Netflix and Nike Training Club Pact Represents Another Flat for Peloton

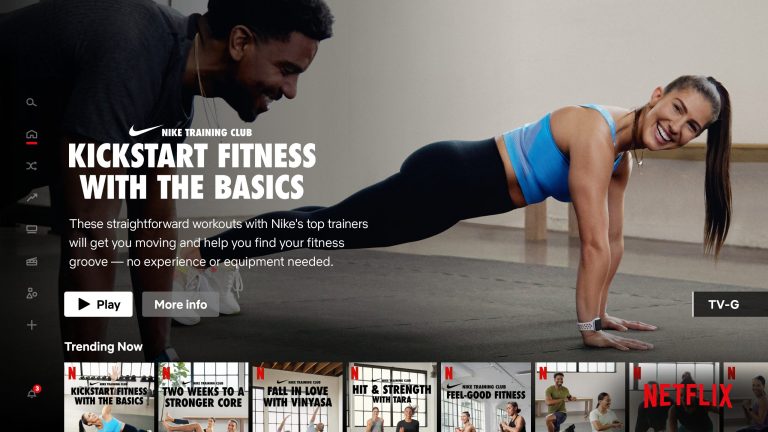

The debut of Nike Training Club workouts on Netflix is a potential coup for both brands, although conspicuously absent from the initial lineup is anything involving stationary bikes.

Yes, that’s a reference to Peloton, which we’ll get to momentarily.

On Dec. 30, Netflix announced that “Just before the new year, Netflix members will be able to stream fitness content from Nike Training Club for the first time ever. Each Nike Training Club program has multiple episodes — a grand total of 30 hours of exercise sessions released in two batches.”

Nike’s news of the deal came 10 days earlier, noting in a Dec. 21 press release that “Members will be able to access curated programs or select workouts by type or duration, and the programming will be available in 10 languages via all Netflix plans. The new initiative will feature a custom Nike collection on Netflix.”

Members can simply search “Nike” on Netflix to bring up the catalog of workout routines.

For Netflix, it’s a worthwhile gambit that some portion of the 223 million global paid subscribers who are deeply engaged in watching streaming TV will want to get off the couch and exercise, increasing engagement with the platform while adding value to the subscription.

Nike Training Club (NTC) was the fitness brand’s first app, launched in 2009, but the company stopped charging for access to the service in 2020, which some saw as a shrewd move.

Reuters reported in 2020 that “Between January and November [2020] the Nike Run Club app was downloaded 15.4 million times around the world, up 45.3% versus the same period in 2019, according to data firm Sensor Tower.”

That same article added: “‘Early in the pandemic, Nike made in-app workouts for its Nike Training Club app free. This was a masterstroke … They know everything – exactly what you’re searching, where you live, what your credit card details are, how much you’re willing to pay,’ said Michael Faherty, a portfolio manager at Nike investor Seilern Investment Management.”

Exchanging subscription fees for user data, Nike has reportedly used the insights to inform pricing strategies, especially on its most expensive footwear.

Meanwhile, Peloton — a pandemic darling whose share price increased 477% from its September 2019 IPO to a high of $167.42 in January 2021 — has lost about 95% of its value since and is currently trading in the range of $8 per share.

With its catalog of thousands of workouts — many of which do not require Peloton hardware to engage — it begs the question: how did Peloton miss a golden distribution opportunity like Netflix?

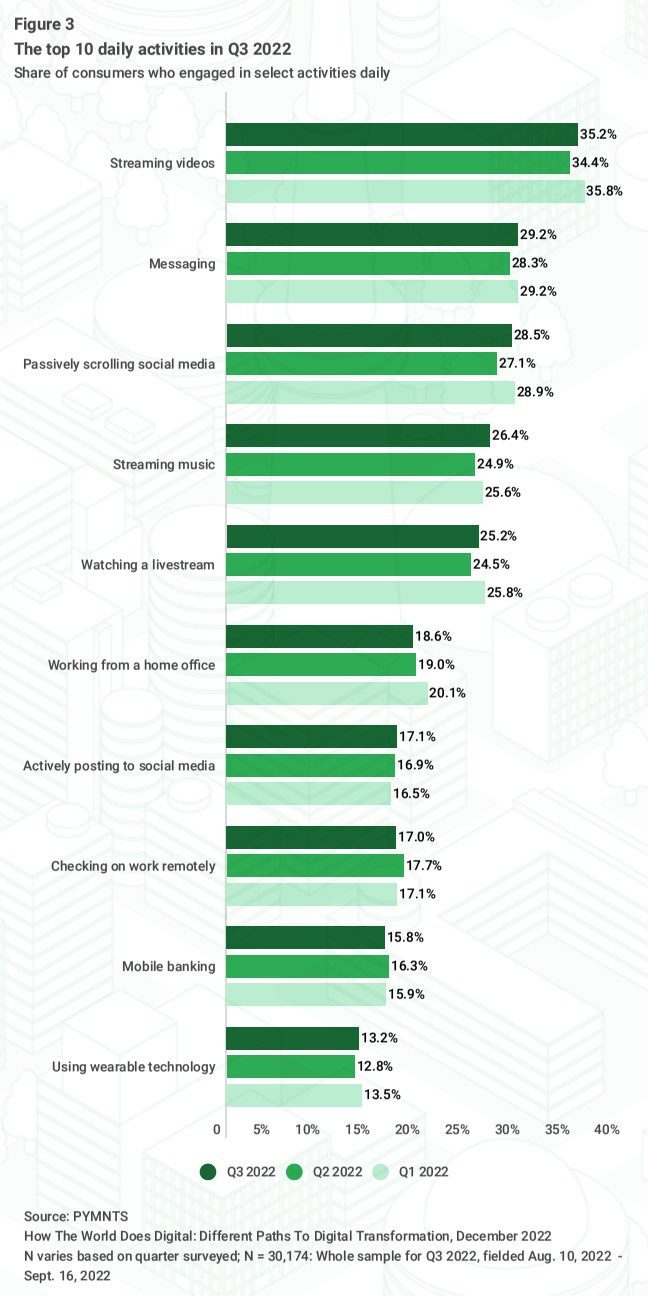

Streaming continues to be a leading connected economy activity, thus offering a gaping doorway to consumer engagement. The PYMNTS Q3 report “How The World Does Digital: Different Paths To Digital Transformation” noted that “as in previous quarters, video streaming captured more daily users than other digital activities we track, at 35%, followed by messaging at 29%, social media browsing at 29% and streaming music at 26%, which maintain their position as the top four.”

Too Little, Too Late

In a classic case of too little, too late, Peloton announced the availability of its bikes, treadmills and accessories on Amazon in August.

In a press release, former Peloton Chief Commercial Officer Kevin Cornils said: “Expanding our distribution channels through Amazon is a natural extension of our business and an organic way to increase access to our brand. We want to meet consumers where they are, and they are shopping on Amazon. Providing additional opportunities to expose people to Peloton is a clear next step.”

Not included in that deal, however, was Peloton programming on Amazon Prime Video, which would make Peloton workouts available to the fitness-minded segment of Amazon Prime’s 200 million subscribers, all of whom get Amazon Prime Video with their subscription.

While it remains to be seen how the Netflix-Nike deal will perform over time, Peloton continues its slide from pandemic heights to new and nail-biting lows.

The Motley Fool reported on Tuesday (Jan. 3) “Peloton’s near-term outlook is grim. Inflation is curbing consumer demand for its pricey bikes and treadmills, which start at $1,445 and $3,495, respectively, and require monthly subscriptions. Rising interest rates will also make it tougher for Peloton to raise fresh cash while driving investors toward more profitable companies. In other words, all the tailwinds that made Peloton such a compelling growth stock in 2020 and 2021 have been replaced by brutal headwinds.”