According to the U.S. Commerce Department, retail sales dropped in January by a seasonally adjusted 0.8%.

Conventional wisdom suggests a post-holiday season decline in sales would be anticipated; however, The Wall Street Journal reports the drop was larger than the 0.6% decline economists were expecting.

As a result, according to the Journal, some fear the numbers might signal some bumpy economic waters ahead.

“[A] pullback by consumers, who account for roughly two thirds of economic activity, would spell a weaker outlook for growth this year than in 2023,” opined the Journal. “Many economists have long expected that higher interest rates and the whittling down of savings Americans built up following the pandemic’s onset would crimp consumer demand.”

In line with the observation, PYMNTS Intelligence (in collaboration with Sezzle) called out the possibility of a weaker outlook last fall when it wrote that “United States consumers are under a lot of pressure, as their purchasing power has been eroding in the last two and half years due to rising price levels across the economy.”

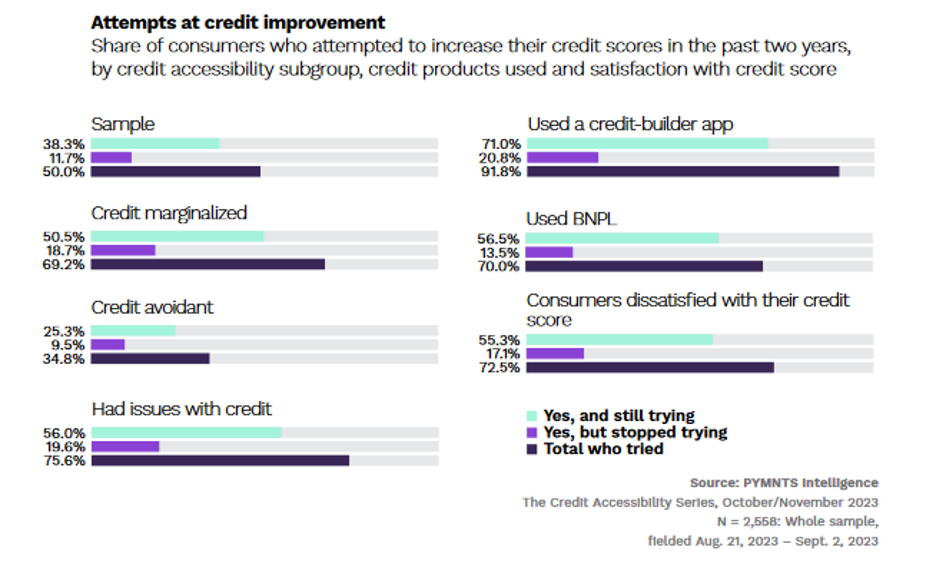

This edition of the Credit Accessibility Series, “Declining Purchasing Power Pushes Consumers to Improve Credit Scores,” drew on data captured in a survey of more than 2,500 U.S. consumers who were asked to share the successes and struggles they encountered as they worked to improve their credit scores.

In compiling the report, PYMNTS Intelligence found “consumers across income levels, credit scores and generations have accumulated high levels of debt,” including “credit card debt [that] recently surpassed $1 trillion for the first time.”

Faced with historically high amounts of credit card debt, it’s little wonder that analysts witnessed a larger-than-expected decline in sales last month. However, the PYMNTS Intelligence found consumers are trying to improve their financial situation and their purchasing power. One way they are doing this is by leveraging buy now, pay later (BNPL).

The study noted that “having a high credit score is pivotal in accessing credit and maintaining purchasing power.” As a result, many consumers said they are deploying resources to improve their financial standing.

One resource that appears to be helping is BNPL, which gives consumers the option to sign up for short-term financing to facilitate purchases and then pay down those purchases over a scheduled period.

Seventy percent of BNPL shoppers said they spent the previous two years increasing their credit limits, and — at the time of the survey — 57% were continuing to do so. Twenty-seven percent of respondents said they used BNPL specifically to raise credit limits.

Those efforts appear to be paying off. Forty-four percent of BNPL shoppers attributed a bump in credit scores to BNPL. In fact, 29% of BNPL users saw their credit scores increase by more than 100 points over 24 months, which they ascribed to BNPL. Meanwhile, only 21% of average consumers and 20% of average credit card users saw similar spikes in credit scores during the same time period.

A 100-point rise in credit scores can have a phenomenal impact on a consumer’s financial standing. If shoppers are using BNPL to enhance credit scores, this in turn can help them qualify for more attractive interest rates, which in turn can drive sales.

Last August, PYMNTS Intelligence (in collaboration with Sezzle) released an earlier volume of the Credit Accessibility Series titled “The Credit Insecure Need More Education.” The study determined when consumers classified as “deep subprime consumers” — those with credit scores of 579 or less — successfully raised those scores, they could lower their interest payments by as much as 24%.

For those that raised credit scores to near prime level, they could decrease their interest payments to 11.8% of their disposable income while increasing their borrowing capacity by 68% of their income. This enabled them to finance an additional $44,000 worth of purchases. And for those who could attain a super prime credit score (720 or higher), it could reduce their interest payments to $5,300 per year — representing approximately 10% of their disposable income.

But BNPL was only one method consumers were using to improve their credit standing.According to “Declining Purchasing Power Pushes Consumers to Improve Credit Scores,” 34% of respondents said they successfully increased their credit scores by 100 points by using credit builder apps.

These findings confirm that most U.S. consumers understand the importance of credit scores and the need to strengthen those tallies whenever possible.

And while nearly 60% of respondents said they believe their current credit scores support their needs and saw no reason to ratchet up the numbers, 15% said they don’t know where to begin to improve their credit scores or that they are simply afraid to take on more debt.

That last finding should stand out to financial services executives who are looking to onboard new customers or strengthen existing relationships. It signals the need to offer some consumers access to information about improving and better managing financial health.