New Report: Why Real-Time Settlement Can Make or Break Main Street Businesses

It’s been long said that small- to medium-sized businesses (SMBs) are the backbone of the American economy.

That’s hard to argue with considering more than 99 percent of American firms are SMBs, 49 percent of the population works for one and they’re responsible for 46 percent of private-sector output, according to Small Business Administration data. Buttressed by 10 years of uninterrupted U.S. economic growth, many SMBs started the year with a fairly bright outlook — until the pandemic and government lockdowns showed up in mid-March.

Our surveys found that like most consumers and businesses, Main Street SMB owners thought in March that the lockdowns would last two or maybe three months tops. But even then, 58.4 percent of U.S. SMBs we surveyed expressed concerns about whether their businesses could hang on that long.

Our latest survey — taken in late June as a collaboration between PYMNTS and Visa — finds Main Street SMBs are a bit more optimistic now, as many of them use digital tools to make up for some of the sales lost to foot traffic. But it also reveals that many SMBs worry about a cash crunch. They want technology to expedite moving funds from their online sales into their bank accounts in real time.

Cash Flow Woes

The PYMNTS study found that sluggish sales figures have cut cash flow for Main Street SMBs hard as the pandemic grinds on. Some 76 percent of merchants we studied reported suffering from at least occasional cash flow issues since the outbreak began.

That includes 31 percent that reported “sometimes” experiencing cash flow shortages, 28 percent who’ve faced “occasional” problems and 17.5 percent who had “frequent” cash flow issues.

Among the roughly 49 percent of Main Street SMBs that reported cash flow facing challenges “sometimes” or “frequently,” 30 percent attributed the problem solely to the pandemic, while another 53 percent cited the pandemic as the primary cause.

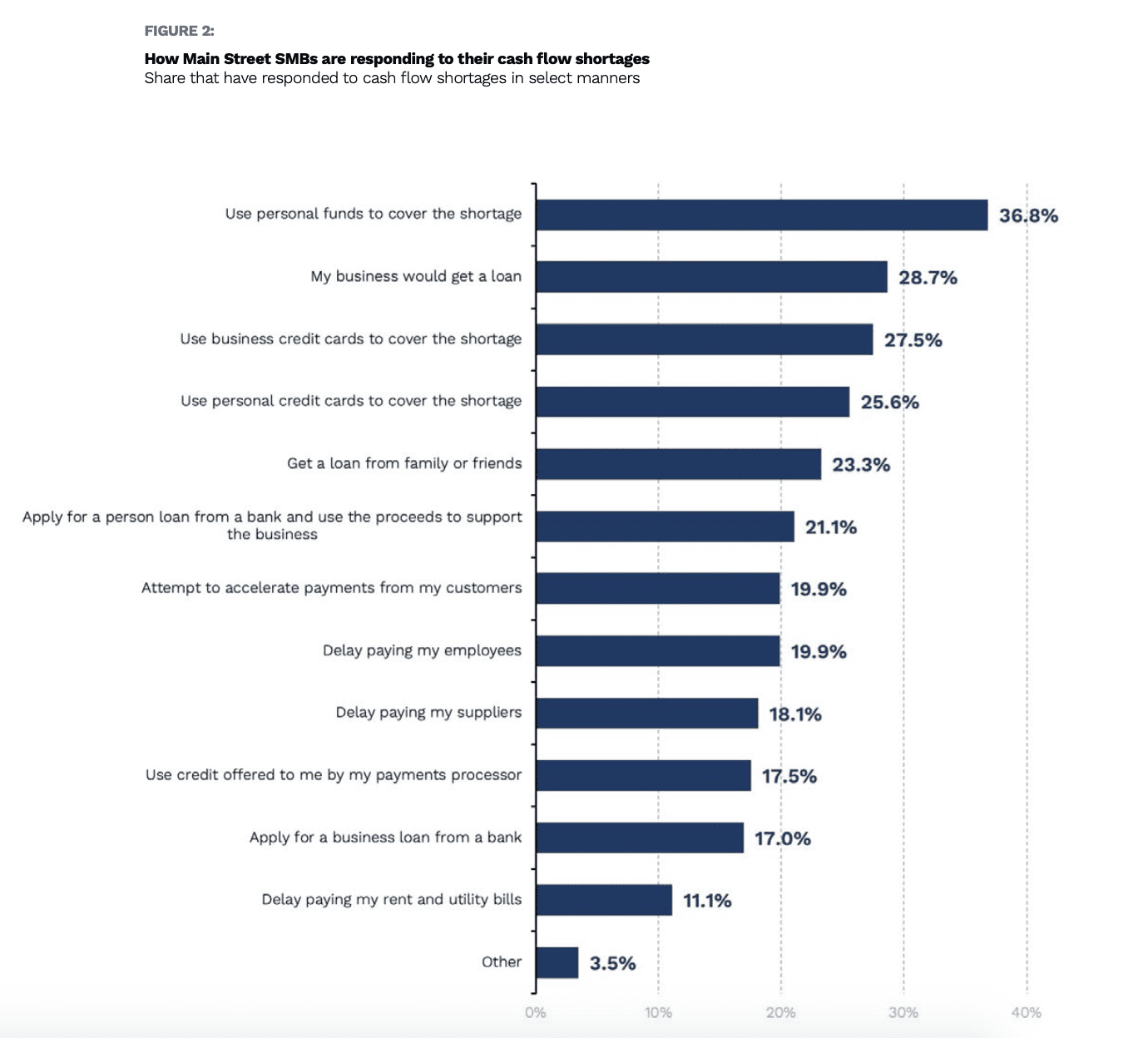

As for how they’re navigating those shortfalls, 37 percent of SMB owners are tapping personal funds, while 26 percent are using personal credit cards. Many are also turning to the option of not paying out funds they should. Some 18 percent reported purposely delaying their supplier payments, while 20 percent are delaying payments to their employees.

However, those solutions are just stopgaps, which is problematic when one considers how long merchants foresee the crisis continuing. The average Main Street SMB owner we surveyed now believes it will take 222 days — or until early next year — before their sales recover from the pandemic-related slump.

Using Digital Tools

The PYMNTS study found that Main Street SMBs have also quickly adopted a number of digital tools to boost sales, improve operating efficiency and make consumers feel safe.

Fifty-nine percent of those Main Street SMBs that responded that they were unsure about whether they’ll survive until the pandemic’s end were the most likely to have adopted digital innovations to attract new customers or interact with consumers who are uncomfortable shopping in physical stores.

On the other hand, those SMBs that view themselves as stable are less likely to have made such changes. For example, only 41 percent of such firms reported adding new digital capabilities to facilitate faster transaction settlements, while just 40 percent said they added technology to attract new customers.

Surging Interest in Real-Time Payments

One thing Main Street SMBs almost universally agree on is a desire to receive funds from those sales in real time. Roughly 91 percent of SMB owners included in this study reported that they were at least slightly interested in that feature or already using it.

Not surprisingly, the more negatively affected by payments delays a business currently is, the more interested it is in real-time settlements. SMBs that reported the slowest settlement times were also the most interested in real-time capabilities. Those whose current transactions typically settle in four or more business days showed the highest interest levels, with 63 percent being “very” or “extremely” interested in real-time payouts.

By contrast, just 44 percent of SMB owners who only wait two or three days to settle funds reported being “very” or “extremely” interested in such systems. But even among SMBs that receive access to funds the next day, about a third cited a desire for real-time payment capabilities.

As for why firms are interested in real-time payments, 58 percent reported a desire to improve cash flow, and 57 percent cited wanting access to funds at any time. Some 28 percent desired real-time payments because they don’t have access to a line of working capital, while 22 percent said such systems would help them pay their vendors on time.

And given the severity of many firms’ cash crunches, the PYMNTS study shows that faster settlements are becoming far more than an area of just casual interest for SMBs. Some 42 percent of SMB owners we polled said they’d be “very” or “extremely” open to switching point-of-sale POS providers or acquirers for real-time settlement capabilities. Another 44 percent are “somewhat” or “slightly” interested in doing so.

The Road Ahead

For now, the many U.S. SMBs attempting to reopen on Main Street are busy navigating a brave new world of social distancing rules, mask ordinances, capacity caps and consumers who worry about shopping in public.

But for Main Street SMBs facing the most difficult shortfalls, access to capital isn’t easily solved by either a bank loan or infusion of funds from an investor. Those most in need of real-time settlements are also often those who face the most difficulty finding funds. Getting approved for a bank loan often isn’t an option, so quick access to electronic funds these SMBS have already accrued might be their best hope for keeping the cash flowing.

After all, time to wait for funds is precisely what many Main Street SMBs lack as they soak up all the costs (cleaning, personal protective equipment, etc.) that reopening has imposed on them.

And, if the PYMNTS study demonstrates nothing else, it’s that an increasing share of SMBs are ready to go wherever they have to get their hands on monies made from customer sales as soon as they make them.