Payments 2022: Why Payments Is Make-Or-Break For Digital Platforms

The last decade has seen the emergence of a new generation of fast-growing, multinational businesses. Digital platforms — fueled by the convergence of mobile devices, data and the cloud — have generated unprecedented value for both their stakeholders and users. However, the payment capabilities that have propelled the growth of platforms such as Uber and Airbnb, for instance, are too inefficient to support their ambitious growth plans over the next three years.

This is a key takeaway from Payments 2022, a PYMNTS study in collaboration of Stripe, based on an extensive survey of 250 payment heads representing various sizes and types of business-to-business (B2B) and business-to-consumer (B2C) digital platforms: B2C service marketplaces, B2B Software-as-a-Service (SaaS) firms, B2C merchant marketplaces, B2C retailers and B2B platforms/utilities. The goal of the survey was to better understand their strategic roadmaps for the next three years, and the role that payments will play in driving those agendas.

This is a key takeaway from Payments 2022, a PYMNTS study in collaboration of Stripe, based on an extensive survey of 250 payment heads representing various sizes and types of business-to-business (B2B) and business-to-consumer (B2C) digital platforms: B2C service marketplaces, B2B Software-as-a-Service (SaaS) firms, B2C merchant marketplaces, B2C retailers and B2B platforms/utilities. The goal of the survey was to better understand their strategic roadmaps for the next three years, and the role that payments will play in driving those agendas.

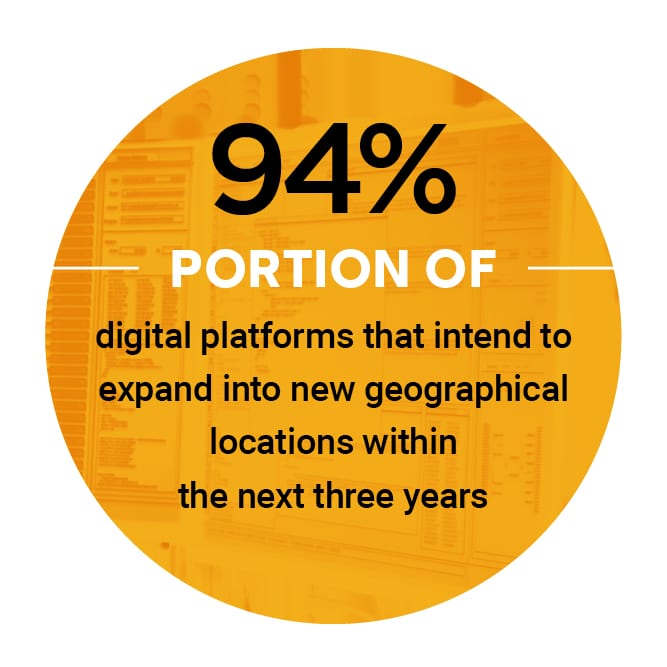

The ambitions of digital platforms are undeniable. The vast majority of them expect to  be larger in the next three years, and they see themselves expanding globally within existing markets, emerging markets in Asia and Latin America, and new digital channels. Approximately 75 percent of those surveyed reported intentions to integrate voice capabilities into their platforms.

be larger in the next three years, and they see themselves expanding globally within existing markets, emerging markets in Asia and Latin America, and new digital channels. Approximately 75 percent of those surveyed reported intentions to integrate voice capabilities into their platforms.

Platforms overwhelmingly view payments as central to achieving their growth objectives. However, confidence in their current payment capabilities and partners does not match their ambitions. Today, only 4 percent of platforms consider how they convert visitors to sales as “extremely” effective. Drags on conversion include chargebacks  and dispute resolution (cited by 62 percent of respondents). Moreover, only a tiny fraction of platforms consider their fraud detection systems as “extremely” effective, with a majority citing false-positives as a major friction point.

and dispute resolution (cited by 62 percent of respondents). Moreover, only a tiny fraction of platforms consider their fraud detection systems as “extremely” effective, with a majority citing false-positives as a major friction point.

All of this is proving costly for digital platforms. They estimated the cost of supporting these payment operations at an average of 2.7 percent of sales — for smaller firms, the burden is even greater at 3.3 percent of sales. To manage their complex payment operations, digital platforms have teams averaging six to 10 employees to support the three processing relationships.

Notable findings from the research include the following key points:

- 75 percent: the share of platforms that intend to implement voice-recognition capabilities

- 67 percent: the share of platforms that rely on outside vendors to ensure transactional compliance

- 62 percent: the share of platforms that cite chargebacks/dispute resolution as a transactional pain point

To learn more about how digital platforms are plotting to achieve their three-year growth plans, and overcome the roadblocks along the way, click here to download the report.