42% of SMBs Would Pay a Fee to Receive Instant Ad Hoc Payments

Small and medium-sized businesses (SMBs) heavily rely on ad hoc payments to sustain their cash flow.

According to “How Instant Ad Hoc Payments Drive SMB Success,” a PYMNTS Intelligence and Ingo Payments collaboration, 65% of SMBs’ total accounts receivable volume is made up of ad hoc payments, which are crucial for revenue streams, especially for services and products sold.

However, manual procedures in processing these payments pose challenges for SMBs, resulting in delays in receiving payments.

Recognizing the importance of real-time payments for their cash flow, SMBs of all sizes embrace instant payment solutions to improve cash flow management and gain a competitive advantage.

However, the adoption of instant payment solutions varies across SMBs of different sizes.

Larger SMBs, generating between $1 million and $5 million in revenue, receive 37% of their ad hoc payments instantly. On the other hand, smaller SMBs, generating less than $1 million but more than $100,000 in revenue, only receive 25% of these payments instantly, suggesting that smaller SMBs are more likely to depend on traditional accounts receivable processes.

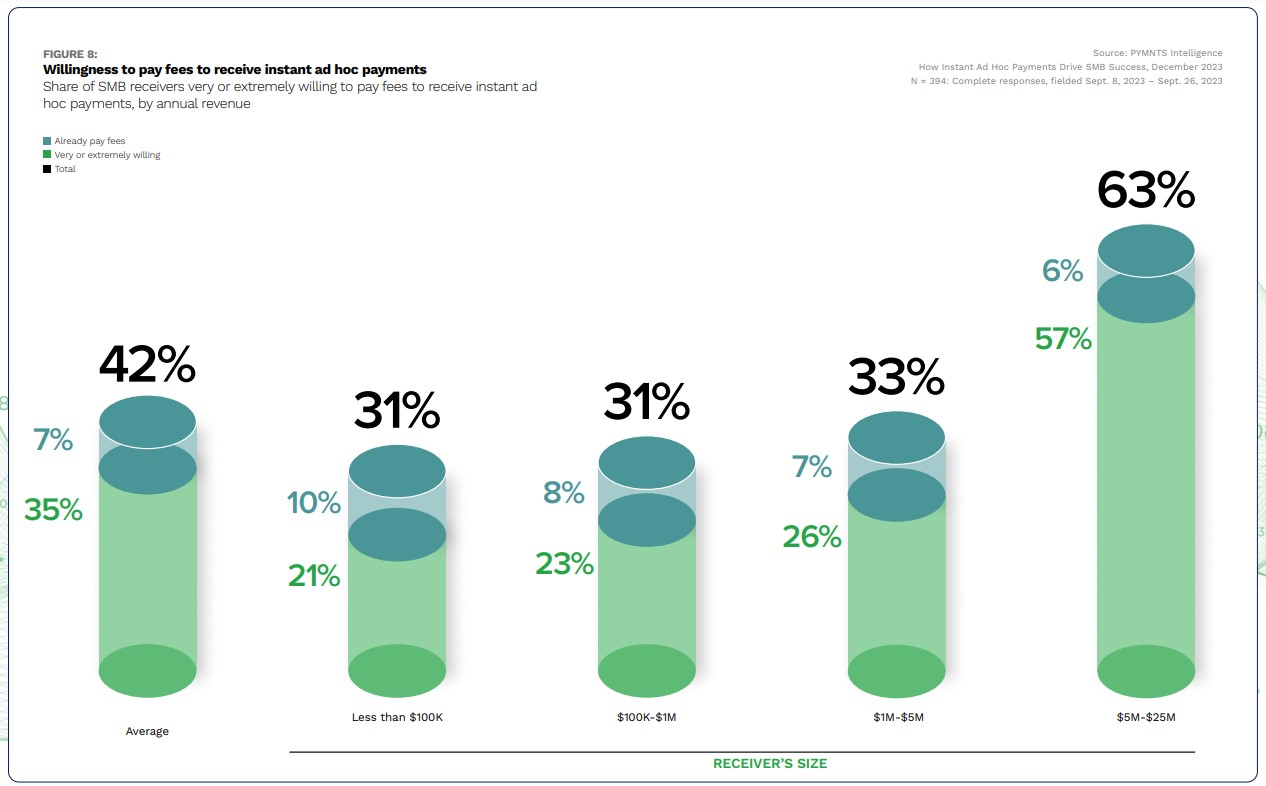

Other SMBs are also willing to pay fees to receive these payments instantly. As per the report, one-third of SMBs are already paying fees for instant payments and 42% of small businesses overall, would be willing to pay a fee to receive instant ad hoc payments.

This inclination toward paying fees becomes more pronounced as the size of the company increases. For instance, 21% of SMBs generating less than $100,000 annually are identified as very or extremely likely to do so, in contrast to 57% of SMBs earning between $5 million and $25 million.

Furthermore, two-thirds of SMBs would maintain a client relationship with senders that offer free instant payments. This highlights the significance of ad hoc payments for SMBs and their willingness to invest in faster payment solutions.

Further data sheds light on challenges in processing ad hoc payments. These include late payments, cost and fraud. According to the study, 24% of SMB receivers report that receiving their payments late is the biggest challenge they faced in the last year. As a result, streamlined processes and timely payments are necessary to ensure smooth cash flow management.

Delving further into the data shows that while bank transfers remain the primary payment method for receiving ad hoc payments, payouts to digital wallets have gained traction.

In fact, SMBs receive 41% of ad hoc payments directly to bank accounts, while 22% are received via digital wallets. This shift towards digital wallet usage suggests a growing trend and interest in these platforms.