By 2023, 73 percent of all offices across the U.S. will have remote workers that eschew the traditional commute to an office setting. Though they may work as far as the other side of the world, remote workers still expect the same level of security, trust and speed in payments. Employers are, therefore, more heavily reliant on digital tools and technologies to accommodate this new online workforce.

In the June edition of the Payments And The Platform Economy Playbook, PYMNTS looks at how new digital technologies and online payment methods are filtering into the working world as the freelance sector grows.

Around the Payments and the Platform Economy

As a way to bridge the trust gap between a remote worker and their employer, some entities, such as Toptal solution TopTracker, are adding payments to their experience. The time-tracking company has partnered with Payoneer for cross-border payments, enabling more efficient money movement between employer and remote employee.

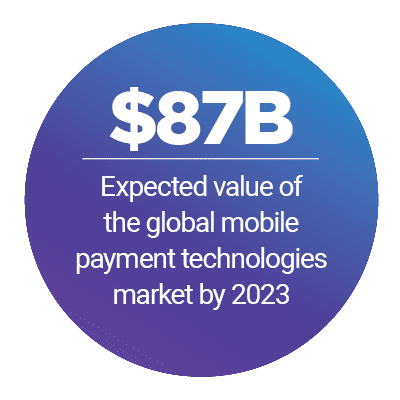

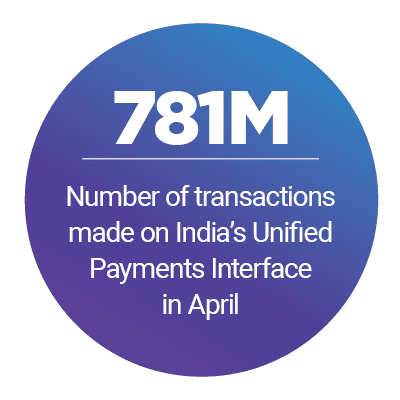

The growth of online payments is prompting new ways for consumers and businesses to interact with each other. In India, Amazon recently launched Amazon Pay as a way to allow customers to make peer-to-peer (P2P) payments. The method relies on the Unified Payments Interface (UPI) in the country, which helps process the rising number of digital and mobile payments.

Advertisement: Scroll to Continue

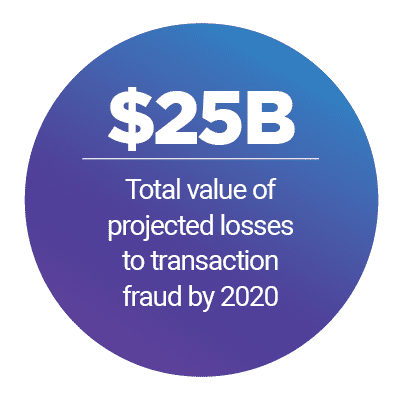

As the needs of the digital consumer change, so do security concerns. In the European Union, measures like Strong Customer Authentication (SCA) are already complicating online payments. With a cap on the amount of money users can send before being asked to authenticate, SCA may be adding a new level of friction to the online payment experience.

As the needs of the digital consumer change, so do security concerns. In the European Union, measures like Strong Customer Authentication (SCA) are already complicating online payments. With a cap on the amount of money users can send before being asked to authenticate, SCA may be adding a new level of friction to the online payment experience.

For more on this and other news in the sharing economy space, take a look at the News and Trends section.

How Toptal Seeks to Instill Freelance Marketplace Trust

For the 73 percent of U.S. offices that will employ remote workers by 2023, trust and security are essential components. Yet, creating that trust for both the employer and employee can be difficult, as needs on both sides of the relationship grow and change. As the future of work gets more digital, facilitating this new relationship will be a responsibility of the online marketplaces freelancers are using to find roles, said Martin Chikilian, VP of talent operations for freelance marketplace Toptal.

To learn more about how hiring platforms like Toptal are cultivating trust, read the feature story.

Fiverr’s Local Market Challenges

Online freelance marketplaces still have a variety of challenges, however. While these marketplaces can connect a freelancer in one region with an employer in another, making sure that both sides of that relationship are satisfied can be tricky.

With employers and freelancers alike expressing different needs, depending on their local markets, including the need for payment in their local currencies, it can take work to ensure they are met. This is especially true when it comes to payments, which can differ significantly in method and speed across local markets.

To learn more about how freelance marketplaces, such as Fiverr, are tackling these challenges, visit the Playbook’s case study.

About the Playbook

The monthly Payments And The Platform Economy Playbook series, a collaboration between PYMNTS and Yapstone, aims to help platform payment decision-makers identify and manage the risks and rewards inherent in shaping their approaches, enabling them to optimize their operations and navigate the real-time challenges they face.