Peru and Pakistan Expect Massive Real-Time Payments Growth by 2027

Each country implementing real-time payment methods has to balance various factors, including its banked population, the current favored payment schemes of the populace and penetration of digital payment methods, among many other variables.  This month PYMNTS explores the state and future of real-time payments in the Netherlands, Nigeria, Norway, Pakistan and Peru.

This month PYMNTS explores the state and future of real-time payments in the Netherlands, Nigeria, Norway, Pakistan and Peru.

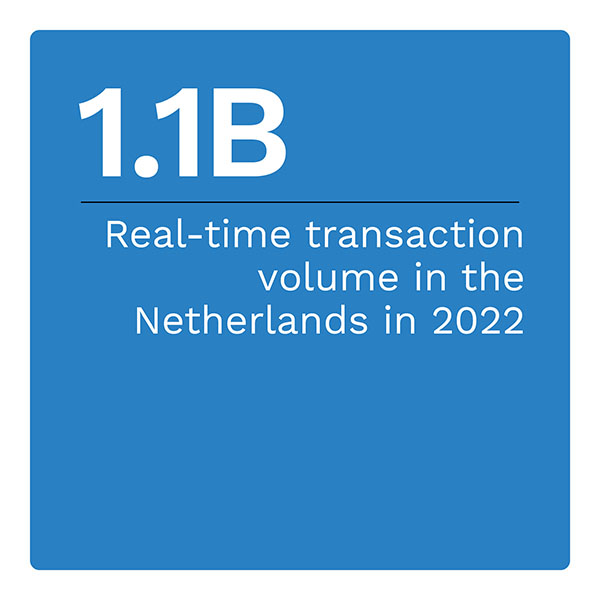

The Netherlands leverages the pan-EU SCT Inst scheme. It allows individuals and businesses to make instant transfers within Europe but continues to lag behind legacy payment options adoption.

Nigeria’s NIBSS scheme, meanwhile, has been embraced by major Nigerian banks and is widely used for various purposes, including eCommerce, bill payments and peer-to-peer (P2P) transactions.

Norway’s largest real-time payment scheme, Vipps, has become a household name in the country by offering a user-friendly mobile app that allows individuals to make instant payments using their smartphones. It has gained massive popularity due to its simplicity, eliminating the need for cash and traditional banking methods among its customers.

In Pakistan, the central bank introduced the Raast Instant Payment System, which provides individuals and businesses with a secure and efficient platform for real-time fund transfers. Pakistan’s central bank is pursuing a phased rollout, so Raast is currently available for only select functions.

Peru has implemented the Immediate Interbank Transfers (IRT) system to facilitate real-time payments. The Peruvian government and financial institutions are actively promoting IRT to drive digital transformation and enhance financial services across the country. However, the adoption of real-time payments in Peru is still in its early stages due to the country’s large proportion of unbanked households.

“The Real-Time Payments World Map,” a collaboration with The Clearing House, outlines the state of these real-time payments systems around the globe and examines how countries compare in terms of total payments volume and growth potential.