From Portugal to the Philippines, Real-Time Payments Increase Their Global Footprint

Real-time payments have gained significant traction worldwide, revolutionizing how consumers and businesses conduct financial transactions.  Many countries have successfully implemented real-time payment systems to enhance efficiency and meet the growing demands of businesses and consumers. Each country’s implementation may differ significantly regarding infrastructure, technology and regulatory frameworks. Still, the common goal is providing faster, more convenient and secure payment experiences while stimulating economic growth and fostering innovation.

Many countries have successfully implemented real-time payment systems to enhance efficiency and meet the growing demands of businesses and consumers. Each country’s implementation may differ significantly regarding infrastructure, technology and regulatory frameworks. Still, the common goal is providing faster, more convenient and secure payment experiences while stimulating economic growth and fostering innovation.

Global Real-Time Payments Implementation

Some real-time payment schemes have run into significant friction before they even launch. Canada, for instance, delayed the rollout of its Real-Time Rail system to validate it’s end-to-end integration.

The country initially announced the system last year but postponed the launch pending a review by Payments Canada to ensure it has adequate delivery assurance and program management.

Other countries’ rollouts have continued on schedule but have met varying levels of adoption. The Philippines’ InstaPay scheme has been slow to catch on since its introduction, with paper-based transactions such as cash and check making up 98% of payments volume and real-time options accounting for just 0.7%. However, the country’s geography gives it tremendous potential for real-time payments to enable rapid transactions between communities separated by water.

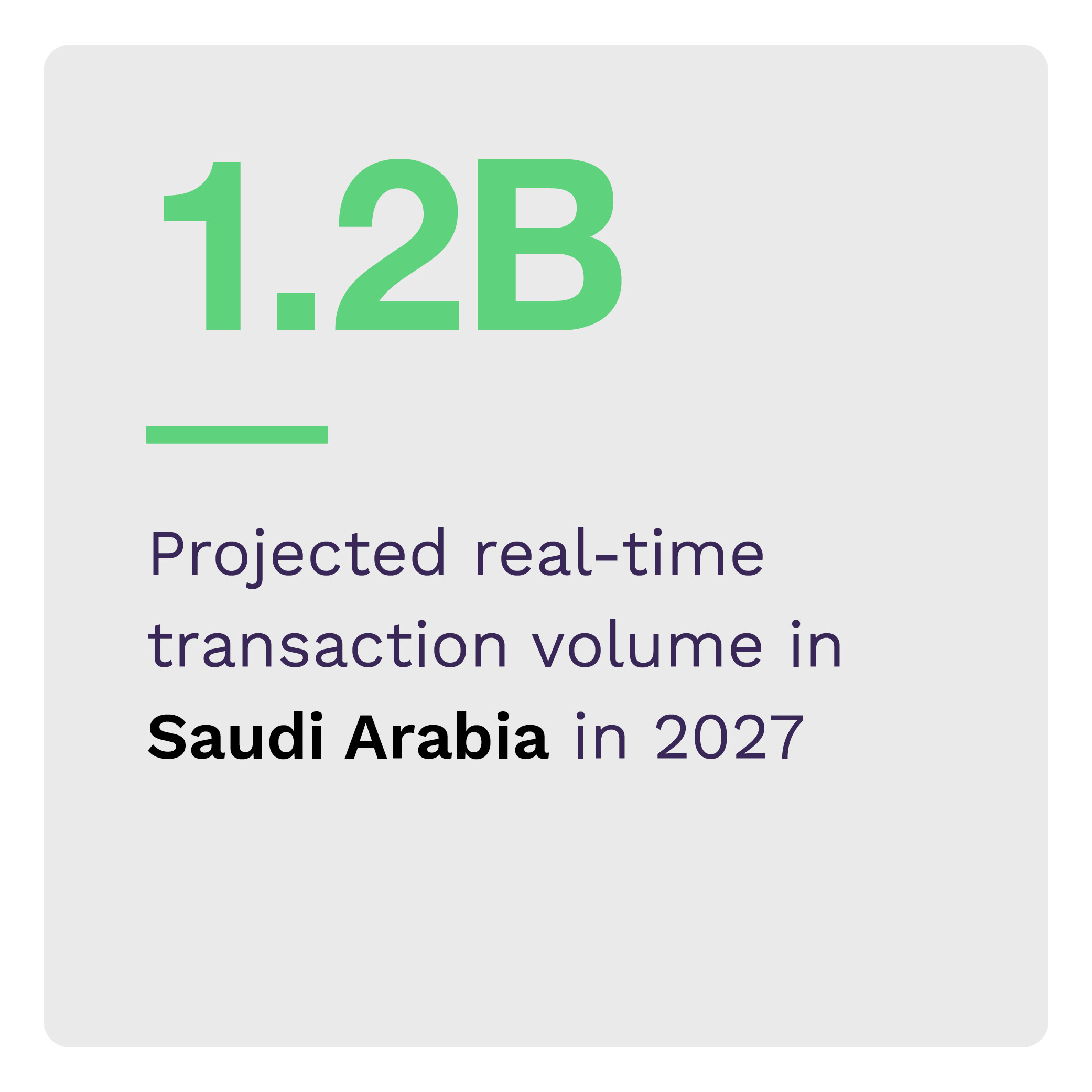

Saudi Arabia, meanwhile, has aggressively pushed the widespread adoption of its Sarie system since its inception. While usage remained low in 2022, experts predict that the lingering economic aftereffects of the pandemic will accelerate its usage.

Saudi Arabia, meanwhile, has aggressively pushed the widespread adoption of its Sarie system since its inception. While usage remained low in 2022, experts predict that the lingering economic aftereffects of the pandemic will accelerate its usage.

All real-time payment schemes have a common aspect: their dedication to quickness, convenience and security, even if met with hiccups. Real-time payments have proven instrumental in enabling instant peer-to-peer transfers, faster eCommerce transactions and smoother business-to-business payments. As more countries adopt and enhance their real-time payment systems, the global financial landscape offers new possibilities for individuals, businesses and economies to thrive.

The “Real-Time Payments World Map,” a collaboration with The Clearing House, examines the current and projected state of real-time payments schemes and volume worldwide.