REPORT: The QSR’s Digital Checklist For Surviving The Long Haul

The ongoing pandemic is devastating the restaurant industry, with eateries leaning heavily on mobile ordering to make up for declines in walk-in traffic.

The ongoing pandemic is devastating the restaurant industry, with eateries leaning heavily on mobile ordering to make up for declines in walk-in traffic.

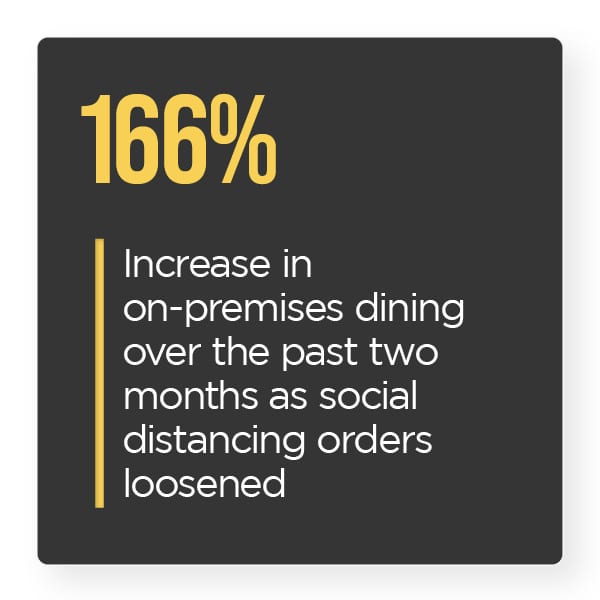

Restaurants are gradually opening dining rooms and patios at limited capacity, but some of these reopenings could end soon as colder weather shuts down the outdoor areas that are generally considered safer options.

Restaurants will once again have to pull out all stops to draw customers, including relying on third-party ordering systems like Grubhub and Uber Eats. Some eateries allege that the apps’ commission fees — which can be as high as 40 percent — are eating into their margins, but they cannot abandon these apps lest they risk losing the customers that use them, leaving eateries in a  Catch-22.

Catch-22.

The October Order To Eat Tracker® explores the latest in restaurant ordering developments, including record-setting revenues for the delivery industry, new ordering innovations for both restaurants and third-party ordering providers as well as how innovations like curbside pickup and grocery orders are helping quick-service restaurants (QSRs) weather the health crisis.

Developments From The Order To Eat World

The delivery sector is setting record revenues as dining rooms are operating at limited capacity, but this trend was in the works long before the pandemic began. A study found that the industry expanded by 20 percent over the past five years, with online food delivery revenue expected to hit $24 billion by 2023. This surge is in large part due to the popularity of third-party ordering platforms like DoorDash, Grubhub, Postmates, Uber Eats and the pizza-focused Slice.

QSRs are also improving their in-house ordering systems to make up for declines in walk-in traffic. Burger King, for example, unveiled plans for a new store concept that features touchless ordering as its centerpiece. The restaurant model consists of pickup windows, park-and-order lanes and drive-thrus, and customers’ orders are delivered via conveyor belts to limit person-to-person contact and reduce the risk of COVID-19 infection.

Third-party ordering services are also exp anding their functionalities. Uber Eats, for example, introduced a contactless system for placing takeout or dine-in orders, with customers using their phones to scan QR codes and access restaurant menus. This allows restaurants to shift away from digital menus, which could potentially act as vectors for COVID-19. The contactless pickup ordering feature is offered nationwide, but the dine-in solution is currently available only in select U.S. cities, including Boston, Chicago, New York and Washington, D.C.

anding their functionalities. Uber Eats, for example, introduced a contactless system for placing takeout or dine-in orders, with customers using their phones to scan QR codes and access restaurant menus. This allows restaurants to shift away from digital menus, which could potentially act as vectors for COVID-19. The contactless pickup ordering feature is offered nationwide, but the dine-in solution is currently available only in select U.S. cities, including Boston, Chicago, New York and Washington, D.C.

For more on these and other order to eat news items, download this month’s Tracker.

How Restaurants Can Survive The Pandemic With Curbside Pickup And Grocery Orders

The ongoing pandemic has forced QSRs to rethink their business models from the ground up as social distancing slows walk-in traffic to a crawl. Remote ordering and delivery are some of the primary ways QSRs are staying afloat during the crisis, but some are leveraging more creative approaches.

In this month’s Feature Story, PYMNTS talked to Natalie Anderson Liu, vice president of brand for burger chain MOOYAH, about how the QSR deployed curbside pickup and bulk grocery orders to meet customers’ needs and break even at a time when turning a profit is harder than ever.

Deep Dive: How Restaurants Are Meeting Customers’ Demands To Drive Revenue

Deep Dive: How Restaurants Are Meeting Customers’ Demands To Drive Revenue

Customers’ expectations of QSRs were changing long before the pandemic’s onset, with consumers demanding quicker services, more convenient ordering and ironclad security measures. Restaurants deploying these upgrades were forced to kick into high gear when the pandemic hit and roll out these improvements at breakneck speed.

This month’s Deep Dive explores how restaurants, such as Chipotle and Shake Shack are innovating their drive-thrus and ordering solutions to satisfy customers’ ever-evolving demands.

About The Tracker

The monthly Order To Eat Tracker®, a PYMNTS and Paytronix collaboration, offers coverage of the most recent news and trends in the restaurant ordering ecosystem.