Zoku Sushi: Ghost Kitchens Are Key To Winning The Delivery Wars

Quick service restaurants (QSRs) are trimming store sizes and shifting priorities onto fulfilling digital orders as quickly and smoothly as possible. Staff can better focus on preparing meals for pickup and delivery when they do not also have to spend much time on face-to-face interactions with in-store customers.

Some operations like Chipotle are even rolling out store designs that feature pick-up windows to let order-ahead diners collect their items without having to enter the restaurant. Others are taking the idea even further and doing away with consumer-facing locations entirely. These “ghost kitchens” are delivery-only, with owners spending less on property and directing funds into technological investments, lower menu prices and other concerns.

The February Order To Eat Tracker® details the latest trends in delivery as well as new digital approaches that QSRs are taking to appeal to modern consumers.

Around The Order To Eat World

Fast casual restaurants and QSRs often rely on large order aggregators for gaining visibility among consumers and netting more deliveries. This is a popular strategy — DoorDash handled a full 35 percent of all meal deliveries in the United States in 2018, and Grubhub closely trailed on its heels, claiming 30 percent of orders. DoorDash has also been working to cement its standing with a series of promotions conducted alongside its restaurant partners. The platform recently launched a promotion with Popeyes to offer free chicken sandwiches for no delivery cost to customers who place orders over $20.

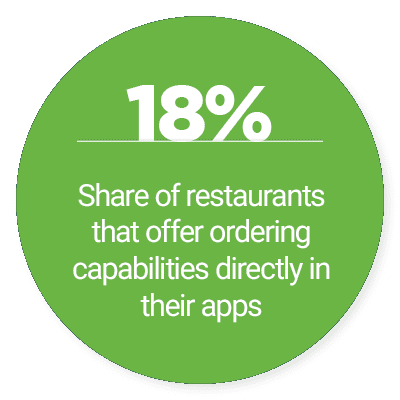

Some restaurants are bucking the order aggregator trend, however. These eateries are typically turned off by fees or concerns that customers may develop loyalty to the platform — not to the restaurants. Mediterranean QSR Dill & Parsley and sandwich brand Cousins Subs recently both encouraged consumers to buy directly from them with the launch of new ordering apps that also offer promotions.

A strong delivery strategy can help U.S.-based QSRs draw millennials consumers, with half of this age group reporting that they place more deliveries now than they did two years ago. This trend may be driving the growth that Applebee’s noted in its off-site sales. The brand is now piloting a new store model intended to better support such takeout and delivery purchases.

A strong delivery strategy can help U.S.-based QSRs draw millennials consumers, with half of this age group reporting that they place more deliveries now than they did two years ago. This trend may be driving the growth that Applebee’s noted in its off-site sales. The brand is now piloting a new store model intended to better support such takeout and delivery purchases.

Find more on these and the rest of the latest headlines in the Tracker.

Ghost Kitchens May Be The Spirit Of Modern Delivery

QSR’s speedy delivery times will no longer set them apart from the competition. Consumers’ expectations have shifted, and some restaurateurs like Charlie Yi — CEO of online-only sushi restaurant Zoku Sushi — believe that meal quality and price will instead be the deciding factors. Kitchens must figure out ways to reduce their operational costs so that they can provide these compelling prices. In this month’s Feature Story, Yi explains how a digital-only ghost kitchen approach — combined with strategy of accepting orders directly rather than through aggregator platforms — helps restaurants control expenses and sate modern consumers’ needs.

To read the full story, download the Tracker.

Deep Dive: Cloud Inventory Management Can Ease Back-Of-House Woes

Inventory management is particularly challenging in the food industry. Restaurants that overstock risk their ingredients spoiling — a major waste of both supplies and money — but understocking will irritate customers who cannot purchase the meals they want.

QSRs aiming to precisely assess their inventory needs are now turning to cloud-based software that can give them real-time supplies tracking and alerts. This month’s Deep Dive examines how cloud inventory management tools are being leveraged in the QSR industry and the software’s potential to simplify restocking decisions.

Find this story in the Tracker.

About the Tracker

The Order To Eat Tracker®, a PYMNTS and Paytronix collaboration, is a monthly report that examines the evolving restaurant space. The report highlights how fast food, fast-casual and QSR establishments are embracing technology, enhancing loyalty offerings and working with aggregated service providers to offer more seamless in-house and delivery ordering experiences and improve customer engagement.