Thailand Ranked First Globally in Real-Time Payments Transactions per Capita

The value proposition of real-time payments is undeniable: payments initiated, cleared and completed in just seconds — at any time. In other words, payees get immediate access to their funds. Naturally, the revolutionary payment method continues to gain swift momentum worldwide as more countries introduce real-time payment schemes and platforms or expand and enhance existing systems and infrastructures.

The value proposition of real-time payments is undeniable: payments initiated, cleared and completed in just seconds — at any time. In other words, payees get immediate access to their funds. Naturally, the revolutionary payment method continues to gain swift momentum worldwide as more countries introduce real-time payment schemes and platforms or expand and enhance existing systems and infrastructures.

Thailand led all countries in real-time payment transactions per capita in 2022, with the payment method accounting for 34% of all transactions. Thanks in part to the increasing popularity of the PromptPay scheme among Thai consumers, experts anticipate even more growth ahead. Projections suggest Thailanders will conduct 32 billion transactions via real-time payments in 2027.

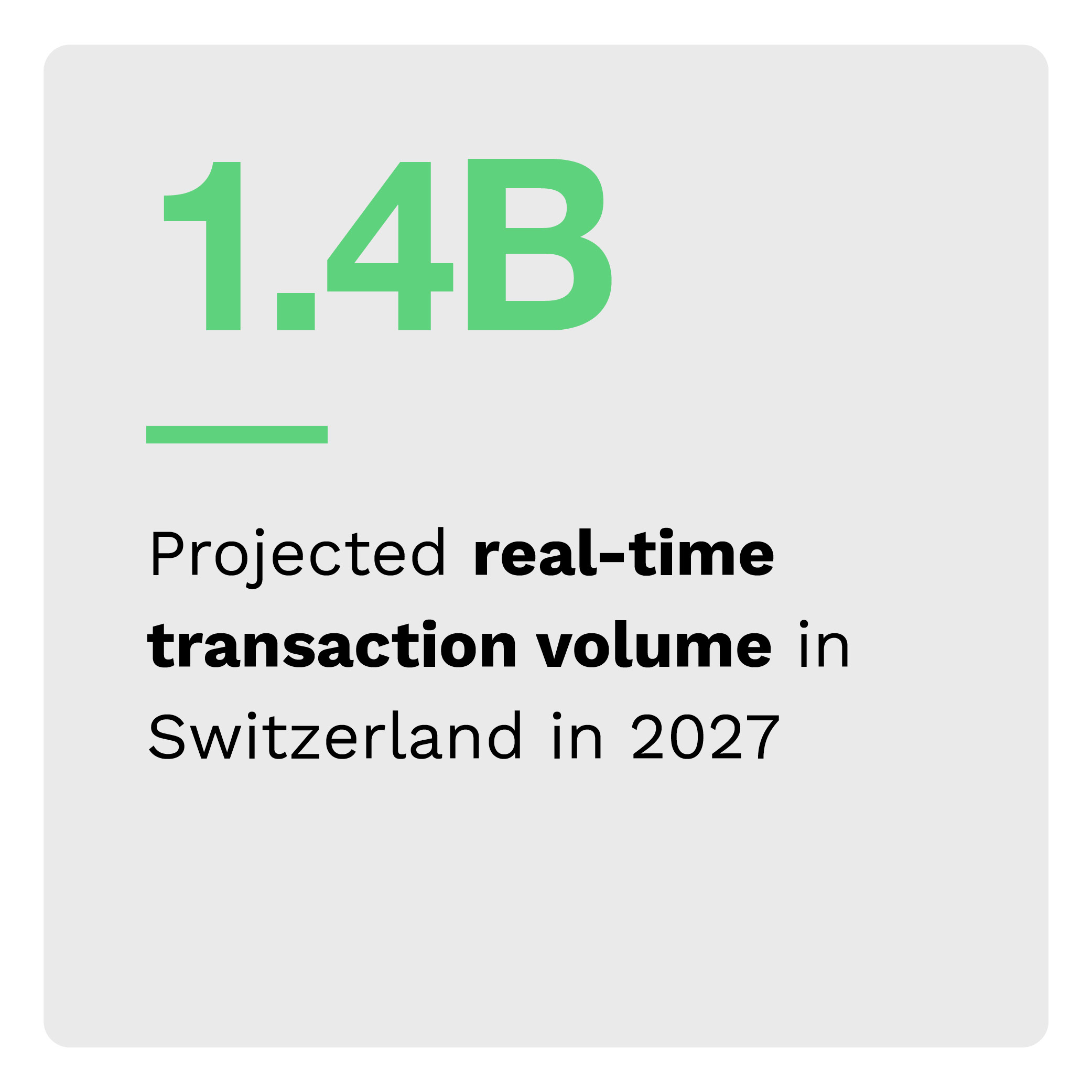

Meanwhile, in Switzerland, where real-time payment transactions number in the hundreds of millions annually, plans are underway to launch a new scheme in 2024, SIC5. This system will complement the existing real-time payments TWINT app, which counts more than 5 million users. With expanded capacity, Switzerland projects real-time payments to swell to nearly 1.5 billion transactions by 2027.

In some countries, such as the United Arab Emirates, real-time payments adoption is slow. Despite introducing the widely available Immediate Payment Instruction (IPI) platform to more than 70 financial institutions in 2019, the UAE reports that instant payments accounted for just 1.1% of transactions in 2022.

Taiwan continues to be a leader in real-time payments, having introduced the service in 1987. By 2027, experts anticipate that consumer usage will almost double in volume from its 570 million transactions in 2022.

Not to be outdone, the Central Bank of Turkey has rolled out the Instant and Continuous Transfer of Funds (FAST) system to accelerate the growth of real-time payment transactions within the country. These transactions are projected to surge from 2.3 billion in 2022 to more than 6 billion in 2027.

As the digital economy grows, real-time payment systems are facilitating more and more transactions daily, connecting consumers and businesses worldwide. The “Real-Time Payments World Map,” a collaboration with The Clearing House, examines the current and projected state of real-time payment schemes and volume worldwide.