Revolut’s ‘Pockets’ Tool Aims To Help People Organize Payments

London FinTech Revolut has introduced Pockets, a new organization tool intended to help people organize their payments and better manage their spending.

“We understand how difficult it is to stay on top of all your various bills and subscriptions,” Marsel Nikaj, head of savings at Revolut, said in a statement on Wednesday (Dec. 9).

With Pockets, she added, money management is streamlined to free people from “worrying about missing a payment.”

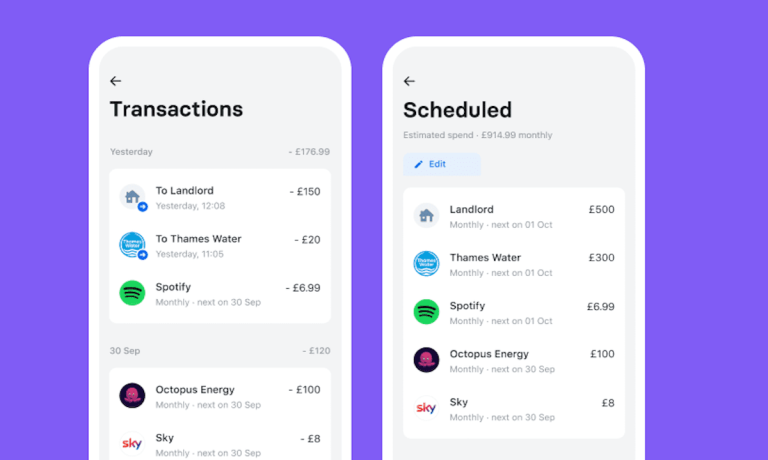

The new tool lets Revolut customers allocate funds to particular Pockets to ensure that they’re not accidentally spending money that should go to bills. People can set up scheduled payments, create their Pockets, sort bills and set money aside, and Revolut will make the payments on the due date.

If customers already have scheduled payments set up with Revolut, all they need to do is create their Pockets for their various subscriptions and bills, then sort their bills into them. Revolut will make sure they are paid when they’re due.

The new feature can be used in Austria, Belgium, Denmark, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, Sweden and the United Kingdom. Additional European markets are planned as part of Revolut’s global expansion.

Founded in 2014 by Nikolay Storonsky and Vlad Yatsenko, Revolut specializes in mobile banking, card payments, money remittance and foreign exchange.

Earlier this month, the unicorn startup rolled out a new solution for its Revolut Business starter pack that gives users in 13 European countries the ability to accept online credit card payments. Revolut’s February funding round valued the company at $5.5 billion.

Revolut also launched Group Bills in August to help customers easily manage group expenses. Instead of splitting one bill at a time, the platform enables users to track, split and settle expenses instantly, in one place. The new tool determines the amount each person is responsible for, adding their name and photo for security.