These are some of the findings detailed in the “Savings Deep Dive Edition” of the New Reality Check: The Paycheck-to-Paycheck Report, a report by PYMNTS Intelligence and LendingClub. The study drew insights from a survey of more than 3,600 consumers to assess their capacity to maintain their savings in the current economic landscape, particularly when confronted with significant expenses.

According to the report, emergency expenses and major life events are the main reasons consumers tap into their savings, with 31% citing emergency spending and 24% citing major life events, such as weddings or home purchases, as reasons for significant reductions in savings.

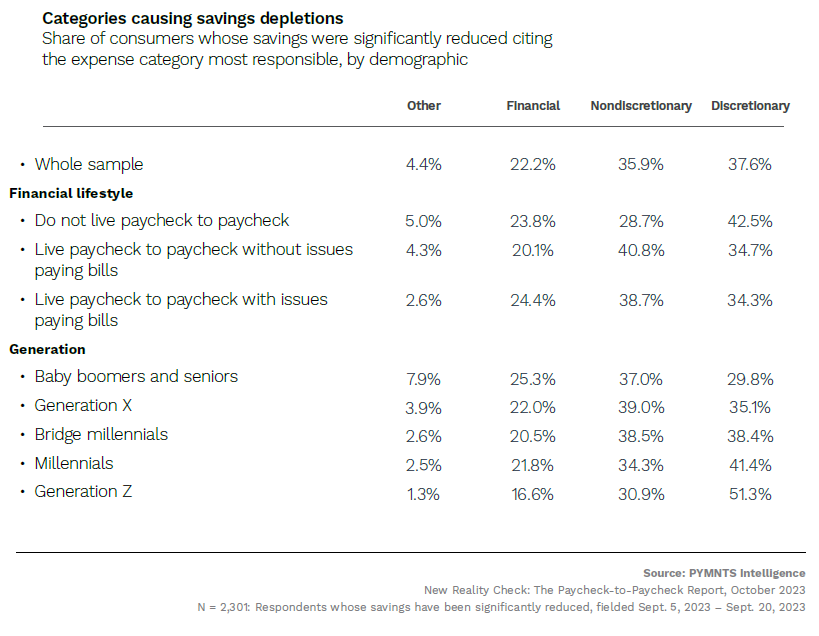

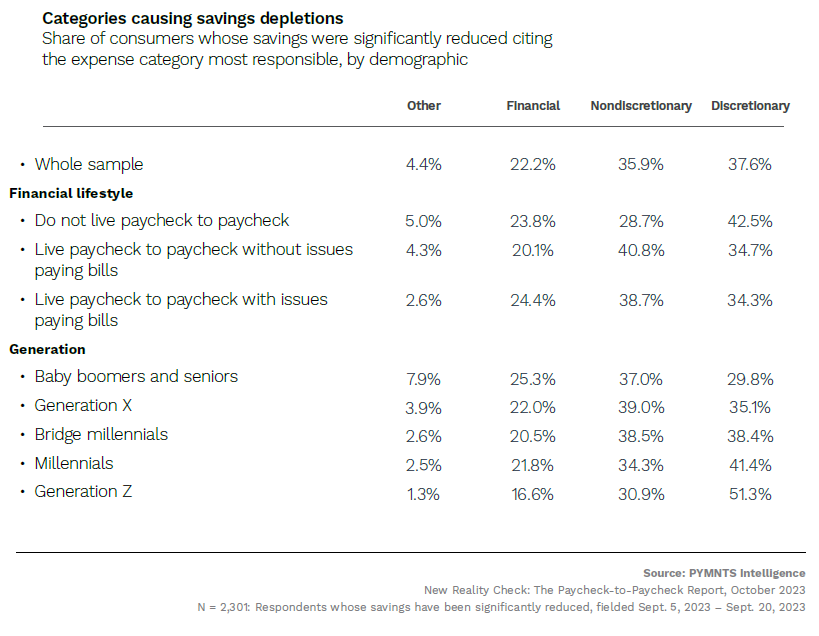

It is also worth noting that 51% of Generation Z consumers specifically attribute their savings depletion to discretionary spending such as major life events, travel, vacation or education expenses. This suggests that Gen Z individuals are more likely to spend on non-essential items or experiences, making it harder for them to maintain a high level of savings.

The report also highlighted that the average consumer depletes two-thirds of their savings every four years to cover a major expense, with paycheck-to-paycheck consumers depleting their savings more often and using a higher percentage of their savings. Gen Z consumers also face such depletions as often as every two years, which can be attributed to their tendency to engage in discretionary spending more frequently.

Against this backdrop, the report emphasized the importance of promoting financial literacy and encouraging responsible spending habits, through educational initiatives and digital tools that help consumers track their spending, set savings goals and prioritize essential expenses.

Advertisement: Scroll to Continue

Additionally, financial institutions (FIs) and FinTech companies can develop innovative solutions to assist consumers in managing their finances effectively. This could include budgeting apps, personalized financial planning services, and educational resources tailored to their specific needs.

This dovetails with separate PYMNTS research that digital budgeting tools have been an inflation era lifeline for younger generations who reported higher anxiety than older groups regarding inflation.

Per the PYMNTS-NCR study’s findings, millennials and Gen Z have a lesser grasp of financial concepts such as loans, mortgages, investments and retirement accounts — “thanks, in large part, to institutional failings of the public education system.”

This is evidenced by the fact that over 40% of teenagers report that their high schools don’t provide any financial literacy courses, and 34% of Gen Z say they rely on platforms like YouTube and TikTok rather than formal education or parental guidance to learn about personal finance.

As a result, younger adults are increasingly resorting to digital banking tools to bridge their financial knowledge gaps, and they have high expectations of these technologies. Notably, 66% of users depend on these apps for convenience, 57% for their user-friendly interfaces, and 46% for their time-saving capabilities.

Given this context, FIs that prioritize these features and cater to these preferences in their mobile banking apps are strategically positioning themselves for success. Ultimately, they are not only meeting the needs of younger users but also attracting a larger portion of these demographics into their customer base.