Business investments in voice technology are speaking loud and clear about priorities. According to a new Adobe study, 91 percent of companies were investing in voice-based commerce and other technologies like Amazon’s Alexa and Google Assistant.

In the Payments 2022 study, PYMNTS takes a look at the future to see how digital is transforming the payments industry through platforms and apps.

The heads of payments firms surveyed in Q1 2019 were optimistic about the future. One quarter (24.8 percent) expected their digital platforms to be much bigger by 2022 than they are now.

B2C merchant marketplaces like Airbnb and Etsy were the most confident among the business types surveyed; 38.2 percent imagined themselves growing much bigger in the next three years.

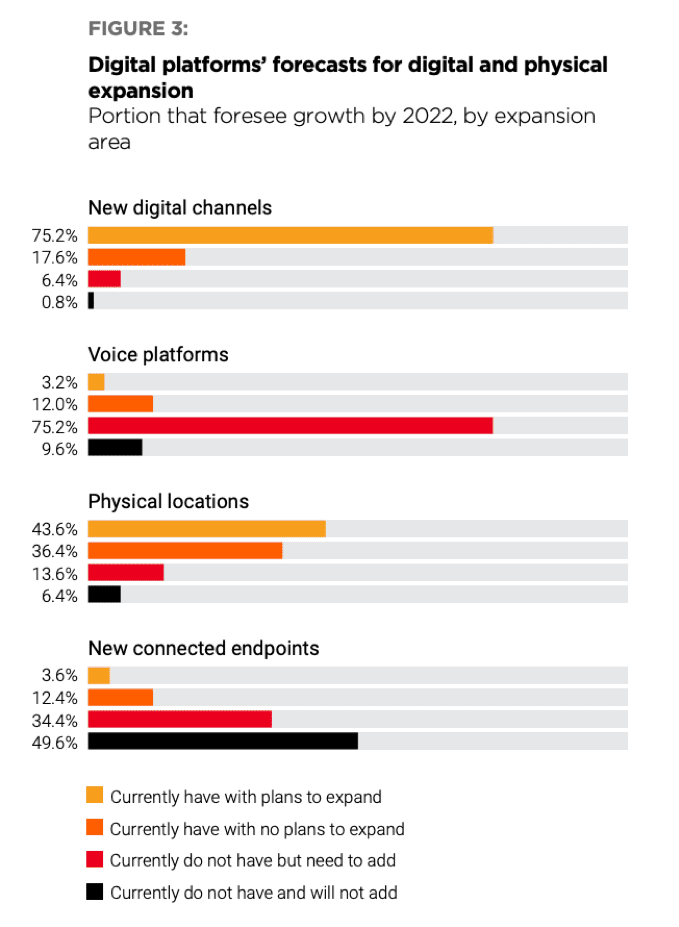

According to the study, there is high interest in new digital channels generally. Over three-fourths (75.2 percent) had plans to expand digital channels in the next three years. The same number do not currently offer a voice platform but see the need for one. Only 9.6 percent had no interest in adopting voice.

Amazon recently introduced Alexa in-skill purchasing to more countries to provide more opportunities for revenue generation from voice apps.

When specifically asked about payments, 61 percent of the platforms in the study say they have plans to add more payments processing platforms to the mix in the near future.

Among digital platforms, payments have become key for expansion and to stay competitive. Nearly all of platforms (98.0 percent) in the study said their payments operations are “very” or “extremely” important to their broader expansion strategies.

Smaller firms were more likely to say payments are “extremely” important to expansion; 86 percent of those generating between $21 million and $50 million in annual revenues thought this compared to 74.4 percent of firms with revenues over $1 billion.

What’s motivating these expansion plans? It’s not just a matter of adding tech just for the sake of it. Most (84.9 percent) cited a desire to get into new geographies. Nearly as many were wanting to meet consumer demand and adding new payment methods to provide more choices to consumers (80.9 percent).

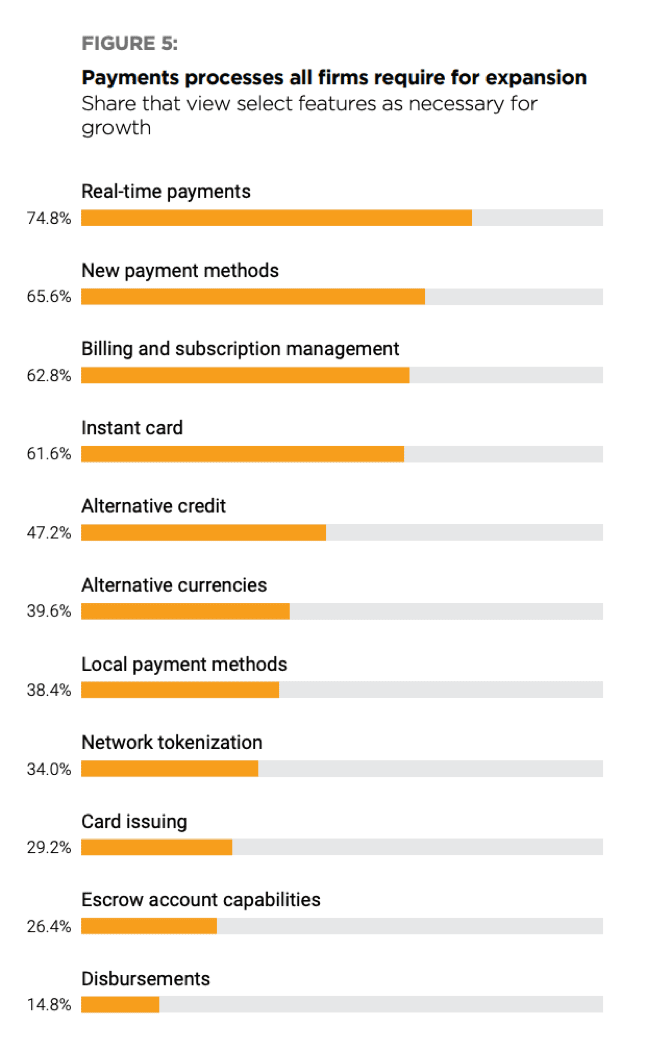

Real-time payment was the feature deemed most critical for growth, cited by 74.8 percent. New payment methods were also popular (65.6 percent) and a similar number (62.8 percent) thought billing and subscription management was necessary.

Boosting conversion is at the crux of all this payment expansion. If a business can improve the customer experience and reduce friction, it is thought to increase transactions and sales. Most digital platforms gave themselves high marks on their transaction conversion performances; 84.4 percent said they were doing “well.” Only 4 percent say their ability to convert visitors to sales today is “extremely” good.

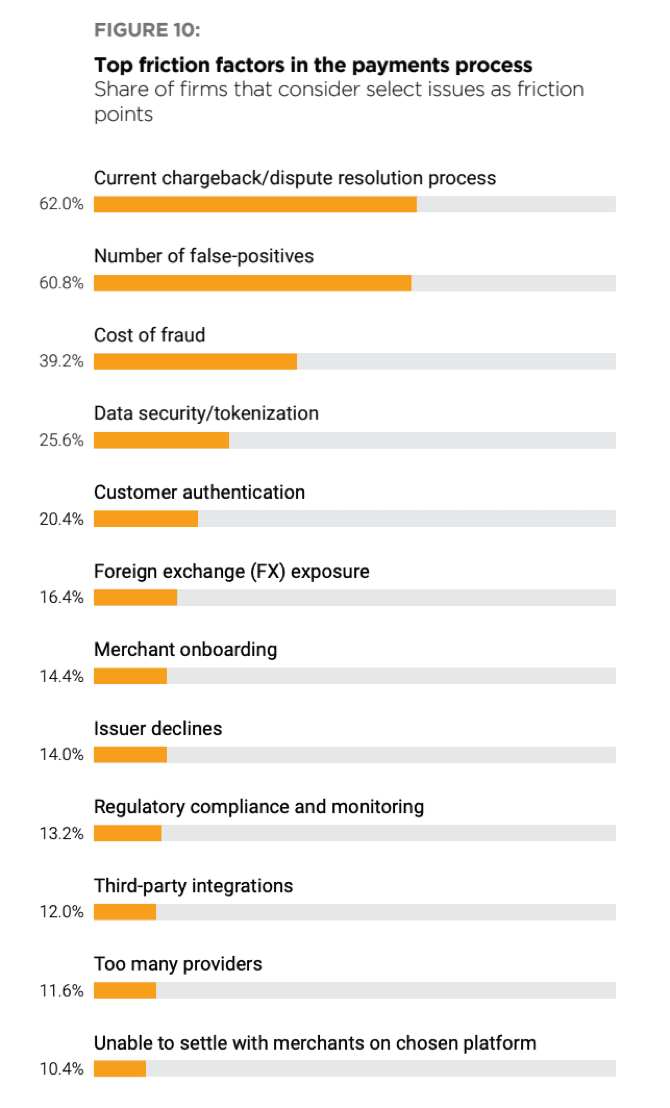

The biggest pain points holding back sales conversion are the dispute resolution process (62.0 percent), false-positives (60.8 percent) and the cost of fraud (39.2 percent).

This isn’t surprising. When a merchant receives a chargeback, it’s likely that the transaction in question took place weeks or even months ago, meaning the revenue was already accounted for at the time. Then it could take another few months before a dispute is fully closed.

The problem with being so diligent about fraud is that it can cost in other ways. False positives or transactions that are declined are related to and compound the cost of fraud. According to the study, the cost of fraud is roughly 2.2 percent of annual revenues on average.

Because of this, 72.5 percent use third-party vendors and 80 percent have two or more vendor relationships to help manage chargebacks.

It would seem that digital platforms are spending a significant amount of time and money on facilitating operations rather than being able to innovate and look to the future.

Most recognize this conundrum. Thirty percent say their current processing relationships are inhibiting their long-term growth, and fewer than 10 percent of these platforms say they intend to keep their payment operations as they are now in the coming years.