Half of Main Street SMBs Say Economic Uncertainty Threatens Business Performance

There are a few ways in which small- and midsized businesses can do battle against inflation.

Increase the prices they charge for goods and services, of course. And/or try to stem the higher wages that must be paid in order to keep staff in place.

The pressures on the top line and the operating income lines are mounting. And those pressures come squarely in the midst of a recovery seen for Main Street businesses — the ones that keep the economy humming.

In fact, as the latest PYMNTS Main Street Index has shown, a broad range of verticals are doing well, seeing tailwinds of recovery from their pandemic lows.

In terms of their year-over-year Main Street Index score variations as of Q1 2022, restaurants are up 29%, fitness establishments are up 25% and personal services providers are up 17%, according to “The Main Street Index,” a PYMNTS and Melio collaboration. And yet there is a ways to go till we get to pre-pandemic levels.

Compared to their Q4 2019 levels, the March 2022 scores of fitness establishments are 3.4% below, retail establishments are 1.8% below and restaurants are 1.3% below where they were at the end of 2019.

Read also: Main Street Restaurants, Fitness, Personal Services Rebound From Pandemic Low

But it is the very cost of living that is creeping up, sending smoke signals as to what might lie ahead. Inflation translates into wage growth, which also is boosted by the fact that the labor markets are so tight.

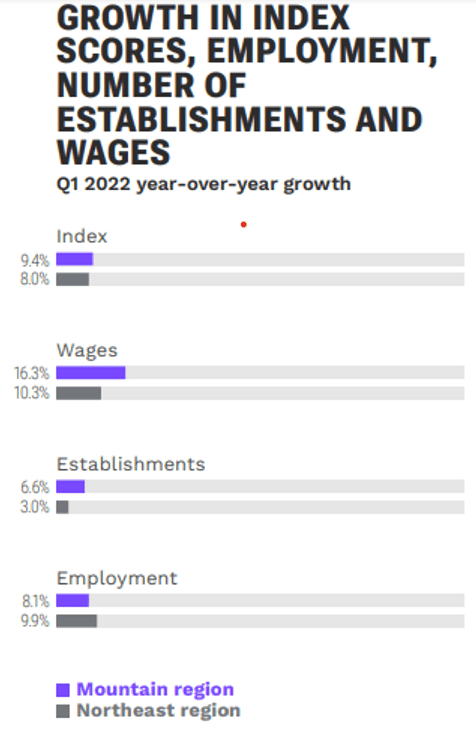

The chart below shows just two regions, the Mountain Region and the Northeast, that show just how pronounced wages and employment have grown. That would make sense in an environment where the number of establishments have also been growing, which is also part of our findings.

But employment and wages are growing faster than the number of establishments, and though we would not necessarily expect a one-to-one to correlation, there would be at least some headwind to overall business creation here. Wage growth is roughly double that of employment, which indicates that there’s less money to go around (to newer hires), so to speak.

But employment and wages are growing faster than the number of establishments, and though we would not necessarily expect a one-to-one to correlation, there would be at least some headwind to overall business creation here. Wage growth is roughly double that of employment, which indicates that there’s less money to go around (to newer hires), so to speak.

Other Main Street studies show that 64% of Main Street respondents expect to see solid sales growth in the present year — and yet 50% say that economic uncertainty could hurt performance. At the end of last year, about a quarter of firms surveyed said they were raising prices — and roughly half a year later, we contend that it’s almost a given that more companies have followed suit. The balancing act between top line torque and operating line pressure becomes a fraught endeavor indeed.

Source: PYMNTS.com