A Paycheck-to-Paycheck Consumer Needs Faster Payouts

The popular conception of a household living paycheck to paycheck may be one of poverty. The reality is that a large share of households representing all economic strata live this way. A recent PYMNTS study found that 48% of high-income households live paycheck to paycheck. Factors such as medical bills, student debt, high discretionary spending and other variables contribute to this. Living paycheck to paycheck means any unexpected expense, even a minor one, can push households into debt to make ends meet.![]()

No one-size-fits-all solution exists for paycheck-to-paycheck households, but certain options can punch above their weight. Implementing fast and easy real-time payments for wages can be a significant boon to these families, for example. Having access to pay consumers earn it rather than waiting for the next payday can make a big difference.

The “Real-Time Payments Tracker®” examines how instant payments can help paycheck-to-paycheck households access money faster and lift them out of financial hardship.

Around the Real-Time Payments Space

Record inflation and a high cost of living have made many American households less financially secure than ever, according to a recent survey. Currently, 58% of Americans live paycheck to paycheck. Another 70% report feeling financial stress, including insecurity about a lack of savings and concerns about credit card debt or job security.

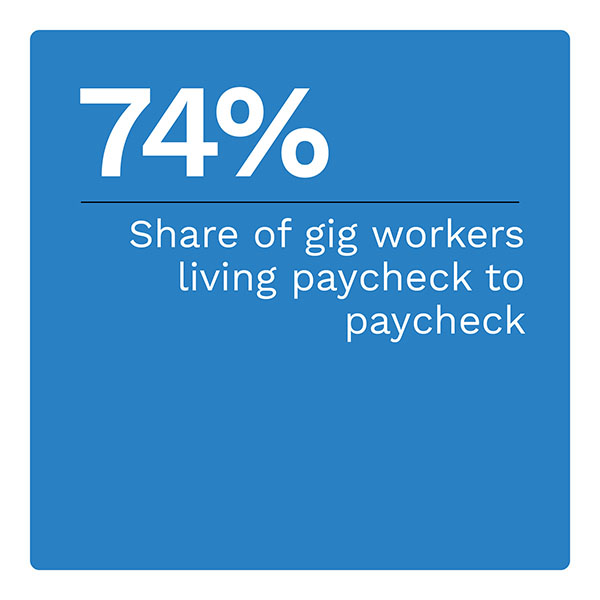

![]() Gig work offers unparalleled flexibility when it comes to scheduling but can be financially challenging. A recent study found that 76% of gig workers live paycheck to paycheck. This share is a much higher percentage than other workers. Forty-two percent of gig workers said they wait too long to get paid. Another 45% said they declined a potential opportunity due to a long onboarding process. More than 8 in 10 said they would sacrifice the flexibility of gig work if it meant making more money.

Gig work offers unparalleled flexibility when it comes to scheduling but can be financially challenging. A recent study found that 76% of gig workers live paycheck to paycheck. This share is a much higher percentage than other workers. Forty-two percent of gig workers said they wait too long to get paid. Another 45% said they declined a potential opportunity due to a long onboarding process. More than 8 in 10 said they would sacrifice the flexibility of gig work if it meant making more money.

For more on these and other stories, visit the Tracker’s News and Trends section.

How EWA Can Change the Game for Paycheck-to-Paycheck Families

Paycheck-to-paycheck households find themselves in a precarious financial situation for many reasons. The economic conditions of the past several years have made matters even worse. Earned wage access (EWA) offers paycheck-to-paycheck households an off-ramp from the vicious circle these high-risk options represent.

To get the Insider POV, we spoke with Rob Nardelli, director of commercial banking and business development at DailyPay, about how EWA can help households avoid the high risk of payday lenders.

Leveraging Real-Time Payments to Help Paycheck-to-Paycheck Households

As inflation grows faster than most wages, an increasing number of households live paycheck to paycheck. These households have just enough money to make it to the next payday with little to no savings or investment account funds. While higher wages are the best long-term solution, providing access to real-time payments could significantly help paycheck-to-paycheck households.

This month’s PYMNTS Intelligence examines how real-time payments can help individuals manage their cash flow more efficiently and how employers can deploy instant payroll to reduce the financial strain on their workers.

About the Tracker

The “Real-Time Payments Tracker®,” a collaboration with The Clearing House, examines how instant payments can help paycheck-to-paycheck households access money faster and lift them out of financial hardship.