cards come with parental controls and could allow issuers to engage customers early in their lives to form a long-lasting relationship.

Find more about these and the rest of the latest headlines in the Tracker.

How FIs Adapt Fraud Detection During Times of Behavioral Upheaval

FIs often monitor what customers’ normal purchasing behaviors look like and create 90-day profiles of customer transaction histories. This information enables the banks to better determine when customers are exhibiting unusual activities, which could indicate that fraudsters have taken over their accounts. The pandemic prompted consumers to radically change their purchasing habits, however, as they suddenly stopped visiting stores and started transacting online with new sellers and for items and services they normally would have bought in-person. That massive shift in spending activity is rendering 90-day profiles obsolete, and FIs have had to respond, said Carlos Mejia, chief digital executive at Florida-based Pacific National Bank.

In this month’s Feature Story, Mejia explained the strategies and technologies helping FIs overcome this challenge and shift fraud-fighting approaches to suit customers’ new habits. He also detailed how they are having to adjust again as business reopenings introduce new fraud threats and further changes what normal customer activity looks like.

Find the full story in the Tracker.

Deep Dive: Why Retailers and Consumers See Safety i n Contactless, CNP Transactions

n Contactless, CNP Transactions

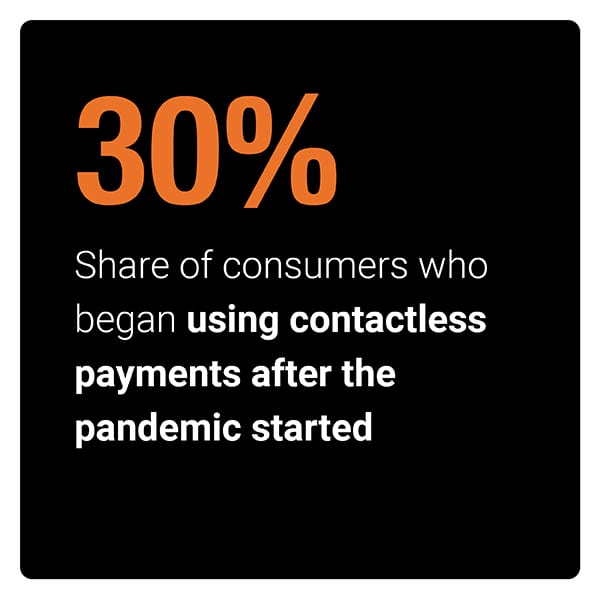

Consumers are reluctant to touch point-of-sale (POS) terminals during the pandemic so that they are not at risk of catching exposure to germs lingering on the devices’ surfaces. Some merchants are also reluctant to accept cash due to similar fears of viral contagion. This has encouraged a rise in contactless purchasing methods, a trend that may continue long after the crisis ends.

This month’s Deep Dive examines how card issuers are seeking to cater to merchants and consumers’ new payment preferences.

Download the Tracker to read more.

About the Tracker

The Next-Gen Debit Tracker®, a PULSE collaboration, provides an in-depth examination of debit’s changing role in both banking and retail and gives a data-rich, insightful look on how providers can innovate within this area.