PYMNTS Intelligence: Restaurants Must Lean Into Digital Loyalty Programs

The pandemic has forced retail businesses of all types, including restaurants, to quickly adapt to a new normal defined by digital-first consumers who spend more time at home and reach for their mobile devices as the go-to way to interact with their favorite merchants. United States consumers now begin 85% of their shopping journeys for retail goods and services online, making digital channels the most critical part of the purchasing funnel.

The seismic shifts of the last two years have arguably impacted the restaurant industry more than any other retail segment. This makes digital transformation especially critical for restaurants, but it is also uniquely challenging. Restaurants serve up the inherently in-person experience of enjoying food — whether dine-in, pickup or delivery — and how they navigate the intersection of the real-life and digital worlds can make or break their ability to retain existing customers and attract new ones.

App-based loyalty programs take center stage in this dynamic. This month’s PYMNTS Intelligence examines the current state of play for restaurant rewards programs, including what customers expect and want from their favorite table-service and quick-service restaurants (QSRs) when it comes to loyalty programs.

Restaurants Falling Short on Rewards

Any owner or manager of a restaurant can attest to the importance of cultivating long-term relationships with loyal, regular customers. These repeat eaters not only represent high lifetime customer value, but also become evangelists who introduce their friends and family to their favorite establishments and broadcast their positive views on social media.

Rewards programs offer a powerful way to boost customer loyalty. A recent industry study found that U.S. QSRs saw a 15% increase in rewards program users in 2021, and these members spent 23% more per order than they did the previous year. More than 70% of all retail and restaurant shoppers surveyed feel more open to joining a loyalty program that offers mobile app functionality. The same study, however, reported that just 16% of top U.S. QSR brands even offer a dedicated loyalty app, and 50% of consumers find little value in existing retail and restaurant loyalty programs in general.

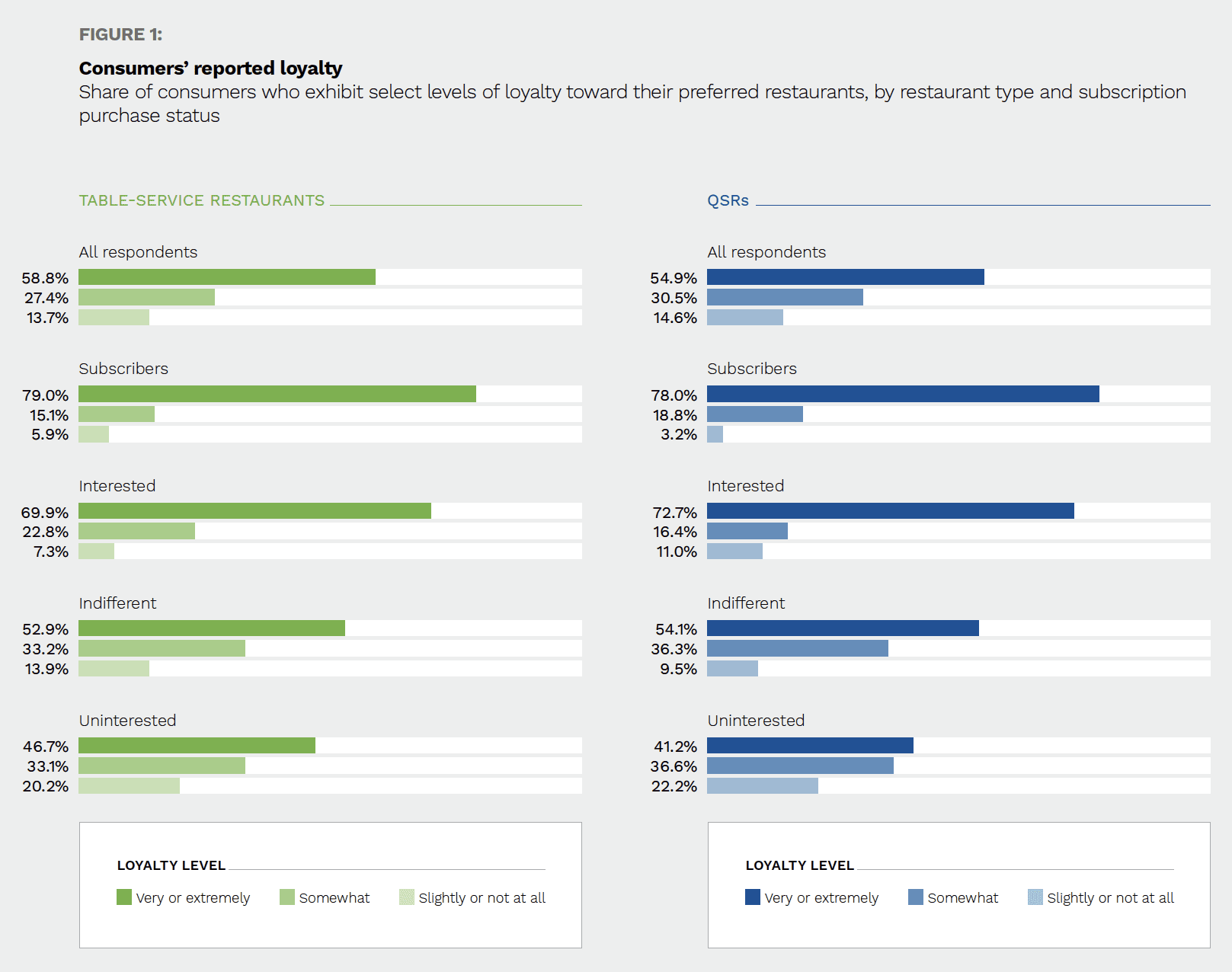

A consumer survey by PYMNTS confirms that restaurants are missing the mark on loyalty programs. Just 44% of respondents said they belong to a loyalty program for at least one table-service restaurant, while only 38% take part in at least one QSR loyalty program. These figures are substantially lower than the shares of those surveyed who identify themselves as having “very” or “extremely” high loyalty levels toward their favorite eateries, comprising 59% for table-service restaurants and 55% for QSRs. The data also shows that consumers who have signed up for a restaurant subscription plan for repeat purchases tend to feel the most loyal, followed by those who are interested in a subscription.

Customers Are Hungry for Key Reward Features

Most of the largest QSR brands have invested heavily in digital loyalty programs and are now reaping the benefits. Papa John’s and Chipotle, for example, added 1 million and 2 million loyalty app members, respectively, in late 2021 alone.  An underlying value proposition from the perspective of restaurants is that loyalty apps facilitate robust data collection, providing vastly greater insights into customer preferences than simple swipe- or stamp card-based loyalty programs. This data powers personalized offers and experiences, something that 72% of retail and restaurant customers say they expect.

An underlying value proposition from the perspective of restaurants is that loyalty apps facilitate robust data collection, providing vastly greater insights into customer preferences than simple swipe- or stamp card-based loyalty programs. This data powers personalized offers and experiences, something that 72% of retail and restaurant customers say they expect.

One key innovation that many restaurant chains offer is automatic membership in their loyalty programs for customers who download their respective mobile apps and place orders. This creates a virtuous cycle, with those who initially want an app for ordering purposes being encouraged to make repeat purchases through rewards and other members-only experiences. The critical link between ordering via apps and digital loyalty program membership does not favor only large brands that have the resources to build their own ecosystems from the ground up. Third-party solutions providers offer robust restaurant management platforms for ordering, delivery and loyalty programs, among other features. Research by Paytronix finds that about one in three delivery orders for a given restaurant come from guests who order multiple times per month from the same respective eatery.

PYMNTS’ research reveals that the availability of loyalty programs is a key factor in many customers’ choice of restaurant, particularly those who already participate in a restaurant subscription program or are interested in doing so, but also for significant shares of those with little or no interest in subscriptions. The upshot is clear: Offering digital loyalty programs is a win-win for customers and restaurants alike.