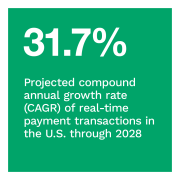

Real-time payments continue their rapid expansion worldwide, bolstered by widespread support from banks, corporations and governments alike. This edition of the “Real-Time Payments World Map” highlights the latest news and developments shaping the real-time payments landscape.

NetXD Simplifies Real-Time Payments Onboarding and Integration in the United States

One notable development is unfolding in the United States. NetXD launched a fully cloud-based solution for The Clearing House’s RTP® network, one of the first of its kind. According to a press release, NetXD aims to streamline the real-time payments process. When it goes live, it will provide instant fraud checks, enable 24/7 payments for financial institutions and eliminate reconciliation choke points. In addition to the RTP network, NetXD facilitates payments for the FedNow® Service and supports traditional rails such as automated clearing house (ACH), wire transfers and credit cards.

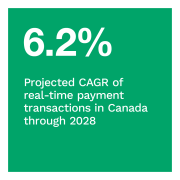

Canada’s Real-Time Rail Enters the Next Phase

Meanwhile, Payments Canada continues to make strides toward launching Canada’s nationwide Real-Time Rail (RTR). This system is designed to enable real-time sending, receiving, clearing and settling of payments. The initiative has been in the works for several years. It achieved a major milestone last June with the completion of the exchange mechanism by partner Interac, facilitating instantaneous exchanges of payment messages.

Meanwhile, Payments Canada continues to make strides toward launching Canada’s nationwide Real-Time Rail (RTR). This system is designed to enable real-time sending, receiving, clearing and settling of payments. The initiative has been in the works for several years. It achieved a major milestone last June with the completion of the exchange mechanism by partner Interac, facilitating instantaneous exchanges of payment messages.

The second phase, focusing on real-time payment clearing and settlement, is currently in development. Besides Interac, Payments Canada has enlisted strategic partners IBM Canada and CGI to support RTR’s development. A formal launch date for the RTR system is yet to be determined.

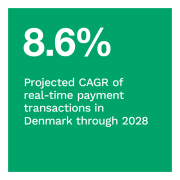

Denmark Integrates Into ECB’s Payment System

An agreement between the European Central Bank (ECB) and Danmarks Nationalbank represents a significant step for real-time payments in Denmark. This agreement brings the country into the ECB’s T2 wholesale payment system and the TARGET Instant Payment Settlement (TIPS) service. The collaboration will streamline the settlement process for high-value transactions conducted in euros and Danish kroner within the T2 system. The Danish kroner is the third currency TIPS accepts for settlement after the euro and the Swedish krona. Market participants in Denmark can now access all three TARGET services, including TARGET-2 Securities (T2S), to settle payments and securities in their native currency. This integration could go a long way toward optimizing liquidity management.

An agreement between the European Central Bank (ECB) and Danmarks Nationalbank represents a significant step for real-time payments in Denmark. This agreement brings the country into the ECB’s T2 wholesale payment system and the TARGET Instant Payment Settlement (TIPS) service. The collaboration will streamline the settlement process for high-value transactions conducted in euros and Danish kroner within the T2 system. The Danish kroner is the third currency TIPS accepts for settlement after the euro and the Swedish krona. Market participants in Denmark can now access all three TARGET services, including TARGET-2 Securities (T2S), to settle payments and securities in their native currency. This integration could go a long way toward optimizing liquidity management.

EBA Announces an Instant Credit Transfer Service

Europe saw another real-time payments advancement with EBA Clearing’s plans for an instant credit transfer service within its RT1 System. Set to launch later in 2024, this cross-border offering will adhere to the One-Leg Out (OLO) Instant Credit Transfers (OCT Inst) scheme established in 2023 by the European Payments Council (EPC). By leveraging the processing infrastructure, interfaces and other crucial elements of EBA Clearing’s pan-European instant payment system, the service aims to empower payment service providers within the Single Euro Payments Area (SEPA). As a result, providers will be able to efficiently manage both inbound and outbound international credit transfers through RT1.

About the Real-Time Payments World Map

“Real-Time Payments World Map,” a collaboration with The Clearing House, describes the growing demand and expansion of instant transactions worldwide.