Today is Chris Cracchiolo’s first day on the job at Walmart. The 19-year American Express veteran is taking over as the head of Walmart+, which is Walmart’s subscription program that launched last September as a foil to Amazon Prime.

Perhaps not a moment too soon — because although Walmart has momentum, it has a long way to go to catch up with Amazon.

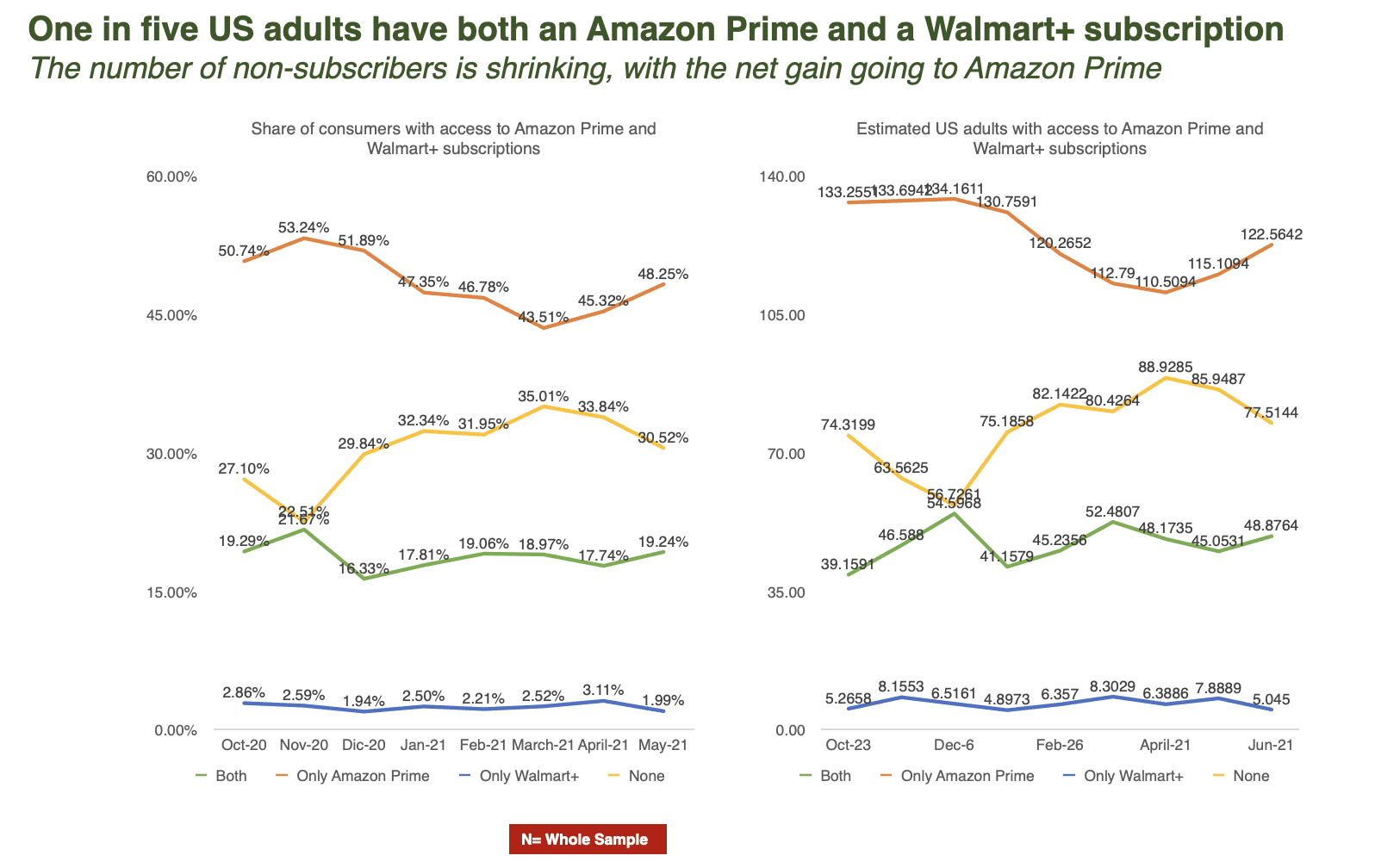

According to the latest PYMNTS data, a national study of 2,297 U.S. consumers conducted between June 24 and June 27, the number of Walmart+ subscribers has increased substantially from October 2020, a month after its launch, to May 2021, just eight months later. There were 44.4 million Walmart+ subscribers then and roughly 53.9 million subscribers in June 2021 — an increase in subscribers of more than 21 percent. The vast majority of that increase in subscribers, about 91 percent, consists of subscribers who are also Amazon Prime members.

As of June 2021, Amazon has 171.4 million Prime members — three times more than Walmart+.

While there’s some good news here for Walmart+, these numbers are only a small piece of the story – and the challenge Mr. Cracchiolo faces.

Deal Day Duels

Deal Day Duels

PYMNTS fielded this study two days after the end of the dueling Amazon Prime Days/Walmart Deal Days events to understand who shopped those mega sales days, what they bought and how much they spent. Using those data, we discovered that the behaviors of users of Amazon Prime and Walmart+ Deal Days is a window into the larger issues facing America’s current reigning king of retail — one that, based on our current projections, is poised to lose that crown to Amazon a little more than a year from today.

We find that Walmart is a retailer that remains largely dependent on grocery sales to boost its top line, and one that continues to lose ground in key non-grocery retail categories.

We also find that the middle- and lower-income consumers living outside of urban centers who were once Walmart’s bread-and-butter customers are also Amazon Prime members who buy groceries and retail products from them. Those consumers spent twice as much with Amazon during Prime Days (a $42 average transaction) as they did with Walmart on Deal Days (a $22 average transaction).

We also learned that one in five U.S. consumers have both an Amazon Prime and a Walmart+ account, with 43 percent and 38 percent of that crossover membership comprised of millennials and bridge millennials (33- to 43-year-old) consumers, respectively. Yet we also see that more of those demographic groups are shopping Amazon for non-grocery retail purchases online for delivery to their homes.

Sixty percent of millennials who have both Walmart+ and Amazon Prime accounts made purchases from Amazon for home delivery in urban centers, compared to 55 percent of that segment who purchased online from Walmart. Half as many opted for buy online pick up at store – Walmart curbside and Amazon at lockers.

These findings also raise a more fundamental question that’s now central to the political and regulatory debate here in the U.S. (and globally) about Amazon (and Big Tech more generally).

Is Amazon too big?

Or just so good that more consumers shop and spend more with them?

After all, at least in the U.S., they do have a choice — the largest retailer in the world, with a Prime-like rival offering.

Spending Trends

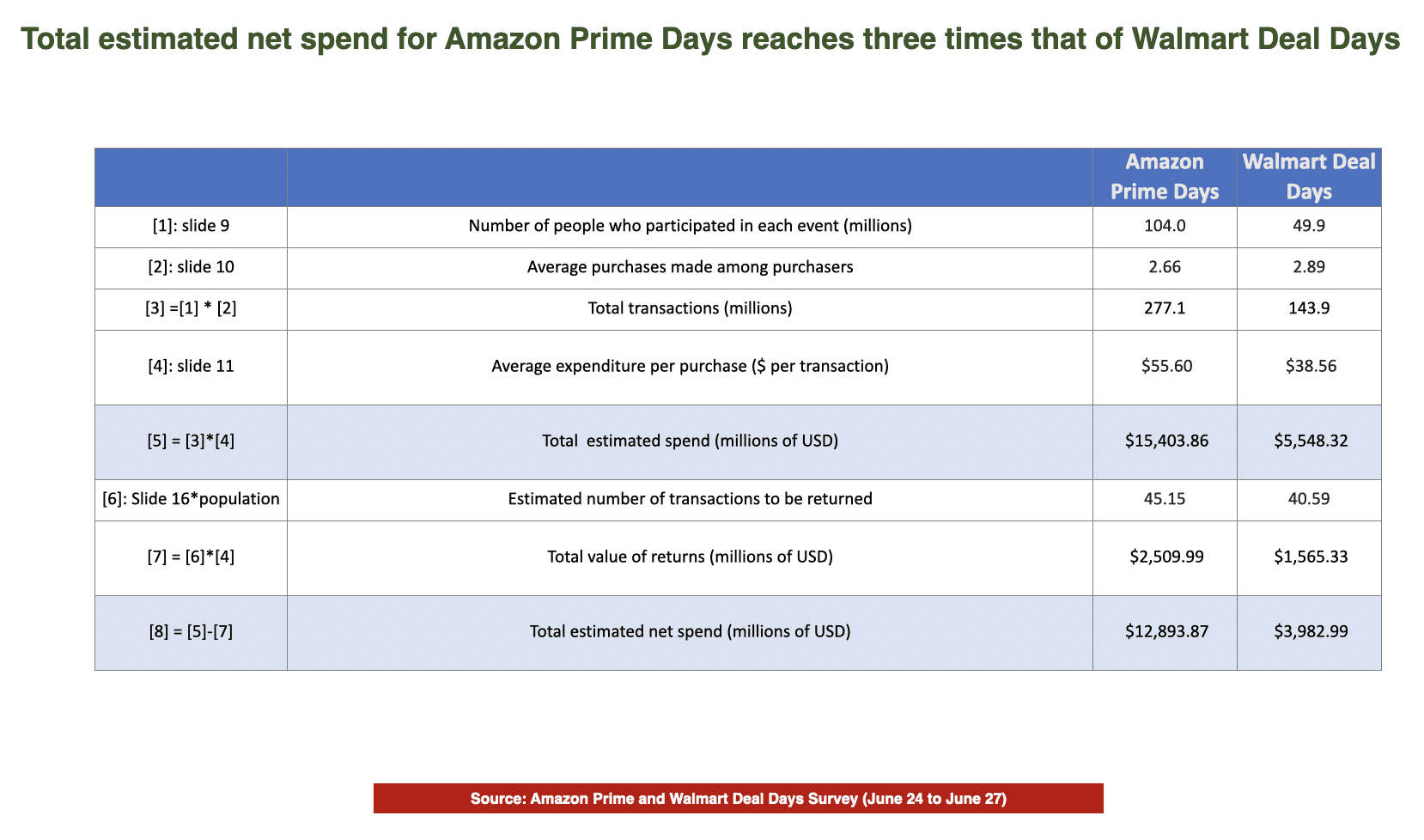

By all accounts, Amazon Prime Days were a barn burner for Amazon. Using our survey data, we estimate that revenues for Amazon are three times those of Walmart for its Deal Days.

More than twice as many consumers participated in Amazon Prime Days (104 million) than Walmart Deal Days (50 million). Walmart got a boost, though, because a consumer didn’t have to be a Walmart+ member to participate in those deals.

More than twice as many consumers participated in Amazon Prime Days (104 million) than Walmart Deal Days (50 million). Walmart got a boost, though, because a consumer didn’t have to be a Walmart+ member to participate in those deals.

The number of purchases was largely similar for both: roughly three per shopper. But the average spend per purchase was roughly 45 percent higher for Amazon Prime customers.

Before accounting for returns — which, based on our study, are projected to be slightly higher for Amazon Prime customers — we estimate that Amazon’s Prime Days delivered $15.4 billion in revenues compared to Walmart+ at roughly $5.5 billion. After returns, the totals are $12.9 billion and $4.0 billion respectively — which means Amazon’s sales were about triple Walmart’s after returns.

The difference in sales results can be attributed to several things. One of them is a basic lack of awareness by shoppers about Walmart’s Deal Days.

There was also no real incentive for shoppers to have a Walmart+ membership to shop Deal Day deals, which were available to any Walmart shopper. Non-Walmart+ shoppers account for 27 percent of all Deal Day participants. By comparison, Prime Days were only available to members.

That gave Walmart a boost. But then…

Half of the consumers in the PYMNTS study who did not participate in Walmart’s Deal Days said they didn’t know about the two-day sales event, and three times more Walmart+ consumers were unaware of Deal Days as Amazon Prime members were unaware of Prime Days.

Forty-four percent of Walmart+ consumers who took advantage of Deal Day sales said they did so because they were shopping anyway, and found that what they already planned to purchase was on sale.

By contrast, the biggest reason that Amazon Prime users didn’t participate in Prime Days is because there wasn’t anything offered that they needed to buy. For those who did, 56 percent found the deals to be “very good,” and half found discounts on products they intended to buy anyway. Only a third of Amazon shoppers planned their shopping around Prime Days, and even fewer spent time tracking down the deals.

Then there is what shoppers bought when Prime Day and Deal Days deals went live.

Grocery Isn’t Enough To Feed The Retail Beast

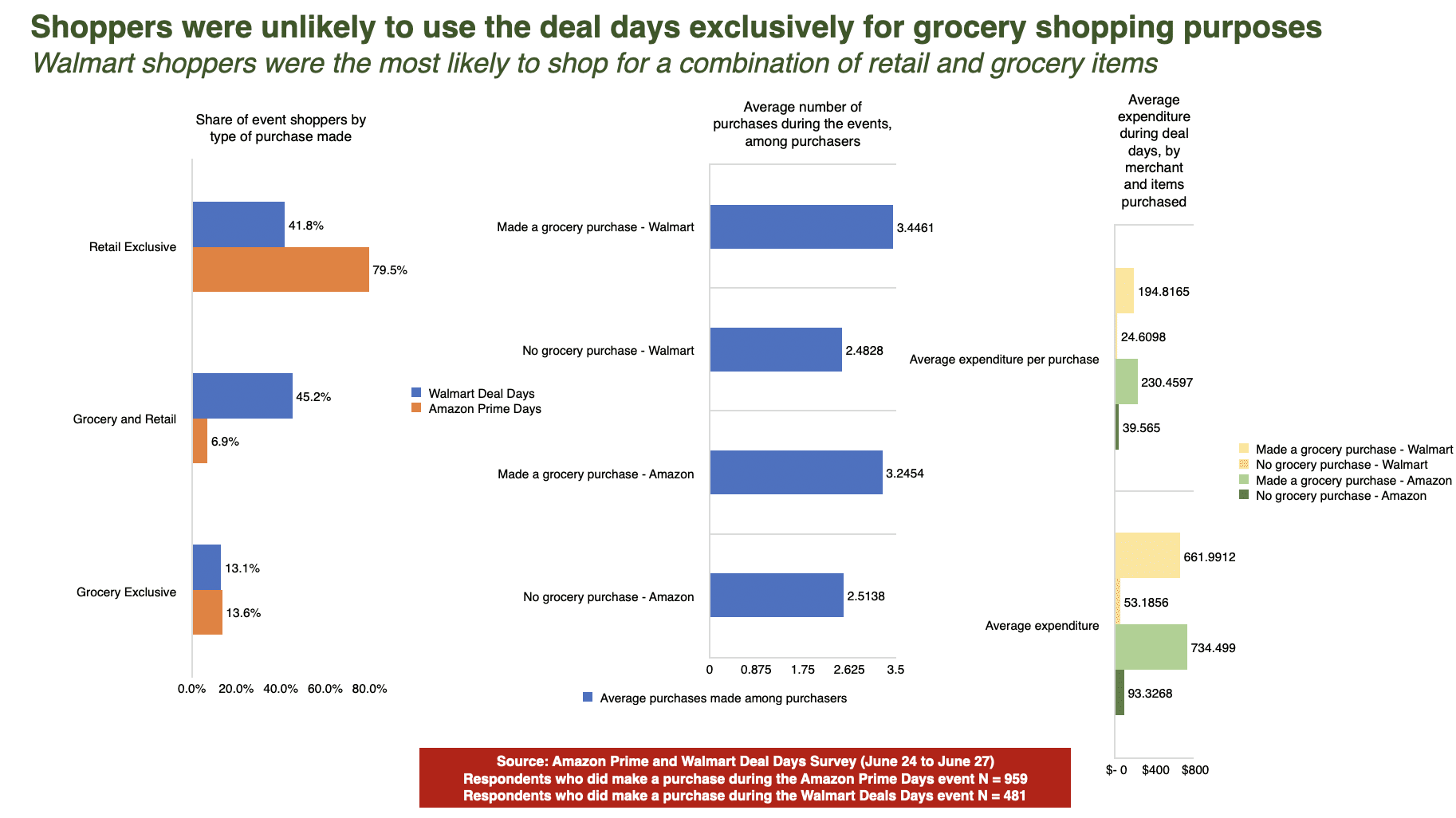

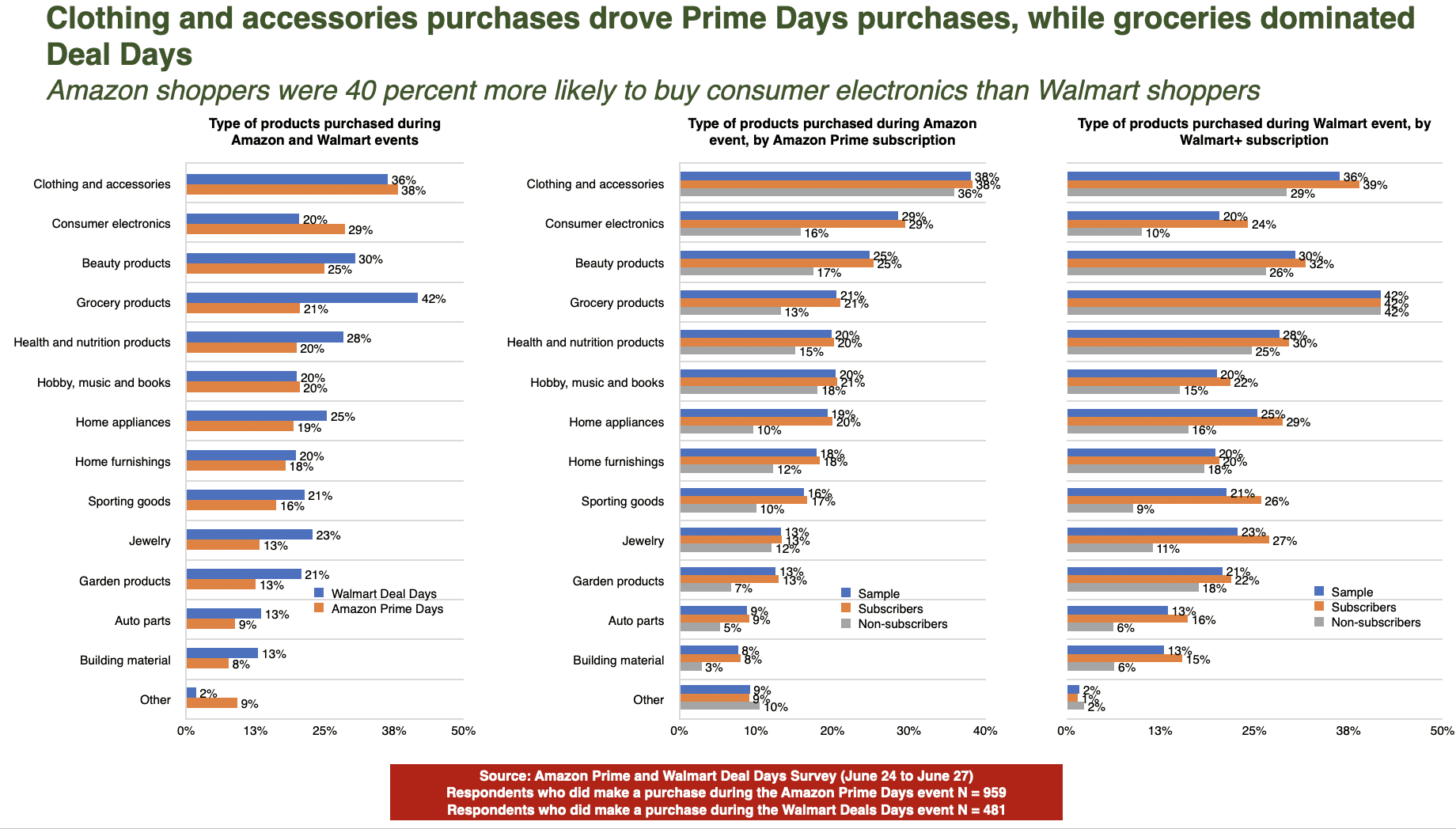

Grocery accounts for 56.3 percent of Walmart’s total sales. And according to Walmart CEO Doug McMillon, grocery is the key driver of Walmart+ signups. It certainly was a key driver of sales for Walmart’s Deal Days in June. Twice as many Walmart+ shoppers made grocery purchases as Amazon Prime members made during those sale days.

It’s also where cracks appear in Walmart’s retail armor.

It’s also where cracks appear in Walmart’s retail armor.

Neither Amazon nor Walmart shoppers were likely to use either of the two-day sales events to make grocery purchases, even though both Walmart+ and Amazon Prime shoppers did buy them during those two-day sales.

In fact, twice as many Walmart+ consumers bought groceries during Deal Days as Prime members, even though the share of Walmart+ and Prime consumers making grocery purchases was the same: one in 10.

The percentage of lower-income consumers making grocery purchases with each was also similar: 6 percent of low-income Amazon Prime Day shoppers made grocery purchases, as did 7 percent of low-income Walmart shoppers. EBT acceptance by Amazon, along with discounted Prime membership status for that segment of consumers, seems to have leveled the grocery playing field, at least as far as Prime Day/Deal Days is concerned. Overall, Amazon Prime customers spent roughly 11 percent more on groceries than Walmart+ consumers over that two-day period.

It is retail sales that tell the real story.

Three times as many Amazon Prime members made retail purchases as Walmart+ customers. According to our data, purchases of clothing, accessories and electronics outpaced Walmart+ customer purchases two to one.

Walmart had a slight advantage in those categories for which consumers wanted same-day pickup – garden materials, building supplies, prescriptions, sporting goods and auto supplies – or where shoppers wanted to inspect a product and/or products for which there is more of an impulse buy (beauty products and jewelry).

Overall, Amazon Prime customers spent 54 percent more on retail purchases than Walmart+ consumers, which boosted total overall spend for Amazon — and across all demographic groups.

Three times as many Gen Z and Gen X, twice as many millennials and bridge millennials and five times as many baby boomer Prime members made retail purchases from Amazon during Prime Days than Walmart+ customers in those same demographic groups.

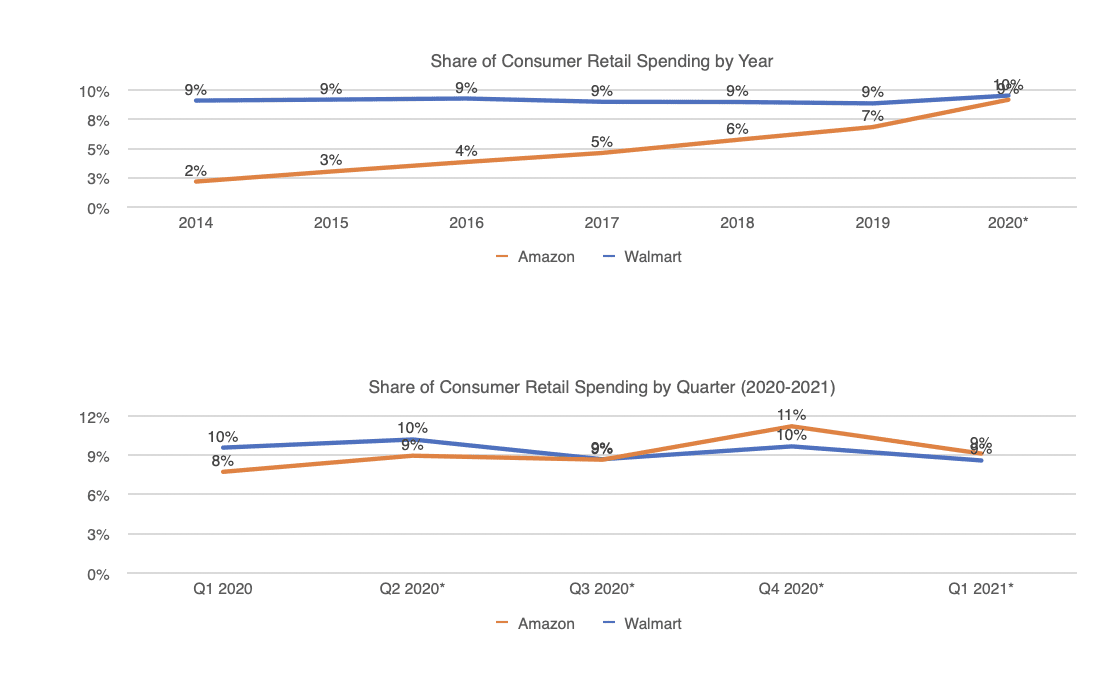

This two-day trend is consistent with the broader consumer retail spend trends that PYMNTS has been tracking with Amazon and Walmart in the U.S.

Over the last three years, we see Amazon gaining ground in key retail segments that were once the stronghold of physical retail — and Walmart in particular.

According to PYMNTS analysis, as of Q1 2021, Amazon now accounts for 9.1 percent of consumer retail spend and 3.5 percent of consumer spend. That’s up from 7.7 percent and 2.6 percent in Q1 2020.

Those gains are the result of Amazon’s share gain in nearly every non-grocery sector — with clothing, auto parts, sporting goods and home furnishings as its biggest category gainers. Walmart’s share of grocery continues to dwarf Amazon’s (even including Whole Foods). But Walmart’s overall share of grocery remains largely flat at 19 percent — and has for the last six years.

Those gains are the result of Amazon’s share gain in nearly every non-grocery sector — with clothing, auto parts, sporting goods and home furnishings as its biggest category gainers. Walmart’s share of grocery continues to dwarf Amazon’s (even including Whole Foods). But Walmart’s overall share of grocery remains largely flat at 19 percent — and has for the last six years.

Yet, it’s the gain in non-grocery retail that we estimate will push Amazon to take the mantle as America’s largest retailer next year.

Part of the push comes from its growing share of Amazon Prime members who once typified Walmart’s core customer base: lower- and middle-income consumers, 90 percent of whom live within 15 minutes of a Walmart store. If Prime Days are any indication, they appear to spend as much or more shopping online with Amazon as they do with Walmart.

Amazon Gains Weight In The Middle

Walmart reports that more than 220 million consumers walk through one of its stores every week somewhere in the world, with roughly 110 million shopping in a store in the U.S. every week. That scale, and its physical stores’ proximity to almost every person living in the U.S., has always been regarded as the retailer’s key competitive advantage.

The blurring of the physical and digital worlds — and the last 18 months of the consumer’s massive shift to digital — has changed that competitive dynamic.

PYMNTS research shows that 68 percent of the U.S. adult population — some 171 million Americans — have access to a Prime membership. Nearly half (47 percent) of those consumers — 81 million — say they shop Amazon every week, or more often than that. Forty-two percent — another 73 million — say they shop Amazon once or several times a month. That’s 153 million consumers, and growing, who shop Amazon’s physical and virtual storefronts at least monthly and who buy a variety of retail products when they do.

We also know from published Amazon reports that Prime members spend twice as much as non-Prime members. PYMNTS’ analysis finds that they also spend more than Walmart+ customers do with Walmart’s Deal Days, regardless of their income level.

More than half of Prime members are female (52 percent), and nearly as many consumers earning less than $50,000 a year are Prime members (26 percent) as Walmart+ members (27 percent). So are those who earn between $50,000 and $100,000 (35 percent for Prime, 33 percent for Walmart+). More of those making $100,000 or more are Prime (41 percent) compared to Walmart+ (38 percent). Largely as many Amazon Prime members live in rural areas (19 percent) as Walmart+ users (18 percent), while twice as many live in small towns (32 percent versus 16 percent).

Nearly twice as many consumers earning less than $50,000 shopped Amazon during Prime Days as Walmart consumers, and they spent more with Amazon than with Walmart. Twice as many shoppers earning $100,000 or more did, too, as did nearly 2.5 times more consumers earning between $50,000 and $100,000.

The average amount per purchase for an Amazon Prime consumer earning less than $50,000 was $20.02, and for Walmart+ it was $14.16. For those earning between $50,000 and $100,00, it was $48.27 and $31.04, respectively.

Every demographic also shopped more with Prime, too, by at least a factor of 1.5 times — even as more millennials and bridge millennials report having both an Amazon Prime and Walmart+ membership. For those demographic groups, use of the Prime membership brings lots of other services, including streaming and access to voice-activated devices.

Millennials and bridge millennials over-index in their ownership and use of voice-activated devices for managing their lives in their homes, including making purchases. Thirty-six percent of this demographic have Walmart+ memberships, and 47 percent to 50 percent buy online for delivery to their homes when shopping with Walmart. Twenty-eight percent of Amazon Prime members are also Walmart+ members.

Quick access to Walmart’s physical store presence appears not to be the primary driver of their relationship with Walmart.

The Retail Rivalry

Many believe that retail’s biggest rivalry will be won in the grocery aisle. This study, along with our examination of Walmart’s and Amazon’s share of retail and consumer spend, tells a different story.

Amazon and Walmart are now competing for the same shopper — a consumer who uses digital channels to make all of her purchases, grocery and retail. When shopping at Amazon and Walmart, this consumer has access to the same methods of payment, including cash and EBT, to pay for those purchases. Amazon Prime membership is an investment that 68 percent of the U.S. adult population has made because it provides access to free shipping on most retail purchases, the windows for which are rapidly shrinking, as well as streaming services that will soon include the MGM video catalog. (Even if it tried, the chances that the FTC could block this merger are slight.) Amazon is competing for spend in a channel that provides ease, convenience and savings — the digital channel.

By contrast, just 21 percent of the U.S. population has invested in a Walmart+ membership. Since Deal Days were open to any and all comers, there seemed to be little incentive for consumers to pay for a Walmart+ account. Walmart seems to struggle with syncing up the “everyday low prices” with “even better deals with free shipping” if a consumer pays $98 a year to become a member.

According to PYMNTS’ connected economy research, Walmart is also competing for spend in two segments where two-thirds of U.S. consumers say they would find value in having a single ecosystem to aggregate those transactions: retail products and groceries.

This national study of 15,000 U.S. consumers, conducted between April and May 2021, finds that the more transactional an activity — like an online ordering experience — the greater the potential for all consumers to perform those activities using digital methods. Online orders — whether for food or retail products — are highly correlated.

Ninety percent of consumers who engage in digital shopping behaviors for retail products also do so when buying food at grocery stores or from restaurants. Two-thirds of consumers would like to have a single ecosystem to aggregate that spend and those activities.

Walmart appears to still be competing in the physical world, banking on the fact that foot traffic and groceries will continue to be strong enough to drive the top line. But our research suggests that’s not enough: Walmart needs retail more than Amazon needs groceries to attract the next generation of consumers, and a more robust online channel to get and keep them. This is also the same consumer who has also found a number of other channels from which to buy their food.

PYMNTS’ latest research on grocery shopping behaviors shows that 28 percent of consumers bought groceries online to be delivered, and 11 percent purchased groceries from aggregators like Instacart. Millennials and bridge millennials accounted for more than half of those purchases. For a generation of consumers who are already used to buying retail products online, shifting more of their grocery spend to those channels — including Amazon’s — could spell trouble for Walmart. More — not all, but enough that visits to the grocery store are less frequent, and the basket sizes not as great because this segment of consumer, in particular, opts for subscriptions and/or online ordering for the center aisle purchases that account for a large portion of grocery store spend.

But, hey, let’s not count Walmart out, and let’s give its new Amex hire a chance. The ability of Walmart+ to sign up almost 54 million members in less than a year is something that Amazon ought to pay attention to, and something that many Amazon wannabees could only hope to do. If anything, the next year will be even more fascinating to watch as two players with the same “super app” ambitions use different tools and strategies to win consumers and keep them spending.