NEW REPORT: Helping Main Street SMBs Close The Cash Flow Gap

Main Street small- to medium-sized businesses (SMBs) are a barometer for the economic vitality and the health of the broader U.S. economy.

Main Street small- to medium-sized businesses (SMBs) are a barometer for the economic vitality and the health of the broader U.S. economy.

After all, a bustling Main Street signals new business opportunities and growth potential. It was this type of local economy that defined most of the past decade and the early part of 2020.

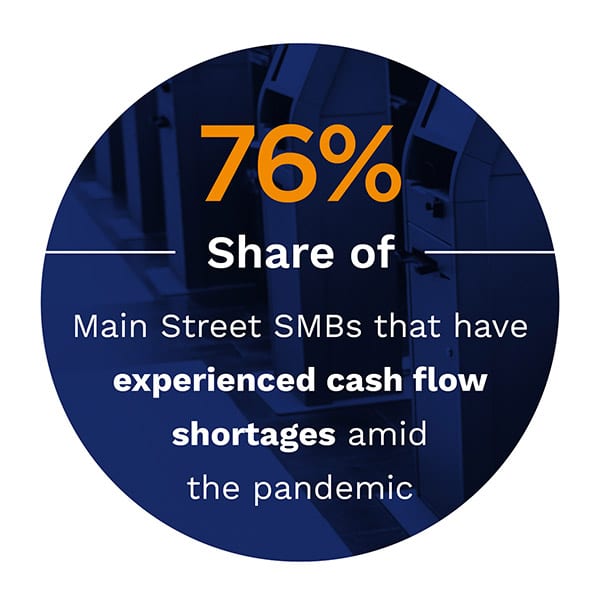

That all came to an end when the pandemic took a hold of the U.S. economy. Seventy-six percent of the SMBs down Main Street USA have experienced cash flow shortages during the four months since the pandemic began. Among those that have, 37 percent have owners who have had to dip into their own, personal funds to keep their businesses afloat, and they say they do not believe their revenues will recover until the early part of Q1 2021.

That all came to an end when the pandemic took a hold of the U.S. economy. Seventy-six percent of the SMBs down Main Street USA have experienced cash flow shortages during the four months since the pandemic began. Among those that have, 37 percent have owners who have had to dip into their own, personal funds to keep their businesses afloat, and they say they do not believe their revenues will recover until the early part of Q1 2021.

So how are Main Street SMBs planning to keep up until things go back to business as usual?

PYMNTS has surveyed more than 1,600 Main Street SMBs during the four months since COVID-19 was first declared a pandemic. We have watched as they improvised new ways to manage the financial challenges posed by the pandemic and listened as they explained their plans for the future. The Road To Recovery: Main Street SMBs And Closing The Cash Flow Gap, in collaboration with Visa, tells their story.

The pandemic has taken a heavy toll these businesses’ financial stabilities. As many as 30 percent of Main Street SMBs that are struggling to maintain their cash flows say their troubles are solely the result of the pandemic, and another 54 percent of them say the pandemic is at least partially to blame. This has left many struggling to make do and feeling unsure of whether they will be able to stay open until their foot traffic returns to its pre-pandemic norms.

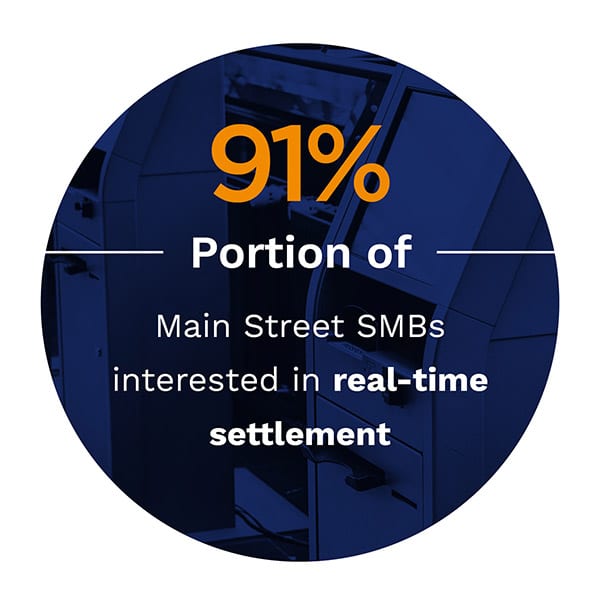

With their future hanging in the balance, many Main Street SMBs are turning to digital payment innovations like real-time settlement to help them stay afloat — and even to help get ahead. Real-time settlement options are seen as a vital tool that can help them overcome their cash flow shortages. Ninety-one percent of Main Street SMBs now say they are interested in real-time settlement of merchant funds, and 42 percent say they would even switch point-of-sale (POS) providers if it  meant having access to real-time settlement capabilities.

meant having access to real-time settlement capabilities.

Real-time settlements adoption is not the only area Main Street SMBs are interested in. Main Street SMBs’ drive to survive the pandemic is powering a wave of merchant innovation. Many are looking to implement or already have implemented digital innovations, primarily because they want to increase their transaction speed and improve their cash flow. Our research found that 48.1 percent of Main Street SMBs have already adopted or improved their digital capabilities since the pandemic began to be able to process transactions more quickly, and 42.2 percent have done so to improve their cash flow.

Main Street SMBs have implemented all these changes and more to survive, but they are only a small part of a much larger, more complex drive toward digitization — during the pandemic and beyond.

To learn more about how Main Street SMBs are innovating to overcome the pandemic, download The Road To Recovery: Main Street SMBs And Closing The Cash Flow Gap.