Many consumers move to new countries to pursue economic opportunities, but adjusting to these locations also requires learning the ins and outs of new financial systems — a transition that can be filled with friction.

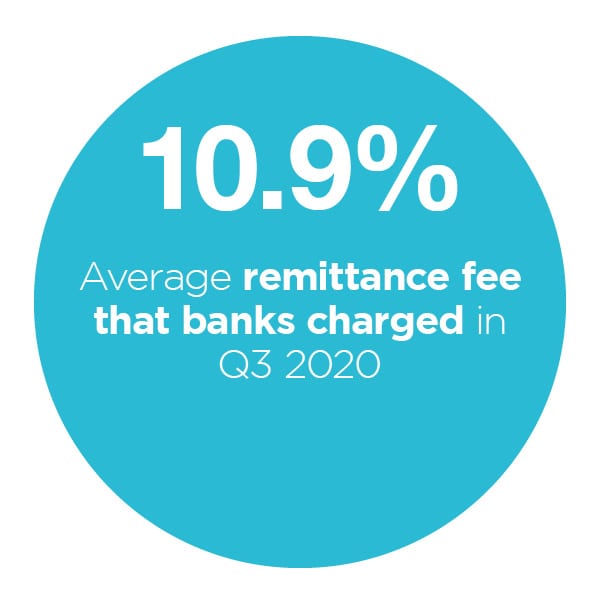

Immigrants must quickly establish local bank accounts in their host countries so they can easily receive payroll, and many also seek seamless, cost-effective ways to send money back home. These customers may struggle to find convenient services, however. Traditional financial institutions (FIs) may offer only money  transfers made via expensive correspondent banking networks, and some customers may require assistance from several financial services providers to meet their needs.

transfers made via expensive correspondent banking networks, and some customers may require assistance from several financial services providers to meet their needs.

The November Smarter Payments Tracker® examines how FIs and FinTechs are innovating to deliver more compelling cross-border and international banking offerings. It also looks at the role of Banking-as-a-Service (BaaS) solutions in powering FIs’ and FinTechs’ efforts to cater to expatriates and immigrant workers.

Around The World Of Smarter Payments

Remittances fuel many economies, and Pakistan is looking to encourage these financial flows by making it easier for expatriates to send money home and make other investments in the country. The central bank and several other commercial banks collaborated on a cross-border bank account offering that Pakistanis overseas can use to store rupees and foreign currencies as well as to pay bills and make other transactions in the nation.

FIs and FinTechs in Europe are preparing for additional cross-border financial frictions amid the prospect of a no-deal Brexit. Such a move would see the United Kingdom exit the European Union and abandon the financial regulations that are in place in the region, and some FIs that have served both markets are now withdrawing to serve one or the other.

Some smaller players are looking to avoid shouldering the regulatory compliance work involved in serving additional global markets by turning to already-licensed partners. United States-based neobank Unifimoney, for example, recently partnered with Singapore-based FinTech Nium to deliver compliant cross-border transfers from U.S. customers to recipients in Asia and Europe.

Find more about these and all the rest of the latest headlines in the Tracker®.

How Rayo Delivers Immigrant-Focused Financial Services

Consumers who move to the U.S. require local bank accounts and debit cards to manage their daily saving and spending needs as well as convenient services that allow them to send money to family back home. They often find it difficult to meet these numerous needs, however, prompting many to turn to apps from several financial services providers, according to Joaquín Ayuso, CEO of immigrant-focused banking services provider Rayo. In the Feature Story, Ayuso explains how working with BaaS providers can help financial services companies add necessary capabilities and offer all-in-one banking platforms to better support this customer base.

Get the full story in the Tracker®.

How BaaS Can Energize International Remittances

How BaaS Can Energize International Remittances

Legacy banks often send remittances over correspondent banking networks, which can drive up costs. Research suggests that mobile-based services may offer a less expensive alternative, and many FIs and FinTechs are interested in deploying these offerings so they can win over more customers. The Deep Dive examines how banks and FinTechs can use BaaS solutions to more easily build out and improve their remittances services.

Check out the Tracker® to read more.

About The Tracker

The Smarter Payments Tracker®, done in collaboration with Nium, details the latest regulatory trends and technologies affecting international remittances.