Would a Seismic NFT Shakeout Really Be All Bad? Some Say No

If May came in like a lion and out like a lamb for the non-fungible token (NFT) market, June went out like a lambchop.

After a statistics-warping spike on May 1 that nearly shut down the Ethereum blockchain, sales volume, prices and buyers have all plummeted.

Read more: Bored Apes NFT Rampage Spikes Transaction Fees to $200M for 55,000 Sales

One reason is likely the shock to the system crypto took in early May, when the Terra/LUNA stablecoin ecosystem collapsed, wiping out $48 billion in value and triggering a wave of panic and insolvencies in the crypto lending market.

But NFT sales numbers have been dropping all year. And anecdotally at least, the “cool” factor has been slipping as celebrities who once hyped them — particularly the Bored Ape Yacht Club (BAYC) cartoon avatars that sell for six and seven figures — have been quietly changing their social media portraits.

“The Tonight Show” host Jimmy Fallon — who talked Bored Apes with Paris Hilton in January, leading Mashable to declare that the pair “pumping their NFTs is beyond cringe” — deleted his in late June while a big industry tradeshow, NFT NYC, was in town. Tennis superstar Serena Williams and actress-turned-lifestyle maven Reese Witherspoon are among those who’ve done the same.

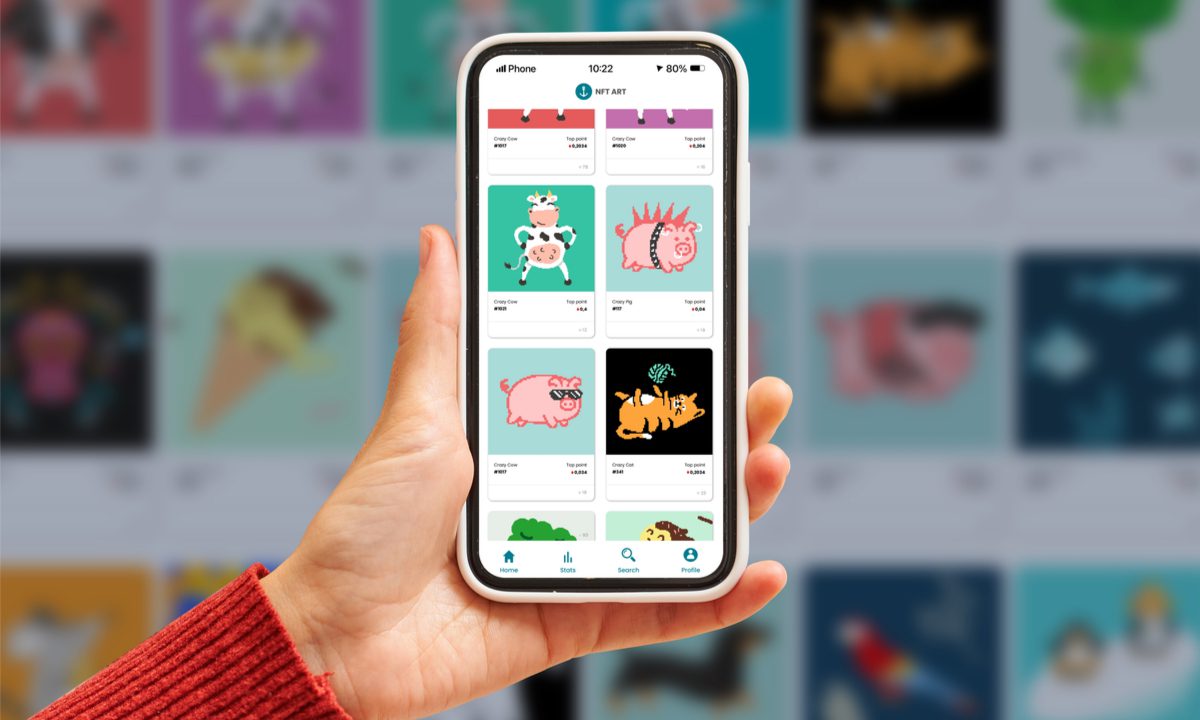

While NFTs have many potential uses — they are unique tokens that can hold any type of media, including documents, images, video and music — the vast majority of the market has been limited to the NFT “collectables” market, which is actually useful for very little other than staking claim on your Twitter profile to be a part of the trendy Bored Ape Yacht Club club, and speculation.

“Without question, the NFT market has fallen off the cliff this June,” Pedro Herrera, head of research at crypto tracker DappRadar, told Bloomberg at the end of the month. “It is fair to say that in recent weeks, investors were looking for safer places to put their money amid the Terra collapse and the rumors surrounding potential liquidations.”

During the first half of 2022, the number of NFT buyers dropped more than 46% since the beginning of the year, the average sale price is down about 70% and total sales are down 84% — the latter falling below $1 billion for the first time since last June, according to NFT tracking site CryptoSlam.

Culling the Herd?

There have been plenty of declarations in the last six months that the NFT bubble has popped — The Wall Street Journal called it in early May, days before the Terra/LUNA collapse sent crypto running for cover.

See also: NFT Weekly: The Popping of the NFT Bubble Has Been Declared Again, but Investments Keep Coming

But this time, the drop in the crypto market — the vast majority of NFTs are priced in ether — is not only steeper, investors are running scared. Several crypto lenders that are in or close to bankruptcy this month were damaged by losses suffered in the fallout of the Terra/LUNA collapse, but even huge lines of credit have been able to stem what Voyager Digital called a “run” of clients pulling assets in its Chapter 11 filing on Wednesday (July 6).

Related: Voyager’s Digital Bankruptcy Hints at Crypto’s Shaky Foundations

A bigger question, however, is whether that’s a bad thing.

If it is a Beanie Baby moment in the NFT collectable world, there are still plenty of uses for NFTs — even collectables — beyond the ludicrously priced BAYC and Crypto Punk images. Professional baseball, football and hockey organizations all embraced NFTs as the evolution of trading cards this year, joining the NBA, which brought basketball into the NFT space early.

Read more: Topps Releases New NFT Collection for MLB

The “non-fungible” part means no two NFTs are alike and all transactions are traceable on an immutable blockchain, making them useful for everything from event ticketing to transferring financial instruments. It also means they could have substantial utility in tracing digital rights of all kinds and bringing planned scarcity to types of media that are easily reproduced, such as artwork and songs.

See also: Goldman’s Interest in NFTs Could Speed the Tokenization of Real Assets

Much like the broader cryptocurrency industry itself, NFTs projects are due for a thinning of the herd, much like the dot-com industry went through in 2001 — from which it emerged stronger and with solid, sustainable use cases.

Sign up here for daily updates on all of PYMNTS’ Crypto coverage.