Subway Rolls With Personal Digitized Loyalty In Delicate Dance With Aggregators

Dining out is on the menu for many United States consumers once again.

Overall restaurant sales nationwide jumped $70.6 billion in June, notching their third straight month of reaching an all-time high. These developments have instilled hope in an industry that saw heavy losses resulting from closures and pandemic-related restrictions, although restaurants are still unsure of  what the spread of the novel coronavirus’ delta variant will mean for their operations.

what the spread of the novel coronavirus’ delta variant will mean for their operations.

All indicators suggest that delivery options will continue to curry favor with consumers despite the momentous rise in on-site dining, however. Recent trends show that consumers were almost twice as interested in receiving deliveries from restaurants between March and May of this year as they were prior to March 2020, for example. This, in turn, has driven increased demand for food aggregator platforms like Grubhub and DoorDash, which have since become dominant players in the U.S. delivery market.

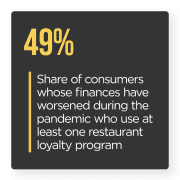

Aggregators’ rise is not all good news for restaurants, however. These services can charge commission fees ranging from 15 percent to 30 percent, for example, prompting restaurants to foist some of the costs onto customers. The August edition of the Order To Eat Tracker® examines how quick-service restaurants (QSRs) can leverage digital solutions and loyalty programs to engage customers and own the customer relationship rather than relinquishing control to food aggregators.

Around The Order To Eat Space

Food delivery aggregators are expected to extend their dominance this year even after witnessing record growth in 2020. Uber Eats, for example, is slated to see its revenues rise 80 percent, while DoorDash’s are set to climb 45 percent and Grubhub’s are set to rise 25 percent year over year.

One unfortunate reality behind the proliferation of third-party delivery services is that many charge significant fees, although several U.S. municipalities are working to address this. New York City announced that it would extend a 20 percent cap on delivery provider fees through February 2022, with various local municipalities in the state passing laws that require these services to share their customer data with restaurants. Some major food aggregators, notably DoorDash and Grubhub, have been vocally opposed to these measures.

QSRs and eateries of all sizes are also beginning to realize that offering compelling digital features and personalized loyalty solutions can help them regain control of the customer relationship despite aggregators’ market dominance. Fast food behemoth McDonald’s launched its first-ever U.S. loyalty program, MyMcDonald’s Rewards, for example. The app-based solution allows customers to accrue 100 points for each dollar spent, which enables them to select from a menu of assorted items as a reward.

For more on these stories and other order to eat headlines, download the Tracker.

Subway On Taking Control Of The Customer Relationship With Digital Features And Loyalty Programs

Consumers’ rush for delivery options over the past 18 months has driven many restaurants to partner with third-party aggregators. Engaging consumers in the long term, however, requires that restaurants meet their needs with enticing rewards programs and convenient digital features.

Consumers’ rush for delivery options over the past 18 months has driven many restaurants to partner with third-party aggregators. Engaging consumers in the long term, however, requires that restaurants meet their needs with enticing rewards programs and convenient digital features.

In this month’s Feature Story, Dan Holm, senior director of Digital Platforms and Innovation at sandwich chain Subway, explains why restaurants must cater to customers’ increased cravings for delivery services, seamless digital ordering options and standout loyalty offerings.

Deep Dive: How The Restaurant Industry Can Respond To Food Delivery Aggregators’ Emergence

Food aggregator services have been involved in the restaurant space for merely a decade, but they have come to dominate the delivery segment during that time. While these platforms offer convenience and familiarity for consumers, their fees can top 30 percent — leaving restaurants to foot the bill or shunt the cost onto consumers.

This month’s Deep Dive examines food aggregators’ rapid rise, how this trend is challenging restaurants and the restaurant industry as a whole, and how innovative loyalty features and other offerings can help eateries stay in the game and own the customer relationship.

About The Tracker

The monthly Order To Eat Tracker®, a PYMNTS and Paytronix collaboration, offers coverage of the most recent news and trends in the restaurant ordering ecosystem.