A ‘Diaper’ By Any Other Tax Code: The Complexities Of Selling Across State Tax Laws

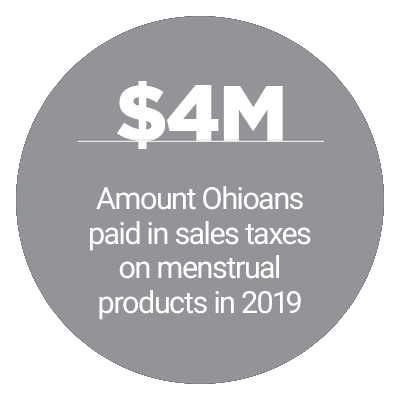

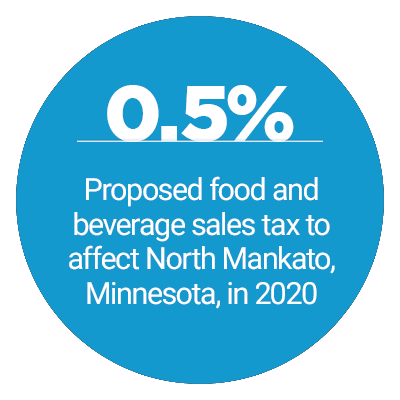

Merchants aiming to sell nationwide must pay attention to how their goods are treated by each state’s tax code. Items considered as exempt medical necessities in some states may be taxed at high rates in others, and businesses cannot afford to be caught by surprise. For example, some states do not tax diapers and tampons to ensure that these necessities are not priced out of reach for those in need, and to avoid making only some consumers shoulder the generation of public revenue.

Even the ways retailers package their items can make a difference in their taxes. Sellers that bundle tax-exempt food products with taxable items may find themselves suddenly responsible for taxes on the whole array — including items that would be tax-free if sold separately.

This month’s Next-Gen Sales Tax Tracker examines these compliance complexities and their impact, as well as ongoing efforts to streamline how retailers can fulfill their obligations.

Around The Next-Gen Sales Tax Wor ld

ld

Easing tax compliance helps governments and retailers alike. An Illinois bill could aid both by making online marketplaces responsible for tax collection on the third-party sales facilitated through their platforms. That would ease third-party sellers’ compliance work, and would mean government officials could monitor fewer entities, focusing on a handful of marketplaces rather than thousands of individual sellers.

Alaska is also trying to simplify tax collection, which can be particularly challenging in a location with no statewide sales tax, but more than 100 local tax codes. Municipalities are, thus, teaming up to create more standardized tax codes, and to deploy an app through which retailers will submit tax collections.

There are more complexities in store for merchants, though. Out-of-state retailers that sold into California, Louisiana and South Carolina are being asked to retroactively comply with remote seller laws, and pay taxes on sales conducted in the years before the laws were in place. Businesses are pushing back, however, arguing that such demands may not be legal.

Learn more about these and other next-gen sales tax headlines in the Tracker’s News & Trends section.

National Retailers On Staying Compliant When Tax Exemptions Are Only Statewide

States and their tax codes do not always agree on which products are tax-exempt medical necessities, and which should be taxed like other discretionary purchases. Retailers avoided that discord for years by limiting their physical presence to only tax-exempting states, but the 2018 Wayfair ruling changed their operations. Businesses like incontinence supply seller NorthShore Care Supply are now struggling with the added costs and compliance hurdles involved in managing each state’s tax code.

In this month’s feature story, NorthShore President Adam Greenberg explained the impact that the ruling has had on the retailer and its customers, and how the business is working to manage the tax policies. Phillip Vander Klay, director of policy and government relations for the National Diaper Bank Network, added his perspective on how such taxes are impacting low-income consumers’ ability to access necessary products, and the movements to revise state tax laws.

Find the full story in the Tracker.

Deep Dive : Holiday Gift Baskets, Software Bundles And A New Arena Of Tax Compliance

: Holiday Gift Baskets, Software Bundles And A New Arena Of Tax Compliance

Retailers must not only pay attention to what they are selling, but how they are selling those items. Combining them into gift baskets and other attractive bundles may be a compelling way to attract consumers, but doing so can incur unexpected costs. Sellers may not be aware that putting tax-exempt items and non-exempt items together under one price tag could result in having to pay taxes on all the composite items — and do so at the highest taxable item’s rate.

This month’s Deep Dive examines the complexities of selling bundled items, different states’ bundled tax policies and ways that both parties can minimize those frictions. Download the Tracker to read the Deep Dive.

About The Tracker

The Next-Gen Sales Tax Tracker, an Avalara collaboration, is the go-to monthly resource for updates on trends and changes in the eCommerce sales tax world.