Real-Time Payments in India, Indonesia Expected to See Largest Growth

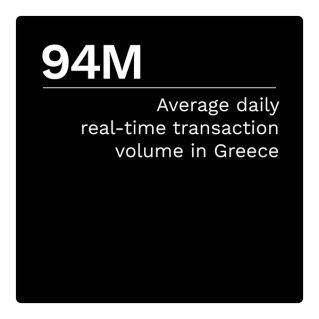

Real-time payment systems have transformed how individuals and businesses transact and manage their money around the globe by allowing users to transfer funds instantly without needing physical cash or checks. Users can transfer funds from anywhere, anytime, using their mobile devices or online banking. This transformation has made payment systems more accessible and streamlined, reducing the need for physical infrastructure and in-person transactions and making instant payments an integral part of the digital economy. Systems in Greece, Hong Kong, Hungary, India and Indonesia are among the many examples of real-time payment systems that have fundamentally changed how consumers manage their money.

Users can transfer funds from anywhere, anytime, using their mobile devices or online banking. This transformation has made payment systems more accessible and streamlined, reducing the need for physical infrastructure and in-person transactions and making instant payments an integral part of the digital economy. Systems in Greece, Hong Kong, Hungary, India and Indonesia are among the many examples of real-time payment systems that have fundamentally changed how consumers manage their money.

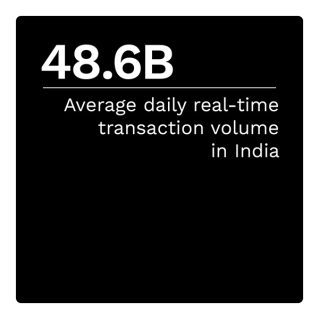

India, for example, introduced its real-time payment scheme in 2016. The National Payments Corporation of India operates the Unified Payments Interface (UPI). UPI enables individuals and businesses to transfer funds instantly and securely using mobile devices or online banking. India currently records more real-time transactions than any other country in the world, thanks to its massive population and high level of digital literacy.

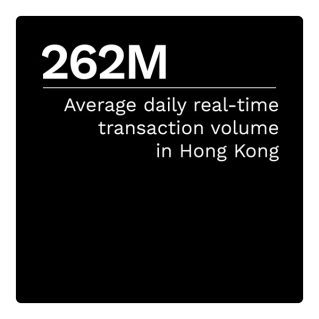

Hong Kong was a later entrant to the real-time payments scene, introducing its real-time payment system in 2018. The Hong Kong Monetary Authority operates Hong Kong’s Faster Payment System (FPS).  FPS enables instant fund transfers between banks, eWallets and payment service providers and supports transactions in Hong Kong dollars and renminbi.

FPS enables instant fund transfers between banks, eWallets and payment service providers and supports transactions in Hong Kong dollars and renminbi.

As the digital economy continues to grow, real-time payment systems are likely to become even more critical, facilitating more transactions and connecting people and businesses around the world.

The “Real-Time Payments World Map,” a collaboration with The Clearing House, presents the state of real-time payment systems worldwide. It highlights five countries each month and compares them to their counterparts’ total payments volume and projected growth.