Digital Ordering Boom Widens Gap Between Big Restaurant Brands and Small Operators

While many businesses are getting back on their feet after the devastating events of 2020, Main Streets’ restaurants are struggling. PYMNTS’ December 2021 Main Street Index study, created in collaboration with Melio, which looks at growth in new establishments, real wages and employment across America’s small businesses, finds that the industry lags behind others.

Read the full report: The Main Street Index

Of the eight sectors examined — professional services, healthcare, personal services, building contractors and remodelers, service and repair, fitness, retail and eating and drinking places — the latter was one of the four sectors that still had not recovered to pre-pandemic levels, remaining around 20% below 2019 performance.

It would appear, from comparing these small businesses’ performances to industry-wide recovery, that small restaurants may be losing sales to major brands. Overall, from a sales perspective at least, the restaurant industry is outperforming 2020 levels. United States Census Bureau data finds that monthly sales at food service and drinking places in September, the most recent month on record, were up 12% from 2019, hitting $71.2 billion up from $63.4 billion.

Source: Monthly Retail Trade and Food Services NAICS 722: Food Services and Drinking Places: U.S. Total

“The data itself is encouraging — dining demand is back, and I think anybody who’s eaten out in the last several months has probably seen that,” Alex Lee, vice president and general manager of Resy and the American Express Global Dining Network, told Karen Webster in a recent interview. “Restaurant reservations are often hard to come by, and the restaurants are often quite full, and certainly that’s encouraging for the industry that has been hit so hard. But I think the theme we look at more than anything is that the recovery from COVID has been unequal and inconsistent.”

See also: Dine-In Restaurant Recovery Hinges on Digital Experiences

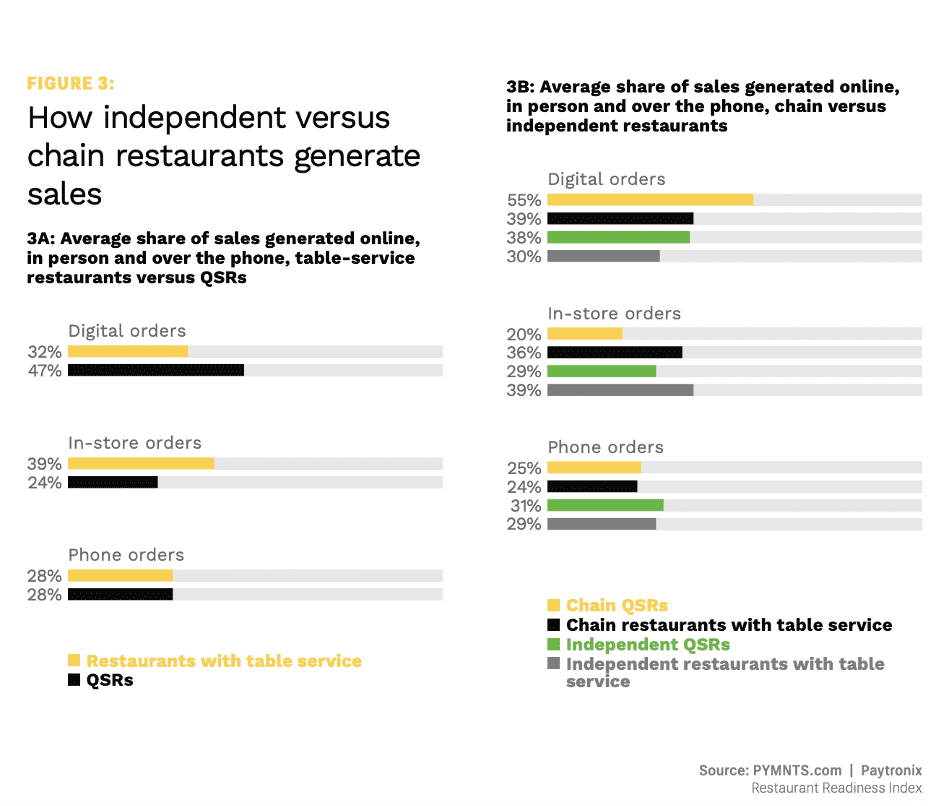

Part of the issue for independent restaurants is that as consumers have increasingly turned to online ordering, they have largely been left out of the industry’s digital shift. Research from PYMNTS’ 2021 Restaurant Readiness Index, created in collaboration with Paytronix, finds that while 55% of chain quick-service restaurants’ (QSRs’) sales are now generated through digital platforms, only 38% of independent QSRs’ sales come in through these channels. Similarly, while 39% of chain full-service restaurants’ (FSRs’) sales are from digital orders, that share falls to 30% for independent FSRs.

Read more: QSRs’ Lagging Loyalty-Reward Investment Hurts Innovation and Sales

Building the kind of ordering app that can compete in today’s competitive digital marketplace — one that is user-friendly, offers compelling rewards and implements learnings from consumers’ previous behaviors to personalize the interface to the user’s own tastes and preferences — is expensive.

Take, for instance, Capriotti’s, a Las Vegas, Nevada-based fast-casual brand with over 125 locations across the country. In an interview with PYMNTS for the September/October Order to Eat Tracker, a PYMNTS and Paytronix collaboration, Jane McPherson, the chain’s senior vice president of marketing, explained how the company was able to leverage its positioning to succeed as consumers’ ordering habits evolved.

Get the Tracker: Order to Eat: A Serving of Data Analytics Helps Personalize Rewards, Drive Redemption at Capriotti’s

“Everyone in the industry saw the big swing to online ordering,” she said. “We were fortunate in that we had so much of our infrastructure really well built out. We had a robust online ordering platform, and we were well-optimized. We quickly implemented a robust curbside pickup solution, offering customers the opportunity to [scan] a QR code and place an order from outside of the store.”

Related news: Capriotti’s on Leveraging Digital Tools, Data Analytics to Drive Customer Loyalty

While there are third-party providers that can help independents make their offerings more digitally available, small businesses remain at a huge disadvantage in the online marketplace, where the interpersonal relationships that tend to differentiate Main Street businesses are deemphasized.