Radius Bank: Virtual Debit, Mobile Tools Help Banks Fight Debit Fraud

A new year has begun, but the pandemic continues to throw financial and operational curveballs at banks, businesses and their consumers regarding how they conduct daily tasks or routine payments.

Financial institutions (FIs) and payment players are now facing questions not only about how they can satisfy their customers after long months of constant change but also about which of these changes will remain once the health crisis has passed.

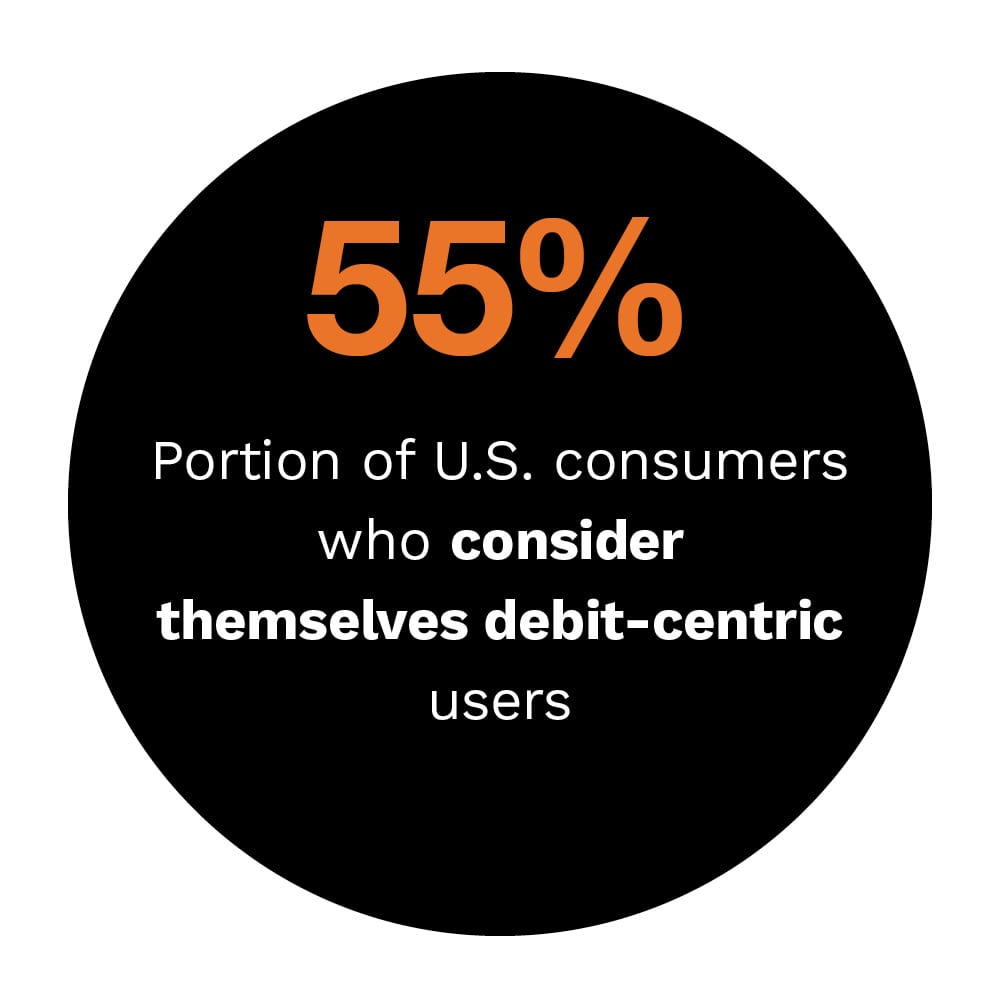

This includes shifts in which consumers are shopping and paying, and in the payment tools or methods they are using to finalize their transactions. Studies showed that many consumers in the United States have begun tapping their debit cards more often for payments, for example, with one report finding that debit use rose about 6 percent year over year. Another study found that 55 percent of U.S. consumers now count themselves as “debit-centric” users, a sizable jump over the 33 percent who said the same about credit cards.

Fraudsters have unfortunately also carefully followed this payment trend, with skimming, prepaid card and ATM fraud all seeing upticks recently — especially in regard to debit transactions. One skimming attack in North Carolina resulted in the loss of $5 million, for example, and instances of prepaid debit card scams and targeted ATM fraud are also skyrocketing. It is therefore critical for FIs, payment providers and businesses to monitor how consumers are tapping debit as well as how they can keep this payment method secure.

Fraudsters have unfortunately also carefully followed this payment trend, with skimming, prepaid card and ATM fraud all seeing upticks recently — especially in regard to debit transactions. One skimming attack in North Carolina resulted in the loss of $5 million, for example, and instances of prepaid debit card scams and targeted ATM fraud are also skyrocketing. It is therefore critical for FIs, payment providers and businesses to monitor how consumers are tapping debit as well as how they can keep this payment method secure.

The January Next-Gen Debit Tracker® analyzes how the continuing pandemic has affected consumers’ debit use and other spending behaviors as well as the growing threat of debit-related fraud. It also examines the tools that FIs can use to stem the rising tide of fraud as well as how features such as contactless or peer-to-peer (P2P) payment tools factor into this changing environment.

Around The Next-Gen Debit World

Debit-related fraud appears to have ramped up significantly in California, where lawmakers are attempting to clamp down on a growing number of schemes targeting its unemployment programs. The state uses prepaid debit cards to send out funds to claimants, but these cards lack security measures like the encoded chips that are typically built into debit cards, leaving them vulnerable to attacks. Bad actors have exploited these flaws to steal $2 billion to date, representing 2 percent of the $110 billion in claims the state sent out in 2020.

Another study indicated that debit-related fraud is on the rise across the U.S. The report noted that U.S. consumers have reported more instances of fraud targeting their debit cards, with about one-quarter of cardholders confirming instances of fraud on their cards. This compares to just 17 percent of cardholders who experienced debit-related fraud as recently as 2018. This represents a rising threat for consumers and their banks, although consumers still appear to be linking their debit cards to emerging payment forms even as such instances are on the rise. The report also found that P2P payment app adoption is growing.

Another report noted that consumers are still clinging to their debit cards, finding that 38 percent used the payment method to make in-person transactions between November and mid-December. Just 25 percent of consumers said the same regarding their credit cards during the same period. Debit’s dominance also expanded during the holiday shopping season, with 40 percent of consumers noting that they used the payment method to make their gift purchases, compared to 29 percent who used their credit cards to do so. The study also noted that many consumers are tapping mobile or digital payment methods, such as P2P apps or mobile wallets, in stores and using debit details to underpin these transactions.

Another report noted that consumers are still clinging to their debit cards, finding that 38 percent used the payment method to make in-person transactions between November and mid-December. Just 25 percent of consumers said the same regarding their credit cards during the same period. Debit’s dominance also expanded during the holiday shopping season, with 40 percent of consumers noting that they used the payment method to make their gift purchases, compared to 29 percent who used their credit cards to do so. The study also noted that many consumers are tapping mobile or digital payment methods, such as P2P apps or mobile wallets, in stores and using debit details to underpin these transactions.

For more on these and other stories, visit the Tracker’s News & Trends.

Radius Bank: How FIs Can Respond To The Pandemic-Driven Surge In Debit Fraud Threats

Payments shifted quickly after the global health crisis prompted restrictions for consumers and businesses alike, leading many to turn to online services for basic purchases or routine transactions. Many consumers also began to lean more heavily on their debit cards to avoid accruing additional interest or debt — with fraudsters following their lead in targeting debit. FIs are thus rethinking their approaches to online payment security, especially as it relates to debit.

Chris Tremont, executive vice president of virtual banking for Radius Bank, spoke to PYMNTS about how the pandemic has affected spending and what FIs can do to keep these transactions safe.

To learn more about how fraudsters are targeting debit and the tools banks can use to stop them, visit the Tracker’s Feature Story.

De ep Dive: How The Pandemic Is Pushing Debit-Related Fraud Forward

ep Dive: How The Pandemic Is Pushing Debit-Related Fraud Forward

Financial players and retailers have worked quickly to keep up with customers’ needs during the pandemic, meaning many have adjusted to rising digital transaction volumes — and rising numbers of digital fraud attempts. One study revealed that 83 percent of top retailers in the U.S. have security vulnerabilities in their online systems that leave gaps fraudsters can exploit. These fraudsters are also increasingly targeting debit transactions as more consumers use them, making it a necessity for retailers and their banking partners to shore up their debit defenses.

To learn more about the pandemic’s impacts on debit-related fraud attempts and how banks can counter them, visit the Tracker’s Deep Dive.

About The Tracker

The Next-Gen Debit Tracker®, a PYMNTS and PULSE collaboration, examines consumers’ changing payment behaviors, innovations that are reshaping consumers’ use of debit and how advanced solutions, such as machine learning technologies, can help financial institutions secure debit payments.